ADMISI London Wheat Report for 13 June

- June 14, 2023

- ADMISI Grains Team

- Follow us on Twitter @TradeADMIS

London Wheat Report

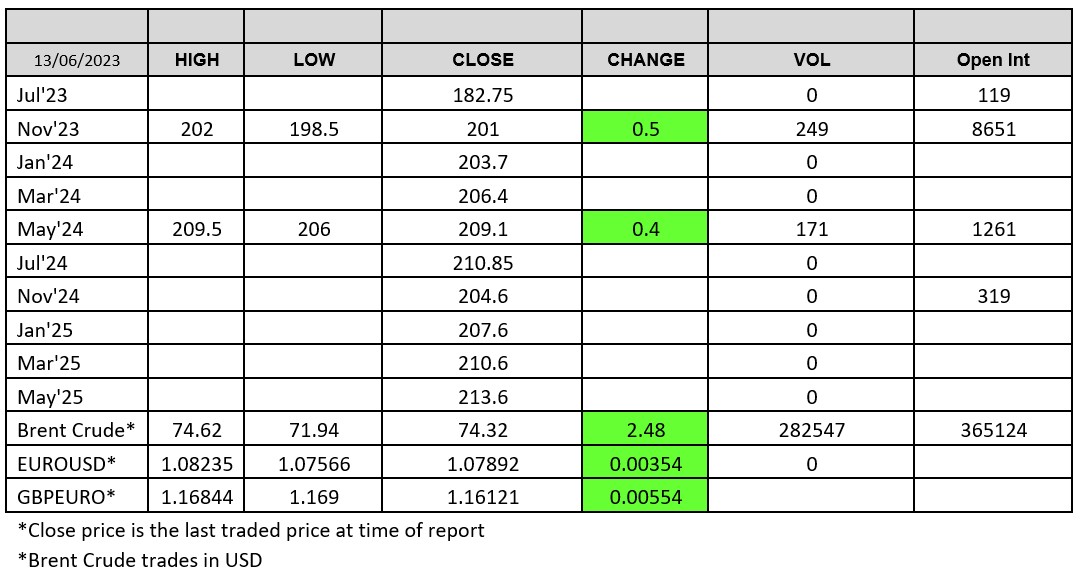

Source: FutureSource

US inflation came in at the lowest level in 2 years, the 4% reading being the lowest since March 2021 with hope from the trade that this bolsters hope the Fed will leave rates unchanged tomorrow. VTB have announced they are selling their 45% stake in Russian grain trading giant Demetra Holdings. Bunge and Viterra have announced that they are officially merging to form a $34bn Agri trading giant, valuing both respective entities at $17bn each although Bunge shareholders will own about 70% of the company due to a significant cash payment from their side. This will substantially expand Bunge’s origination footprint.

US crop progress report:

Corn Emerged 93% (+8% WoW, +6% vs 5yr avg)

Corn Condition 61% Gd/Exc (-3% WoW, -11% YoY)

Winter Wheat Harvest 8% complete (+4% WoW, -1% vs 5yr avg)

Winter Wheat Condition 38% Gd/Exc (+2% WoW, +7% YoY)

Spring Wheat planted 97% complete (+4% wOw, UNCH VS 5YR AVG)

Spring Wheat Condition 60% Gd/Exc (-4% WoW, +6% YoY)

Barley Condition 58% Gd/Exc (-7% WoW, +9% YoY)

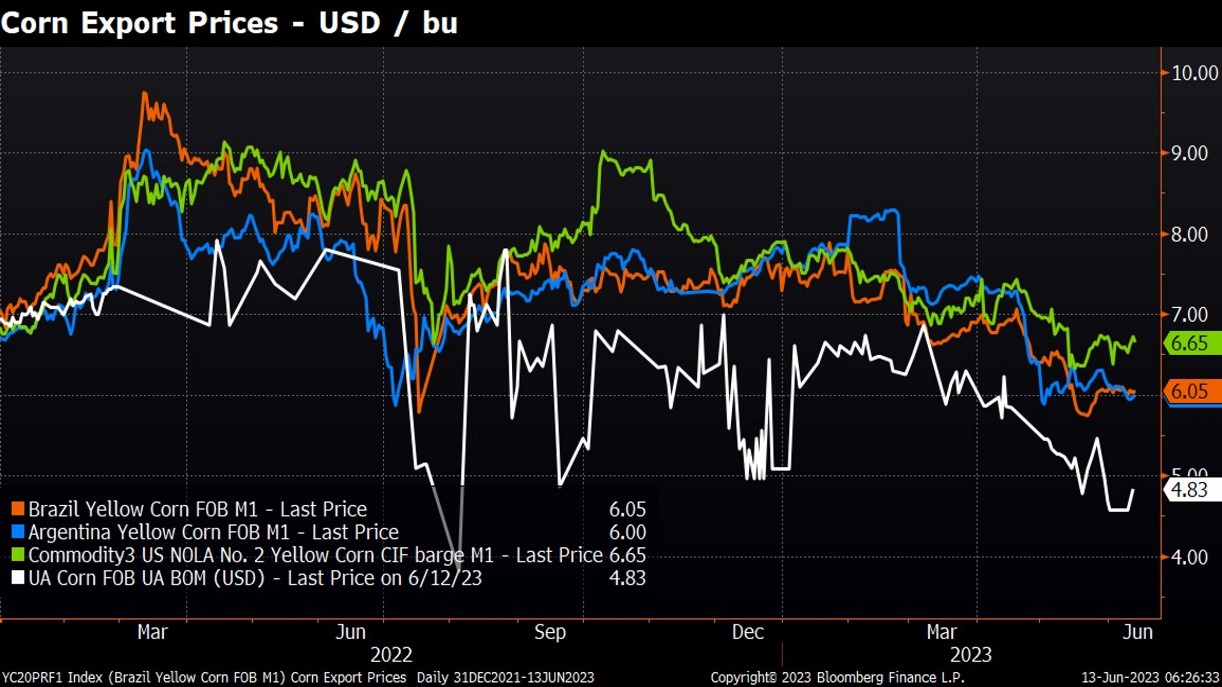

Couple of decent price chats below that I have pinched from our friend Steve Freed from across the pond showing Wheat and Corn export prices. Unsurprisingly Russian Black Sea continues to be lowest and US HRW the highest, still anticipation of wheat export prices to pull lower which would indicate US futures will not have bottomed out as of yet.

Corn prices show that US corn is still facing stiff competition from Ukraine, Brazil and Argentina and we may be seeing yet again issues on US corn exports this summer, which is unsurprising from what the market is chatting.

Wheat markets were once again supported on the back of oilseeds and corn rising in the US. Chicago was trading up 8/10 cents at time of writing and Matif was pushing higher. London Nov-23 also pushed over the £200.50 level that was last night’s settlement. Volumes picked up after a quiet past few days, unsurprising based on the price support.

Corn prices were supported on the USDA’s downgrade. Chicago soybeans and oilseed continued to find support on the back of Brent crude which was trading up just over 3% at $74/ba. Biodiesel demand is back with a vengeance and the continued weather chatter is also helping. Ukraine’s rapeseed harvest is set to double from the five-year average to reach a record level this year according to MARS, estimated at 5.47Mmt for 2023, up from April’s forecast of 3.04Mmt. Matif rapeseed Aug-23 settled up €8.50 on yesterday at €448.5/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.