CORN

Prices were $.03 – $.05 lower closing near session lows. Despite the weakness spreads continued to firm. May-24 held above support at $4.24 ½. Dec-24 finally broke out of its range from Mch 28th with next support at $4.56. Old crop exports at 20 mil. bu. were at the low end of expectations bringing YTD commitments to 1.759 bil. still up 17% from YA however falling behind the USDA forecast of up 26%. The only noted buyer last week was Columbia with 11 mil. bu. This was the 2nd consecutive week where exports were below expectations, surprising considering US corn is priced below SA supplies thru the end of June-24. US corn acres in drought held steady this past week at 23%, just below the 28% from YA. Ukraine’s Ag. Ministry forecasts 2024 grain production will drop nearly 13% to 52.4 mmt. They see corn production at 26.7 mmt down 12.5% vs. the USDA forecast of 29.5 mmt. This afternoon the Rosario Grain Exchange estimates that $1.3 bil. in potential Argentina corn crop value was destroyed by leaf hopper infestation. Last week they cut their production forecast to 50.5 mmt. Overnight the US Ag. attaché to Argentina cut their est. to 51 mmt, well below the official USDA forecast of 55 mmt. Today the BAGE estimates harvest has reached 17% advancing only 2% in the past week. They left their production est. unchanged at 49.5 mmt. The difference between the USDA production forecasts and local estimates among the top 3 other major exporting countries is just over 21 mmt, or 541 mil. bu.

SOYBEANS

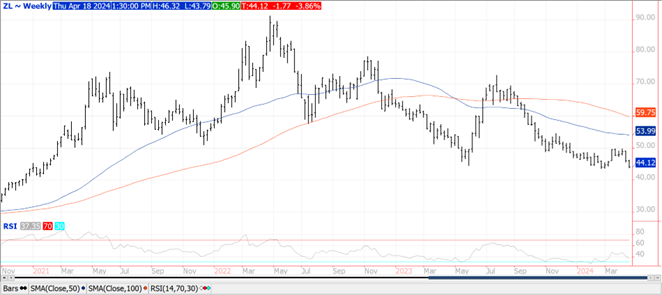

Prices were lower across the board with beans down $.12 – $.15, meal was $1 – $3 lower, while oil dropped another 80 – 90 points. May-24 beans made a fresh 7 week low holding support just above the contract low of $11.28 ½. An inside trade for May-24 meal as prices hold support at its 50 day MA. May-24 oil closed into new contract lows. Next support is 43.57, the Feb-24 low on the weekly chart. Spot board crush margins firmed up another $.04 to $.94 ½, while meal PV improved to 60.5%, the highest since late Jan-24. This week’s drought monitor showed deepening drought conditions in the southern plains with little change elsewhere. Longer term forecasts continue to lean toward much above normal temperatures across the nation’s midsection for the last week of April. Export sales at 28 mil. bu. (18 mil. – 23/24 MY, 10 mil. – 24/25) were in line with expectations. Old crop commitments at 1.517 bil. bu. are down 18% from YA, vs. the revised USDA forecast of down 15%. China/unknown combined to purchase 7 mil. bu. of old crop. Soybean meal sales at only 130k mt were below expectations. YTD commitments are up 14% from YA, vs. the USDA est. of up 8%. The USDA also announced the sale of 138k mt of soybean meal to the Philippines. According to Chinese customs their soybean imports in Q1 at 18.6 mmt are down 11% YOY. Ukraine’s Ag. Ministry forecast soybean production in 2024 will reach 5.2 mmt, up 10.6% from YA while sunflower production at 12.4 mmt would be down 4% YOY. 22% of the US bean acres remain in drought, unchanged from last week and just above the 20% from YA. Argentina’s Ag. Ministry forecasts their 23/24 soybean production at 49.7 mmt, a touch below most estimates between 50 – 51 mmt. The BAGE est. harvest has reached 14%, up from 11% LW. They held their production forecast at 51 mmt.

WHEAT

Prices finished $.04 – $.06 higher in KC and MGEX while Chicago was steady to $.02 higher (May-24 down ¼ cent). This week’s 2nd rain event moved across portions of the WCB including IA overnight. The system is expected to clear the eastern corn belt over the next 24-36 hours. Much cooler temperatures behind the front with low’s this weekend in the mid 20’s for the Dakota’s and possibly NW MN and NE. So far the heaviest accumulations have been in WC Neb along with NE KS and NW MO. Little to no rain across the northern plains with this latest rain event, while the SW plains also continue to miss out. Export sales at 5 mil. bu. (-3 mil. – 23/24, 8 – 24/25) were at the low end of expectations. Old crop commitments at 688 mil. are still up 1% from YA vs. the USDA forecast of down 6.5%. China took shipment of 2 mil. bu. of SRW wheat while also cancelling another 4.6 mil. reducing outstanding sales to only 11 mil. Tunisia reportedly paid $376.50/mt CF for 25k mt of durum wheat. While durum and spring wheat acres in drought held steady at 23% and 26% respectively, winter wheat acres in drought jumped 6% to 24%, still well below the 50% from YA however. Ukraine is forecasting 2024 wheat production at 19.2 mmt, down 13.5% from YA, vs. the USDA forecast of 23.4 mmt.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.