Macroeconomics: The Week Ahead: 18 September to 22 September

Written by Marc Ostwald, ADMISI’s Global Strategist & Chief Economist

The Week Ahead – Preview:

Central bank policy meetings dominate the new week’s schedule, with the focus on the Fed, BoE and BoJ meetings, but Wednesday also has an expected further 50 bps rate cut in Brazil, and no change in change China’s Loan. Prime Rates. Meanwhile, Thursday has a grand total of 10 rate decisions: UK, Norway, Sweden and Switzerland (all +25 bps), Indonesia, Philippines, South Africa & Taiwan (all unchanged), Turkey (+500 bps to 30.0%) and Egypt (+25-50 bps), and there are policy meeting minutes from Australia’s RBA and Canada’s BoC, with a good many ECB speakers on tap.

A busy week for UK data is headlined by Wednesday’s CPI, with Retail Sales, PSNB, Rightmove House Prices, CBI Industrial Trends and GfK Consumer Confidence. There are G7/Australia ‘flash’ Manufacturing and Services PMIs, while the US looks mainly to housing data (NAHB, Starts & Permits, Existing Home Sales) along with Philly Fed Manufacturing survey and TIC Portfolio flows, though the UAW Autoworkers strike and the looming government shutdown may be bigger talking points. A light week in the Eurozone has final CPI and provisional Consumer Confidence, German PPI, French Business Confidence. Japan awaits Trade and National CPI, and the latter is also due in Canada, Mexico and South Africa. Corporate earnings are seasonally typically light, with AutoZone, FedEx, and General Mills among the highlights in the US.

