MORNING AG OUTLOOK

New Month. Grains are lower. SH is down 5 cents and near 12.17. SMH is near 367.8. BOH is near 45.90. CH is down 2 cents and near 4.46. WH is down 2 cents and near 5.92. KWH is down 2 cents and near 6.19. MWH is down 1 cent and near 6.93. US stocks are higher. US Dollar is higher. Crude is higher. Gold is lower.

SH is near 12.17. SH -SK spread is in a carry. SMH-SMK is back to an inverse. Dalian soybean and soymeal were higher, Palmoil and soyoil were lower. Trade estimates US Dec crush at 206.1 mil bu vs 200.1 in Nov and 187.4 last year. US Dec soyoil stocks are est at 1,764 mil lbs vs 1,592 in Nov and 2,306 ly. Weekly US soybean export sales are est at 500-1,059 mt vs 560 last week. There is talk of lower South America crops. Brazil due to talk of variable yields. Argentina due to hot/dry weather. World oilseed demand appears to be below last year especially due to lower China demand.

CH is near 4.46. Overnight, Crude futures are higher. Recent CH range has been 4.38-4.48. Hard to break below support with talk of lower SA crops. CH is hard to rally due to slower demand. US corn export sales are est at 800-1,300 mt vs 954 last week. Weekly US ethanol production jumped higher after last weeks weather influenced lower production, Stocks were down 6 pct vs last week and down 1 pct vs last year. Corn futures trade may be on hold until US response to recent attacks on US Middle East targets. Matif corn is making new lows due to higher EU supplies. EU farmers continue to protest due to higher cost and overall concern about future of EU Ag.

source: PRX ProExporter

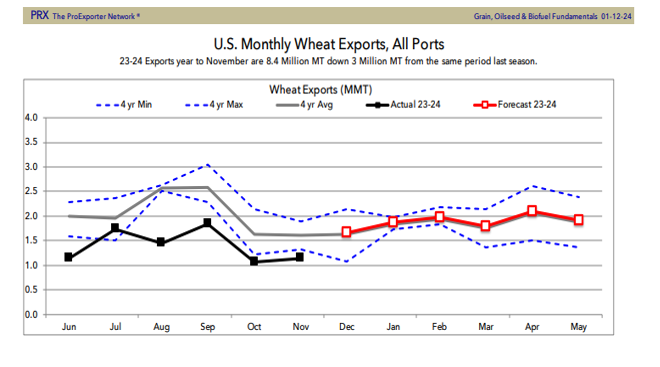

Wheat futures are lower. WH is near 5.92. KWH 6.19. MWH 6.91. Recent WH range has been 5.84-6.17. Funds added to shorts on Wednesday. Russia and EU wheat prices remain a discount to US. Wheat trade trying to price in drop in US and EU 2024 winter wheat acres vs higher monthly US wheat state crop ratings and higher EU and Russia available export supplies. US wheat export sales are est at 275-600 mt vs 451 last week. NE Africa remains dry. US plains and Canada weather is improving. Global wheat import demand has slowed as buyers search for funding. Red Sea unrest could also be slowing demand.

Interested in more futures markets? Explore our Market Dashboards here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.