MORNING AG OUTLOOK

Grains are lower. Stocks are lower. US Dollar is higher. Crude is slightly lower. Gold is mixed. US and UK banned trading of Russian nickel, aluminum and copper and delivery to exchanges. China Q1 GDP was better than expected. World awaits Israel response to Iran missile attack.

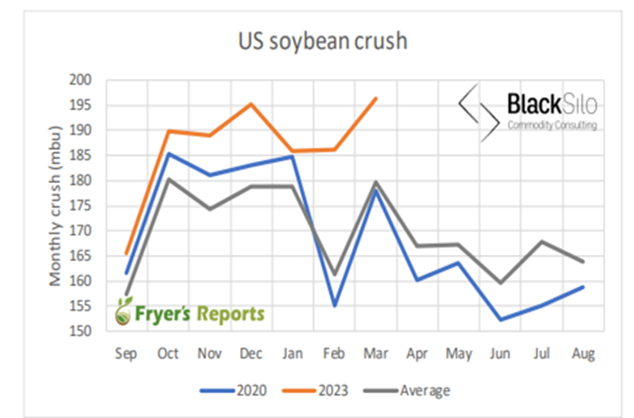

SK is near 11.55. SK-SN spread continues to widen. Dalian soybean, soyoil and palmoil prices were lower. Soymeal was higher. US March soybean crush was record. US soymeal supplies and soyoil stocks were higher. US soybean exports to date are down 19 pct vs ly and USDA est of a 14 pct drop. Higher product supplies and lower exports weighed on soybean futures. USDA est US soybean plantings at 3 pct vs 1 average and 4 ly. China bought 20 Brazil soybean cargoes since Friday. Brazil farmers continue to be good sellers of soybean with local currency lower. U of IL report suggest Brazil could expand crop acres 70 mil by planting central region pasture and not deforestation. Palmoil prices are lower due to seasonal increase in production.

CK is near 4.30. Sideways market continues. CK-CN spread continues to widen. Cash remains firm. Some commercials have moved their bids to July. USDA estimate US corn plantings at 6 pct vs 8 ly. MO is 26, IA 4. IL 3. Sorghum is 14 pct. US weather uncertainty could last through US July pollination time. For now, US west Midwest planting weather looks good. Dalian corn futures were lower. China corn import demand is lower. This and Middle east tension may be lowering global corn export demand. US corn export are up 34 pct vs ly and USDA est of a 25 pct increase. There remains questions over final Brazil corn crop (lower?) and lower Argentina crop due to disease.

WK is near 5.49. Wheat futures are mixed to lower. Increase uncertainty and higher energy prices may be slowing World wheat buying, Higher US Dollar is not helping new buying. Russia nationalizing Agriculture limits price data but Russia is still cheaper origin. US exports are down 9 pct vs ly and vs USDA est of a 4 pct drop. Egypt is tendering for May 20-30 wheat. USDA rated the US winter wheat crop 55 pct G/E vs 56 last week and 27 ly. IL SRW was rated 78 G/E vs 65 last week, KS HRW is rated 43 G/E vs 49 last week and 14 ly. 11 pct of crop is heading which is a little ahead of average. US spring wheat crop is 7 pct planted vs 2 ly.

Interested in more futures markets? Explore our Market Dashboards here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.