Macroeconomics: The Week Ahead: 29 May to 2 June 2023

- May 30, 2023

- Marc Ostwald

- Follow us on Twitter @TradeADMIS

Written by Marc Ostwald, ADMISI’s Global Strategist & Chief Economist

The Week Ahead – Preview:

The various holidays around the world to start the week will ensure a subdued start, as the US ‘debt ceiling deal’ now faces its much bigger challenge, i.e. getting it passed by Congress. There are a number of both hardline ‘conservative’ Republicans and ‘progressive’ Democrats, who will doubtless be voicing their opposition to the deal from now until Wednesday’s vote, with the X date now set at June 5th. The problems that McCarthy faced in being elected speaker of the House should serve as a reminder just how stubborn the potential opposition may be. Markets will also need to ponder just how much fiscal drag there will be given the deal on the table involves spending cuts, and this will also play into the Fed’s rate decision in June, and obviously follows the uncomfortable message from Friday’s PCE deflators. There are also the results of the Turkish presidential run-off and Spanish regional and municipal elections to consider, and French President Macron will be on alert for a potential further negative ratings action when S&P publishes its review on Friday.

Per se, this will remain front and centre for markets, even though there is a good deal of data to get through, with Eurozone CPI for May, US labour data, China’s NBS PMIs and worldwide Manufacturing PMIs topping the statistical agenda. There are a further raft of central bank speakers, with the ECB publishing the account (minutes) of its May meeting, as well its semi-annual Financial Stability review, the latter getting particular attention in terms of bank balance sheet strength given the sharp rise in rates, and housing and commercial real estate finance, while the Fed issues its latest Beige Book.

In the commodity space, next weekend’s OPEC+ meeting will be in focus, though no changes are expected, despite last week’s ‘ouch’ warning from the Saudi Energy Minister, and there will also be considerable focus on European NatGas prices after last week’s TTF fall, though the steep discount to Asia LNG prices does appear to be reversing. The restrictions on Panama Canal traffic (with no LNG shipments via the canal last week) are creating disruptions to flows from the US to Asia, and some re-routing to Europe. A close also continues to need to be kept on falling oil and gas rig counts in the weekly Baker Hughes report, which suggests the improvement in sector upstream investment over the past 18 months is faltering.

