ADMISI London Wheat Report for 14 June

- June 15, 2023

- ADMISI Grains Team

- Follow us on Twitter @TradeADMIS

London Wheat Report

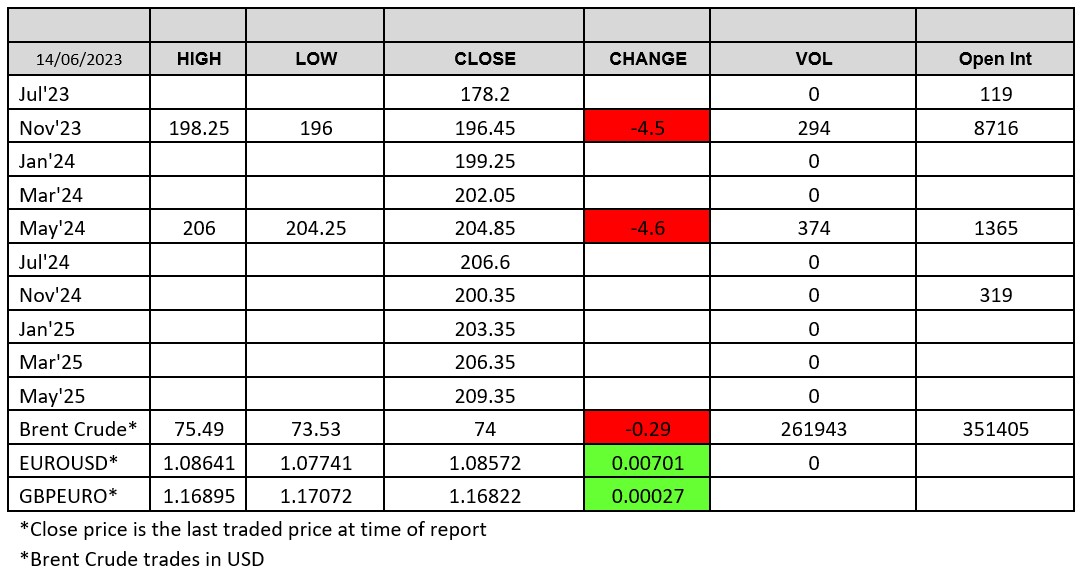

Source: FutureSource

Kremlin chatter continues on grain deal, but no one seems to be bothered by it anymore as the markets were well in the red today. Russia’s “goodwill” cannot last indefinitely when it comes to renewing the Black Sea grain deal, the Kremlin said on Wednesday, a day after President Vladimir Putin said that Moscow was considering withdrawing from the accord.

Ukraine’s grain exports for the 2022/23 season stood at 47.1 million tonnes as of June 14, Agriculture Ministry data showed on Wednesday. The ministry did not give an exact comparison for the same date a year ago but said that Ukraine had exported 47.8 million tonnes of grain as of June 17, 2022. The volume so far in the current July-to-June season included 16.2 million tonnes of wheat, 27.9 million tonnes of corn and about 2.7 million tonnes of barley. The ministry said grain exports during June were 1.8 million tonnes.

Farm office FranceAgriMer on Wednesday lowered by 100,000 tonnes its monthly forecast for French soft wheat exports outside the European Union in the 2022/23 season to 10.2 million tonnes, which would still be 16% above the previous season.

European wheat markets took a pounding today across the curve, Matif wheat down on average 6 euros. Us wheat markets were down too, Kansas and Chicago were down 8 cents at the time of writing and MW slightly down, 2 cents. London wheat saw some volume today, both Nov 23 and May 24 traded around 300 lots each. Nov 23 got down to a low of £196.00 (£5 off ydays Sett.) May 24 did get down as low as £5 but was close. Jul saw no trade but an offer for 20 lots was sat @ £190.00. Nov24 saw no bids, but an offer was there for 10 @ £208.00.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.