ADMISI London Wheat Report for 18 July

- July 19, 2023

- ADMISI Grains Team

- Follow us on Twitter @TradeADMIS

London Wheat Report

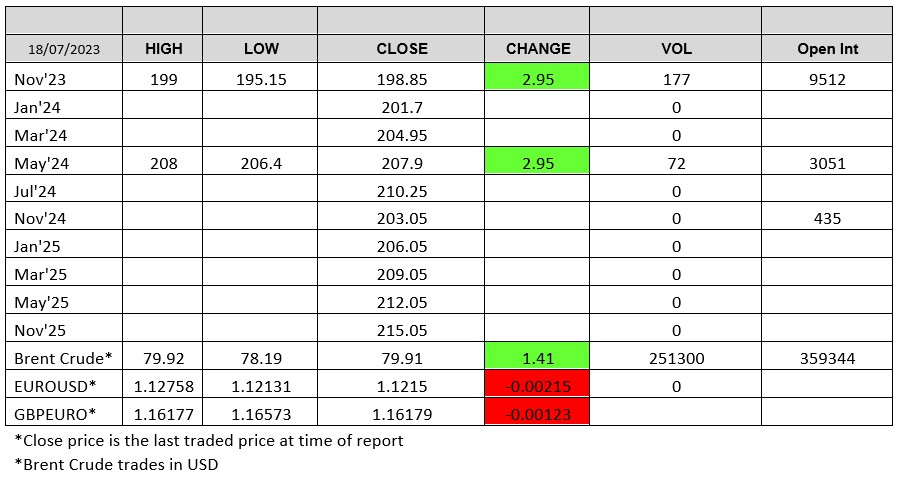

Source: FutureSource

Black Sea Grains deal officially ended today. Plenty of pyro hitting Ukrainian infrastructure in response for the drone based bomb boats that hit the Kerch Bridge in Crimea yesterday. Fighting in Eastern Ukraine continues and the meat grinding process of trying to attain sq/kms is continuing. Russian defensive lines are holding, better than expected really and the Ukrainian offensive does not appear to have the breakthrough punch required, as they have said themselves, they aren’t moving forward in a drastic fashion. 100k Russian troops amassing near Kharkiv, with intelligence saying they will start pushing shortly to try an alleviate pressure further down. All to play for ladies and gents, all to play for. No sign of this ending anytime soon and nor does it appear to be as the amount of $$$$ being made on the sidelines is astronomical.

So after the Corridor ended, Russia have been in talks with Turkey to carry on exporting their own grains, with a 45Mmt exportable surplus from current S&D this year so a deal will be inevitable so interesting to see what will occur regarding Ukrainian exports. The graph below depicts Ukrainian export flows and shows the increase in Danube exports. Impressive for sure, but the Grains corridor still commands 40/50% of vols, and no matter what people say, it most certainly isn’t diddly squat. If they do agree to dredging the Danube and allowing larger draft up to the river ports, then a significant amount can be alleviated from Odessa. Time will tell and let’s see what happens in the next few days.

USA crop conditions report came out last night with some marginal improvements seen.

Corn condition 57% Gd/Exc (+2% WoW, -7% YoY)

Soybean Condition 55% Gd/Exc (+4% WoW, -6% YoY)

Winter Wheat Harvested 56% complete (+9% WoW, -13% 5yr avg)

Spring Wheat Condition 51% Gd/Exc (+4% WoW, -20% YoY)

Topsoil moisture 62% Adeq/Surp (+2% WoW)

Subsoil Moisture 57% Adeq/Surp (+1% WoW)

Wheat markets continue to bounce around following the news and weather reports coming in. Russian exports continue to flow in significant volumes. Over the last week, average Russian FOB prices dropped by $1 to $231.5, reflecting the strengthening of the ruble according to SovEcon. Matif Sep-23 wheat was trading around the €233.75/t levels going into the close. London was also supported on the back of this. Physical UK feed wheat is still to expensive and with a significant carryover, lack of consumer demand and a good crop on the horizon, something will have to change.

Iran slammed a tender in today for 180kt of corn which included Ukrainian origin. Algeria tendered to buy up to 240kt of corn from Brazil and Argentina. Soybean complex was supported with Chicago trading up, Sep-23 beans were up 12 cents. Matif rapeseed was also supported with Nov-23 trading around the €480 level going into the close.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.