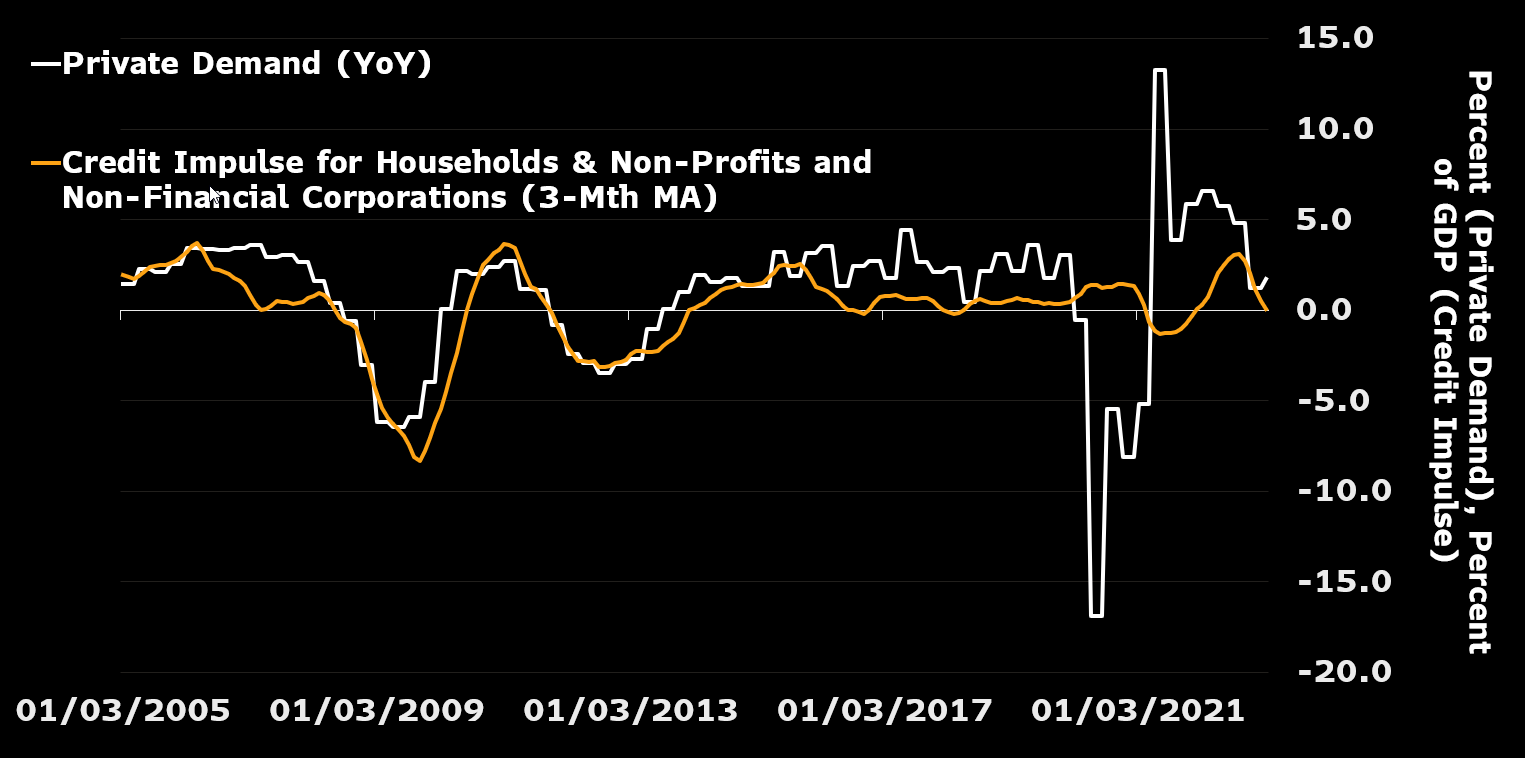

In terms of the week’s data run, the Eurozone national CPI readings are all expected to show modest increases or in Italy’s case a drop in m/m terms, and per se reap the base effect rewards in terms of y/y rates falling: Spain 3.4% vs. 3.8%, France 6.4% vs. 6.9%, Germany 6.7% vs. 7.6% and Italy 7.5% vs. 8.7%. In turn, the pan Eurozone reading is forecast to drop to 6.3% from 7.0%, but the fly in the ointment is expected to be only a marginal fall in the core rate to 5.5% y/y from 5.6%, which thanks to pressure from package holidays (which are weighted higher this year) will likely be reversed in June and July. German Unemployment is seen rising a further 15K after an unexpected 25K jump in April, while attention needs to be paid to the Private Sector Credit component of M3, after it fell sharply as a % of GDP to just 0.1% in March, sending a negative signal on the credit impulse (see chart). As for Friday’s Payrolls, forecasters are once again looking for a substantive loss of momentum – Private seen at 173K vs. April’s 230K, even if their pessimism has been proven wrong all too often in the past 12 months. The Unemployment Rate is seen edging up to 3.5% from an over 50 year low of 3.4%, with Average Hourly Earnings seen offering the Fed a crumb of comfort by easing to 0.3% m/m from April’s 0.5%, with the y/y rate unchanged at a still quite lofty 4.4%.

In the US, Consumer Confidence is seen falling further to 99.0 from April’s 101.3, with the strength of the Present Situation sub-index contrasting very sharply with desultory levels of Expectations. House Prices are expected to edge higher in m/m terms, while Auto Sales are expected to give much of April’s surge to 15.91 Mln SAAR with a drop to 15.3 Mln, and per see implying a drop in May headline Retail Sales. The array of labour market indicators are forecast to show JOLTS Job Openings easing further, but still quite far above pre-pandemic levels, while the focus in terms of Challenger Job Cuts will be on the breadth that was evident in sector terms in April.

China’s NBS PMIs are not expected to alter perceptions that the post “Zero Covid” recovery is proving to be disappointing, with Manufacturing seen edging up to 49.5, but Services losing traction with a drop to 55.0 from 56.4. Friday’s Manufacturing PMIs are likely to echo the G7 flash readings with pervasive weakness in many countries.

As the UK govt looks to follow France with a voluntary basic food price cap agreement with supermarkets, the focus will be on the latest BRC Shop Price Index (last 8.8% y/y), which should ease modestly after the Kantar Grocery Price edged down 0.1 ppt to 17.1%. UK Net New Consumer Credit is expected to continue to hold up at a respectable £1.5 Bln, but Lending Secured on Dwellings is forecast to remain weak at just £500 Mln, after an unexpectedly weak no change in March, with total Approvals also seen still very subdued at 54K.

Elsewhere Japan’s Q1 CapEx is forecast to slow to 5.4% y/y from Q4’s 7.7%, but broadly in line with the 0.6% q/q expansion in Business Spending in the Q4 GDP report. A similar picture is seen in Australia with Q1 CapEx seen slowing to just 1.0% from 2.2%, with April CPI expected to edge down 0.1 ppt to 6.2% y/y. Canada’s Q1 GDP is forecast to expand at a respectable 2.5% q/q SAAR, thanks wholly to the 0.6% m/m jump in January, with March monthly GDP expected to contract -0.1% m/m, signalling a sharp loss of momentum going into Q2. Meanwhile, Indian Q1 GDP and GVA are both forecast to pick up to 5.1% and 4.9% y/y respectively, from 4.4% and 4.6%, on the back of strong demand for back office services, a boost to agricultural output from a good harvest, and a round of govt subsidies for the manufacturing sector, though net exports may be a drag.

Outside of the Eurozone and Japan, govt bond supply takes a break with no coupon sales in the US and UK (outside of BoE QT), while there are auctions in Germany, France, Italy and Spain, with Japan selling 2 & 10-yr. Assuming that the debt ceiling deal is ratified, markets will also be watching closely to see the extent of a surge in US T-Bill sales as the Treasury rebuilds its cash balance at the Fed, which will be substantial on banking sector liquidity. It will be a seasonally typical light week for corporate earnings, with highlights for the week as compiled by Bloomberg News likely to include: Broadcom, Crowdstrike, Dell Technologies, Dollar General, HP, Lululemon Athletica, National Bank of Canada, Salesforce, Veeva Systems, VMware.

To view the full report and to sign up for daily market commentary please email admisi@admisi.com

The information within this publication has been compiled for general purposes only. Although every attempt has been made to ensure the accuracy of the information, ADM Investor Services International Limited (ADMISI) assumes no responsibility for any errors or omissions and will not update it. The views in this publication reflect solely those of the authors and not necessarily those of ADMISI or its affiliated institutions. This publication and information herein should not be considered investment advice nor an offer to sell or an invitation to invest in any products mentioned by ADMISI.

© 2023 ADM Investor Services International Limited.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.