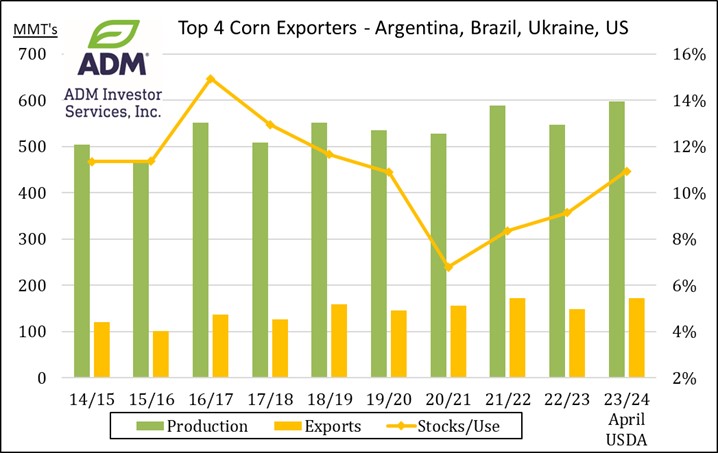

CORN

Prices closed up $.06 – $.07 near session highs, however little changed for the week. Spreads firmed a touch. The rebound in May-24 peaked right at yesterday’s high at $4.37 ½ while consolidating near its 50 day MA. US 7-day rainfall forecasts favors the NC Midwest while areas to the south dry out. Late yesterday the BAGE lowered their Argentine production forecast 2.5 mmt to 49.5 mmt, well below the revised USDA est. of 55 mmt and just below the Rosario Grain Exchange est. of 50.5 mmt. The BAGE estimate harvest has reached 15%. Today Safras & Mercado raised their Brazilian corn est. slightly to 126 mmt, vs. USDA at 124 mmt, with Conab way down at 111 mmt. The biggest feature from yesterday’s USDA WASDE report is the continued disconnect between USDA production estimates in SA which are still 18 mmt higher than Conab/Argentine exchange estimates combined. The USDA est. show stocks/use among major exporters matching a 4 year high at 11%. How this sorts out over the next 60-90 days along with US weather will determine in what direction corn prices finally breakout.

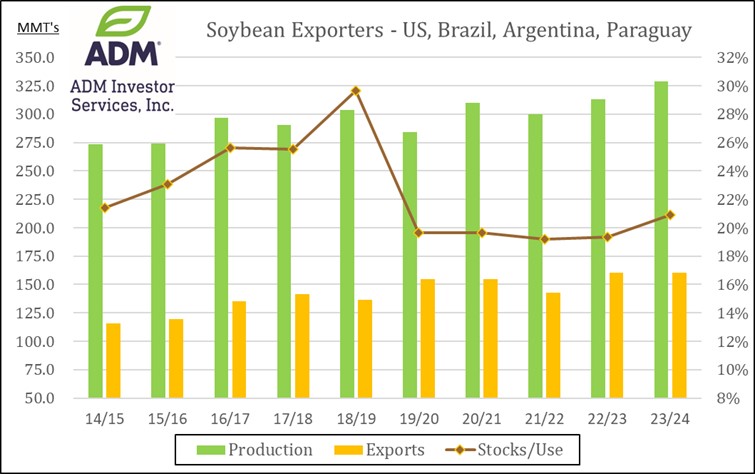

SOYBEANS

Prices were mixed with beans $.12 – $.15 higher, meal surged to new highs late closing $6 – $9 higher, while oil was down 10 – 15. Today’s rebound in May-24 beans was capped right at its 50 day MA. May-24 oil slipped to a new monthly low with next support at contract low of 44.18. Resistance for May-24 meal is at last month’s high at 338.80. Spot board crush margins rebounded $.04 today closing the week at $.89 ½ bu. while meal PV jumped to 60%, both matching a 2 month high. Agriculture markets today benefited from a broad based commodities rally. Strength appears to be driven by increased tensions in the Middle East stoking fears violent attacks may expand beyond the Israel-Hamas war. Rains have starting to fill in over drier areas of Brazil in MGDS and Parana. Accumulations are expected to reach 1–2.5” (isolated areas to receive more) by the middle of next week. This will provide a nice boost in the short term as the monsoonal season is coming to a close. Week 2 of the outlook provides little to no moisture south of the Amazon basin. Forecasts for Argentina remain mostly favorable. The USDA did announce the sale of 124k tons (4.5 mil. bu.) of 23/24 soybeans to an unknown buyer. The USDA and Argentine exchanges are in step with production est. at 50-51 mmt. In Brazil the USDA is still 8.5 mmt above Conab at 155 mmt and 146.5 mmt respectively. Safras & Mercado today raised their production forecast 2.65 mmt to 151.25 mmt. Chinese customs data showed their Mch-24 imports at 5.54 mmt were down 20% from YA. Their Q1 imports at 18.58 mmt are down 11% from YA and the lowest for Q1 since 2020. Recall however, the USDA no longer utilizes Chinese custom data to estimate their imports, but rather rely on vessel counts from exporting nations.

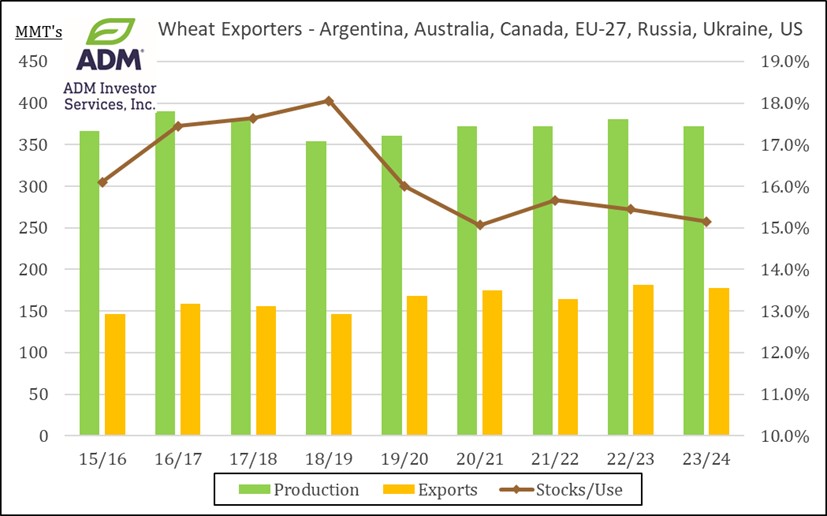

WHEAT

Prices were $.04 – $.08 higher across all 3 classes at midday. Chicago May-24 held trend line support keeping the short-term trend higher. May-24 KC continues to grind sideways in a $5.50 – $6.05 range. Ukraine’s spring plantings have reached 1.26 mil. HA, most of this is barley. Russia’s Ag. Ministry raised their wheat export tax 1.25% to 3,276.60 roubles/mt for the period ending April 23rd. The USDA global estimates show stocks/use ratio among exporters slipping to 15.1% in 2023/24, matching the lowest in a decade. Despite 2+ years of war, Russian/Ukrainian exports account for a record 32.6% of the global share. Traders will also be mindful of potential imports by India. While the USDA held their production at a record 110.6 mmt, they raised their usage forecast nearly 3 mmt to 113 mmt allowing stocks/use to slip to only 6%, matching a 17 year low.

>>See more market commentary here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.