ADMISI London Wheat Report for 17 July

- July 18, 2023

- ADMISI Grains Team

- Follow us on Twitter @TradeADMIS

London Wheat Report

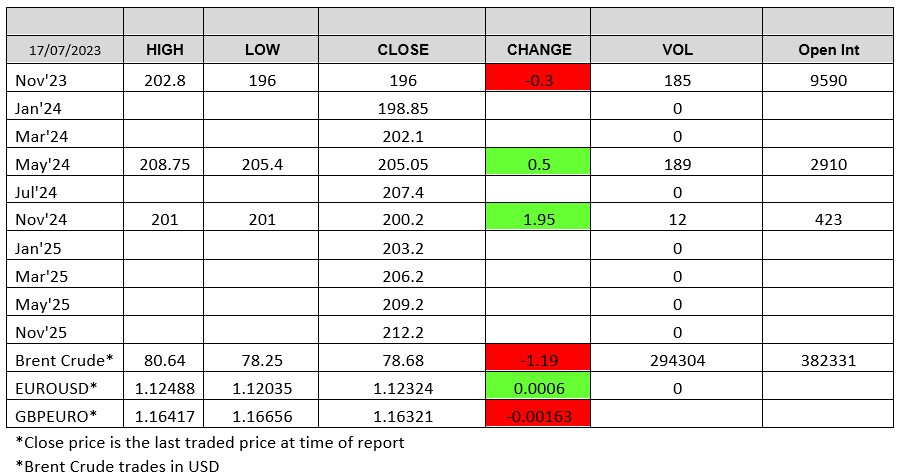

Source: FutureSource

Well, what a weekend in the tennis and what an absolute scorcher of a game between Djokovic and Alcaraz in the men’s final. A truly spectacular men’s Wimbledon final. A bit more pyro today seen on the Kerch bridge with a reported drone attack closing it off again .. still amazes me is hasn’t been taken out of action completely but this is the quasi political nature of this war. Heatwaves hit Europe, China and the US.

Well, surprise surprise, Moscow has announced that it does not see a future in the grains corridor or the deal unless its requests are met in ‘concrete’ rather than just lip service according to the Kremlin spokesman. Although from what I have seen and read in the media over the past few weeks, the ammonia pipeline deal Ukraine were open to as was the SWIFT payment system for the Russian Ag Bank. Will we see it roll over tomorrow or will it reappear end of the week or within the next 10 days … Can’t see it stopping forever and I am sure we will hear from Moscow an announcement that a deal has been made in the near future, but we will have to wait and see. As the last two ships have cleared the transit lines, insurers are now investigating whether to freeze cover for any ships travelling to Ukraine although most shipowners will not be letting vessels into Ukrainian ports.

Wheat markets were naturally supported this morning as the bulls made the most of the grains corridor coming to a halt. Funds were tiny buyers of wheat last week as shown in the CFTC. US weekly wheat inspections were down 40% to 253,409t in W/E July 13th. Chicago was trading up 16/18 cents on the overnight and supported in the open before changing course and trading lower later on this afternoon with sep-23 trading 8 cents lower at time of writing. Matif wheat followed a similar path with Sep-23 hitting a trading high of €238/t earlier today before pulling back later in the afternoon and trading around the unchanged levels with Sep-23 sitting around €233/t. Vols on Matif were strong, unsurprising across both Sep and Dec-23. London bobbed along on a similar stance, vols were not that strong overall.

CFTC showed that funds were modest sellers of Chicago beans. US weekly soybean inspections were down 48% to 155,556t in the W/E 13th July, down from a previous 300,765t. Brazil’s 2023/24 soybean crop output is projected to reach 163.2Mmt, up 4.5% from 156.1Mmt for 2022/23. China is forecast to continue buying Brazilian beans for Sep – Dec 2023 according to trade sources. Matif rapeseed was supported in today’s trade. Managed money also increased their corn short position being net sellers of nearly 45k contracts to just over 63k short.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.