ADMISI London Wheat Report for 29 June

- June 30, 2023

- ADMISI Grains Team

- Follow us on Twitter @TradeADMIS

London Wheat Report

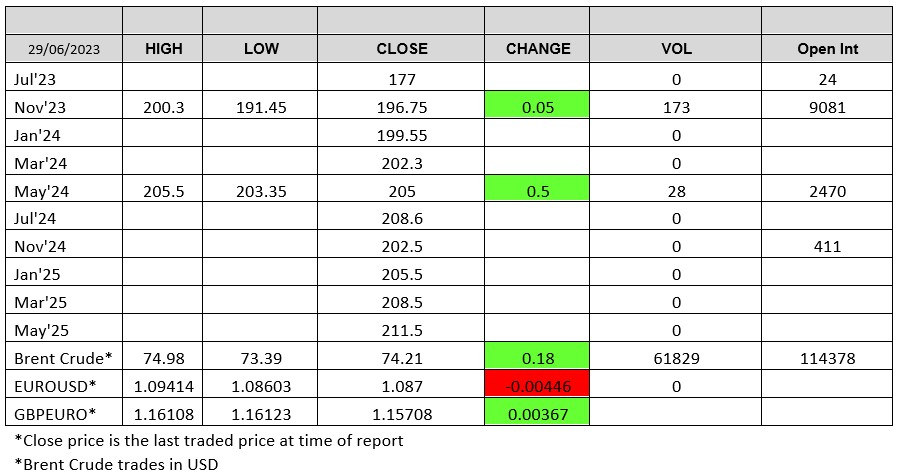

Source: FutureSource

US economic data came through better than expected as final US GDP was 2% vs estimate of 1.4%. Unemployment was also lower and US banking stock rose as lenders sailed straight through the Fed’s stress test. Thames Water is sitting on the brink of supposed nationalistion if it can’t agree on refinancing … what happens when you sell off public goods to the sharks. England were still trailing Aussie at time of writing.

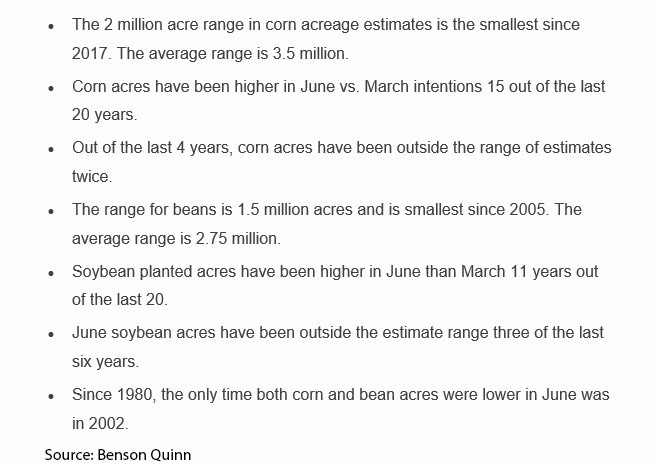

Tomorrow we have the USDA stocks and planted acreage report followed by the 4th July weekend, Independence Day, markets are open Monday but closed Tuesday with a lot of the trade taking time off for the extended weekend. Acres wise can’t see too much changing from the March predictions to be honest although stocks report should be more interesting as this is a true reflection of current demand.

See data from @Benson Quinn:

Wheat markets were hovering around the unchanged levels, dipping up and down throughout the day both in the US and Europe. US weekly wheat net sales climbed up 41.5% in the week ending June 22nd at 155.2kt. Rouen exports were up at 100.4kt week ending 28th June – up 11%. Russia collected 2m tons of grain by June 28, more than the same time last year, Interfax reported, citing Ministry of Agriculture. Harvesting underway in 6 Russian regions, Interfax reports. Matif Sep-23 hovered around the €232 levels going into the close. London wheat dropped to a trading low on the Nov-23 of £191.45 before hitting a random high of £200.30 and then fluttering around the £196/197 levels.

US soybean sales were at the lower end of expectations at 227kt. Chicago soybeans were trading higher. South Korea bought a reported 136kt of corn expected to come from South America. Brazil announced that they were buying 500kt of corn to stock up the government reserves. Apart from that not too much excitement really. Matif rapeseed was supported.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.