ADMISI London Wheat Report for 13 July

- July 14, 2023

- ADMISI Grains Team

- Follow us on Twitter @TradeADMIS

London Wheat Report

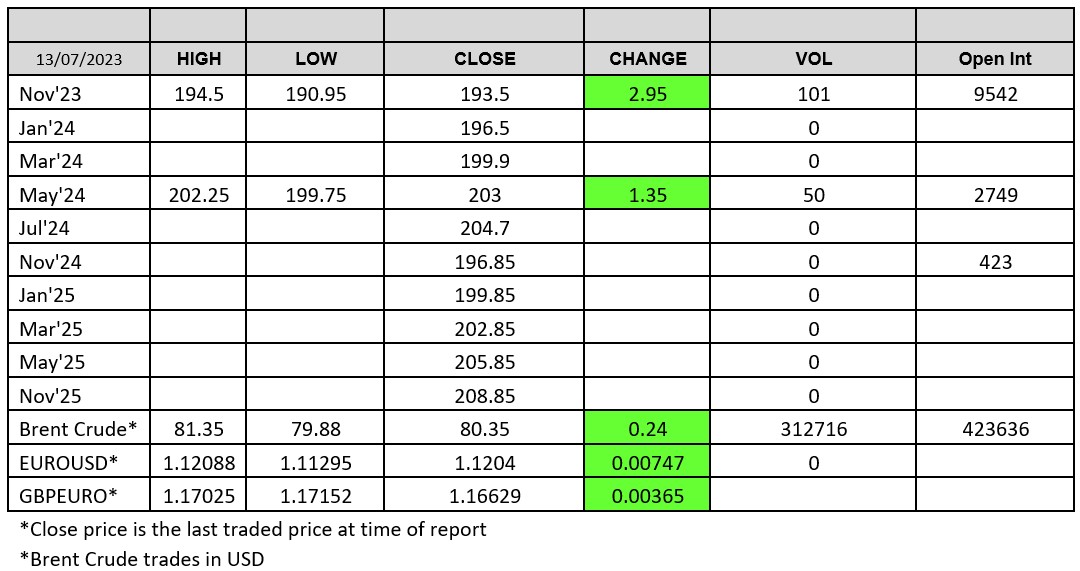

Source: FutureSource

UK govt increases pay offer, offering teachers a 6.5% pay rise. Biden guarantees commitment to Nato. More Kremlin controversy as a well renown and respected General comes out with some more great feedback to the Russian general staff. Black Sea Grain corridor chatter continues with little coming out of it except the EU guaranteeing the Russian Agricultural Bank access to SWIFT. Kremlin are sprouting the usual lyrics here but no doubt it will roll over. GBP is absolutely flying in today’s trade, trading up 0.9% at time of writing against USD @ 1.31 – just imagine the profits made on the back of that debacle of a week …. when it was hitting 1.06.

Well, after yesterday’s bearish report from the USDA. Wheat markets weren’t trading as flat today as I’d have expected after all the news. US weekly wheat net sales slipped 2.5% to 395,700t W/E 6th July. Rouen total weekly exports reach 151kt with wheat exports down 70% W/E 12th July. US domestic supplies are increasing, Canadian crop has indeed lost some of its potential but does not appear to be anywhere near a failure as some Twitter connoisseurs were trying to pump a while back. Chicago was trading up 8 cents at time of writing. Matif was trading supported today with volumes good and Sept-23 settling up €1.50 on yesterday at €229.25/t.

USDA reported 125kt of beans were sold to Mexico for 23/24. Brent crude was trading over $80/ba today. Lots of debate over the ending stock figure from the USDA who pinned ending stocks estimate for 23/24 at 300Mb, whereas the trade were more in the region of 230. Chicago soybeans were trading supported today, boosted by export sales and continued weather chatter. China continues to import Brazilian beans. German farming co-ops have cut their rapeseed outlook by 3.3% on the year to 4.14Mmt. Matif rapeseed Nov-23 settled up €10.25 on yesterday at €481.25/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.