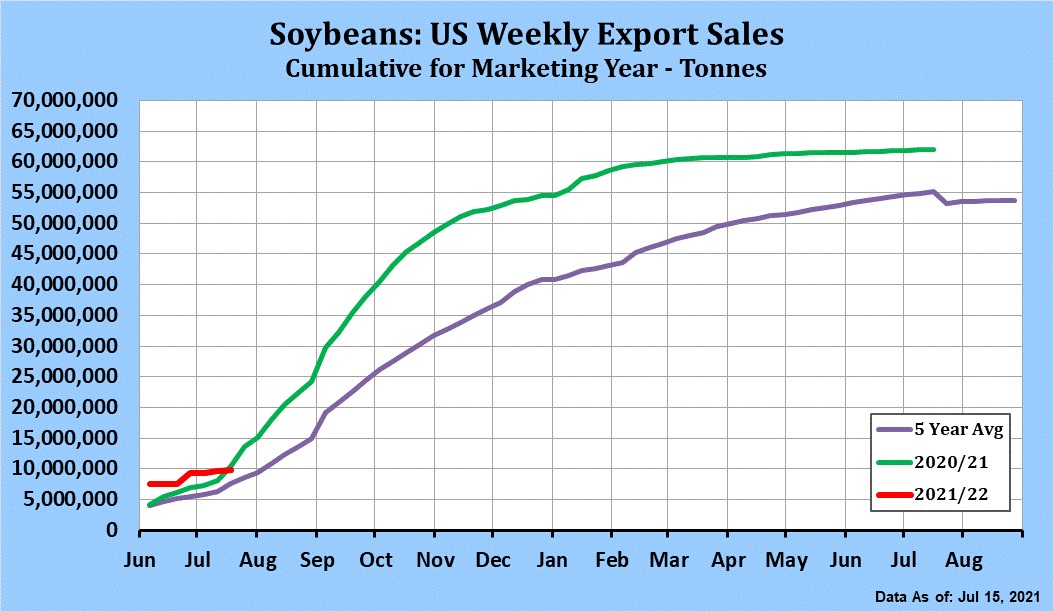

SOYBEANS

Soybean traded lower. SU tested support on talk of chance for US Midwest rains day 11-14 of the long range forecast. Lack of new US new crop soybean export sales also weighed on futures. Dalian soybean, soymeal, soyoil and palmoil futures were lower. China soybean crush margins remain negative. Weekly US soybean export sales were 620 mt. Total commit is near 62.0 mmt vs 46.4 ly. China total commit near 35.8. New crop sales are 9.8 mmt with China 4.1. Trade still wondering if China will take 35 mmt next year. Brazil July exports near 5.4 mmt with est near 9.0. China has not bought US new crop soybean since June 24 when SU was near 12.50.