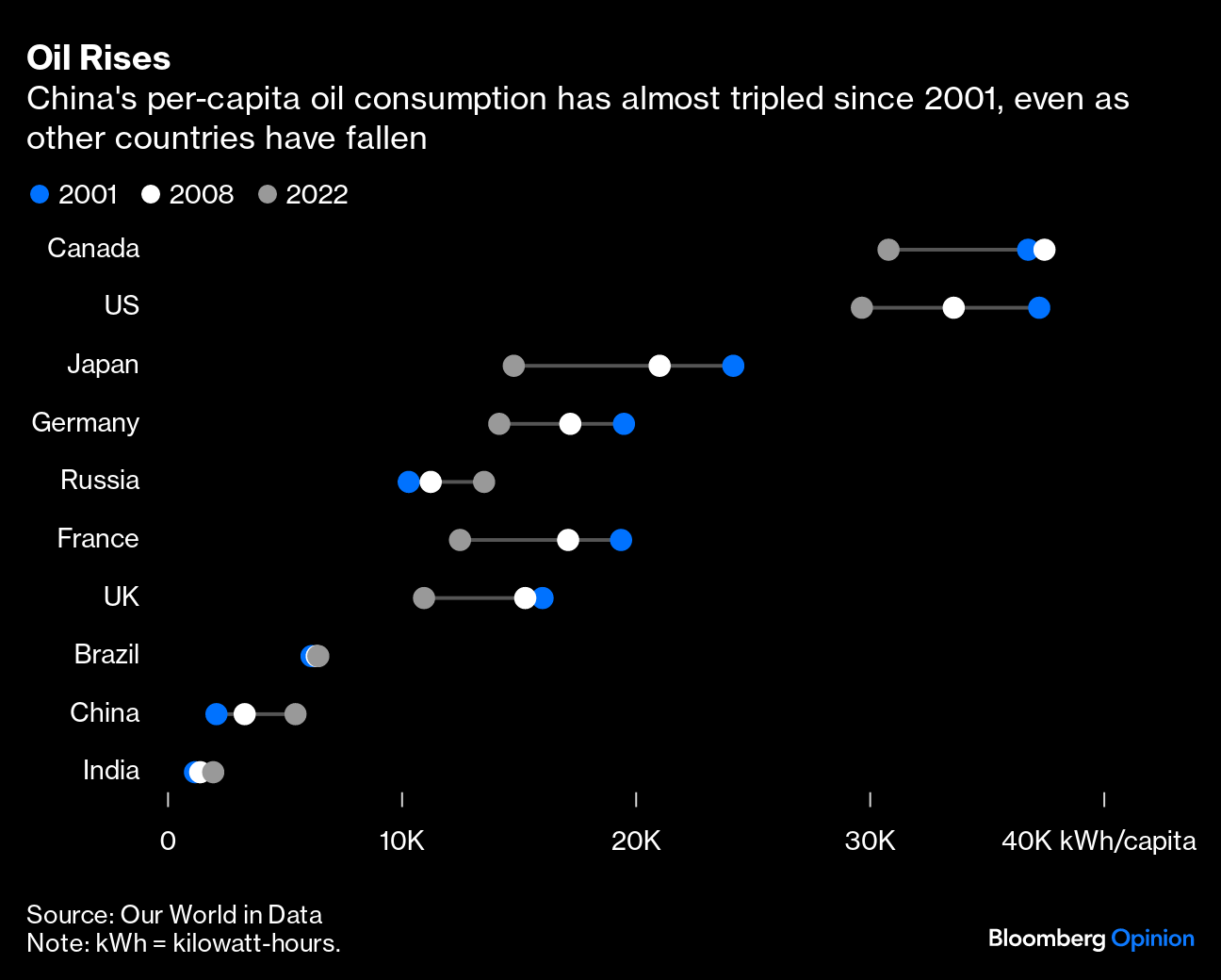

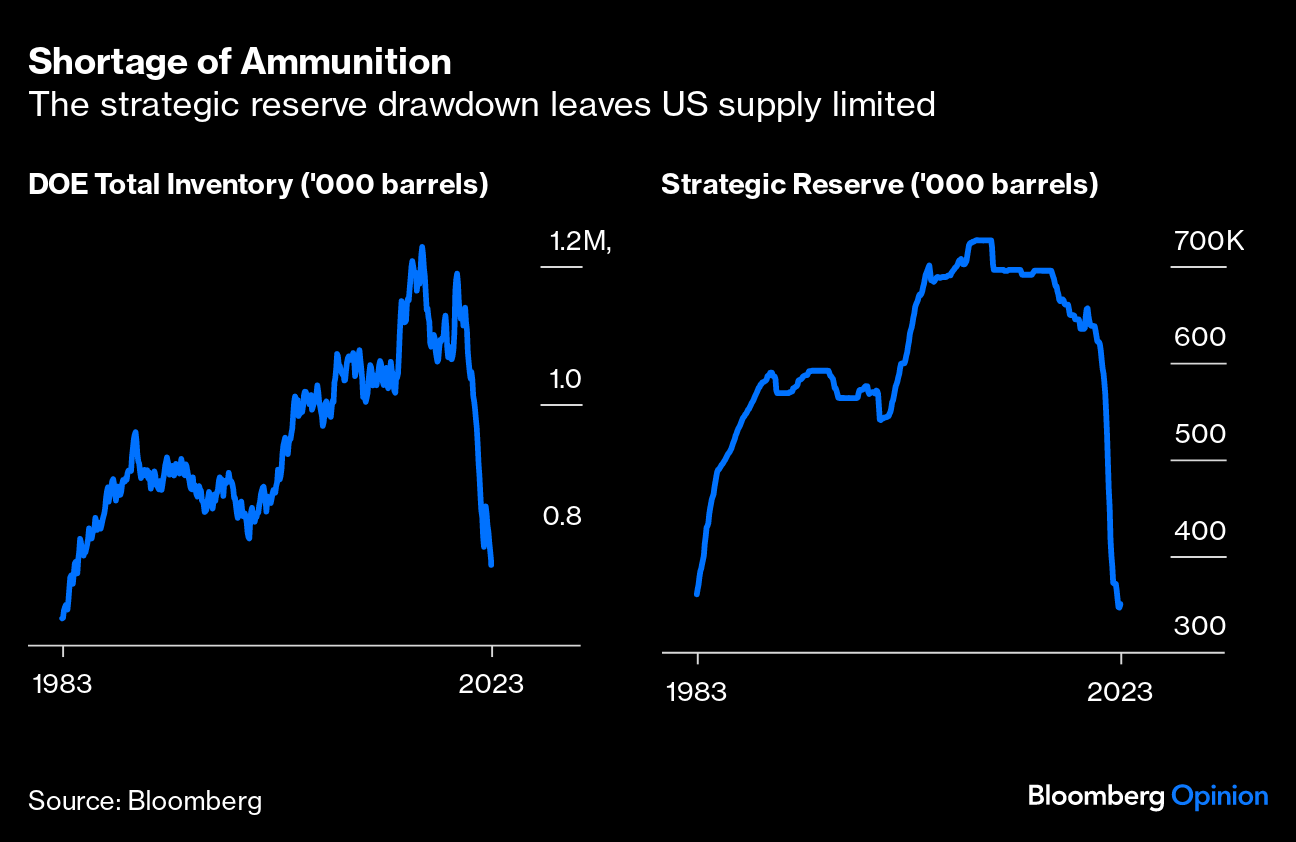

In the commodity space, the continued upward squeeze in oil prices will be front and centre, as Saudi and Russian output cuts bite, with the US (see inventories chart) and the rest of the world no longer able to draw down strategic reserves as they did in 2022. But it also puts both China and to a lesser extent India in the crosshairs, though per capita oil consumption is much lower (see chart), but has still risen sharply in the past two decades (see chart), while also presenting renewed pressure on European energy prices, presumably resulting in more demand destruction. Be that as it may, grains markets will look to monthly reports from EU’s MARS and the IGC. It will also be a huge week for commodity and energy conferences, amongst others: International Copper Forum, Energy Summit and Shanghai Green Steel Summit in China, the World Petroleum Congress in Canada, US Climate Week, Handelsblatt Gas Conference in Germany and UK Wood Mackenzie Hydrogen Conference. It is also well worth casting an eye over the S&P Global Commodity Insights report that suggests to meet current 2050 targets, around $1.5 trillion per annum investment in renewables will be required, but currently actual planned investment is only around $750 billion. Having attended and spoken at Biofuels, ShipZero and Aluminium conferences around Europe in the past fortnight, that funding gap has been all too palpable, along with the need for massive upscaling of production and resource input capacity, and some quantum leaps in technology.

In brief:

The Fed is expected to hold rates and leave the door open to one more rate hike, but likely placing even greater emphasis on being ‘patient’ and ‘cautious’ about a further move (the more so given the potential disruption from the UAW strike and looming government shutdown); the dot plot will as ever be very closely watched. Given the rise in energy prices, there may be an increase in headline PCE deflator forecasts for this year, but a small downward revision to core. They may express some satisfaction at the loosening in the labour market, while also noting resilience in consumer spending.