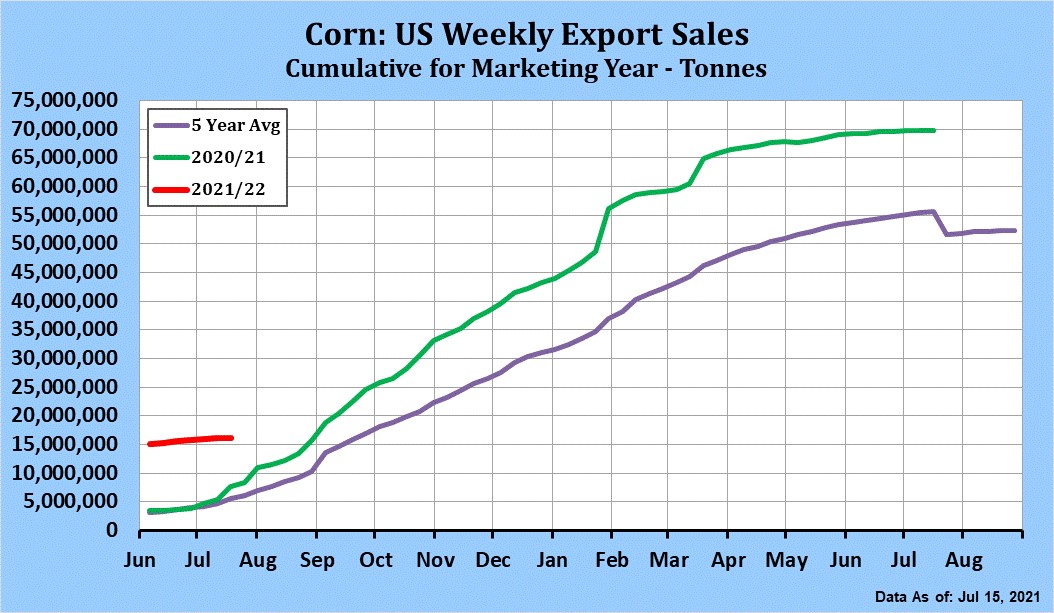

CORN

Corn futures traded lower. CU traded near 5.65. Range was 5.55 to 5.71. Corn was lower on talk of increase chance for upper US Midwest showers day 11-15 of the long range forecast. Most of ND, SD, MN, NE and IA will be warm and dry over the next 10 days. Some weather watchers doubt the forecasted rain. Midday model was drier across MN, IA, W IL and WI. Noon maps also suggest temps in upper 90’s and low 100’s in plains and NW Midwest starting this weekend and into next week. One weather group today estimated US corm yield near 181.3 vs USDA 179.5 due to record yields in IL, IN, KY, MI, MO, NE, OH, TX and WI. Weekly US corn export sales dropped 88 mt. Total commit is near 69.8 mmt vs 43.7 last year. Unshipped sales are 9.0. China has shipped 18.6 mmt with total commit near 23.1. New crop sales are 16.1 mmt with China 10.7. Trade still wondering if China will take 23 mmt next year or are they done at 10.7. Brazil July exports near 1.5 mmt, Argentina 2.7. USDA est their combined July-Sep export near 15.5 mmt. USDA est US 2020/21 corn carryout near 1,082 mil bu vs 1,919 ly. 2021 acres are est near 92.7 vs 90.8 last year. Yield is est near 179.5. First farmer yield survey is August 12. 21/22 demand is est near 14,840 vs 15,045 this year. This leaves a carryout near 1,432. Most private analyst est demand near 15,265 and carryout near 930.

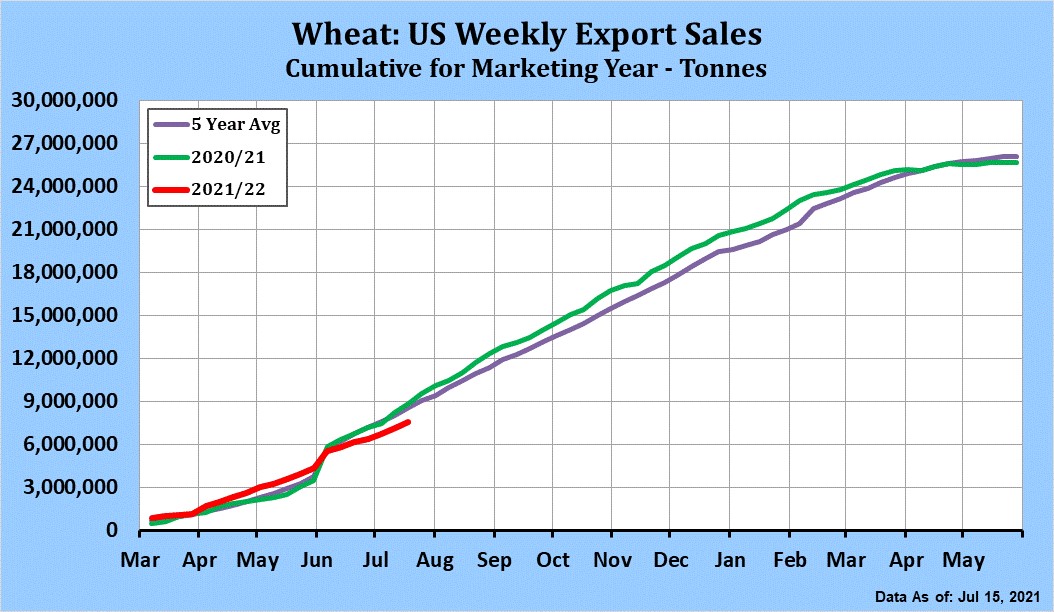

WHEAT

Wheat trade was mixed. Chicago Sep traded near 6.92. Range was 6.81 to 7.09. KC Sep traded near 6.54. Range was 6.44 to 6.66. Winter wheat futures continue to correct an overbought technical position. WU and KWU also followed lower corn trade. WU rejected 7.20 and is back near 6.80. Next support is 6.70. KWU rejected 6.70. Next support is near 6.40. Minn spring wheat futures managed to trade higher. MWU ended near 9.04. Range was 8.71 to 9.07. MWU rejected contract high near 9.44 and had loss 65 cents since Mondays high. Key support is near 8.50. Noon US plains weather maps reduced north plains rains on day 11-14. This weekend and next week should be warm and dry across US HRS area. Weekly US wheat export sales were 473 mt. Total commit is near 7.6 mmt vs 8.8 last year. USDA goal is 23.8 mmt vs 27.0 ly. USDA est total World wheat trade near a record 204.0 mmt. Early harvest yields and dry spring wheat weather has some talking Russia wheat crop near 80 mmt vs USDA 85. Better EU harvest weather weighed on Matif wheat futures.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.