In the UK, Wednesday’s CPI is forecast to show headline CPI moving back up to 7.1% y/y from 6.8% (fuel price rises seen outweighing easing food and some services pressures), with core CPI only seen easing to 6.8% y/y from 6.9%. Per se, this will leave the BoE’s MPC with little or no choice but to hike rates a further 25 bps to 5.50%, though the question is how much emphasis is put on rates being close to a peak (as suggested by governor Bailey in recent testimony), above all with the signs that the UK economy is nearing stall speed, and the weakness in the Euro area.

The consensus looks for no change in China’s Loan Prime Rate fixings, but with the additional measures taken by the PBOC last week, on top of the prior month’s MTLF cut, there may be room for a marginal cut in the 1-yr rate.

The BoJ is expected to hold rates, and to maintain the current range for the 10-yr JGB yield target. The question is how Ueda & Co balance the softening signs on the economy (perhaps above all wages), against the potential upward pressure on inflation from the weakness of the JPY, and indeed oil prices.

The question for the SNB, Norges Bank and Riksbank meetings is the extent to which they signal an imminent peak in rates after hiking 25 bps this week, with surveys suggesting all of the economies are slowing, if not tipping into recession.

Forecasters expect Manufacturing PMIs in the Eurozone and UK to remain firmly in contraction territory, but to edge up marginally from August levels, with Services readings seen little changed and also signalling contraction, though more modest. US Manufacturing is also seen contracting modestly, while Services remain just about in expansion.

To view the full report and to sign up for daily market commentary please email admisi@admisi.com

The information within this publication has been compiled for general purposes only. Although every attempt has been made to ensure the accuracy of the information, ADM Investor Services International Limited (ADMISI) assumes no responsibility for any errors or omissions and will not update it. The views in this publication reflect solely those of the authors and not necessarily those of ADMISI or its affiliated institutions. This publication and information herein should not be considered investment advice nor an offer to sell or an invitation to invest in any products mentioned by ADMISI.

© 2023 ADM Investor Services International Limited.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.