TODAY —- CATTLE ON FEED, COMMITMENTS OF TRADERS

Wheat prices overnight are up 4 1/2 in SRW, up 7 in HRW, up 13 1/2 in HRS; Corn is up 2; Soybeans up 6 1/4; Soymeal up $0.02; Soyoil up 0.90.

For the week so far wheat prices are down 9 in SRW, up 5 3/4 in HRW, up 52 1/2 in HRS; Corn is down 27 3/4; Soybeans down 15; Soymeal down $2.81; Soyoil up 5.03.

For the month to date wheat prices are down 10 3/4 in SRW, up 1 in HRW, up 85 1/4 in HRS; Corn is down 7 1/2; Soybeans down 74 3/4; Soymeal down $42.50; Soyoil up 2.27.

Chinese Ag futures (SEP 21) Soybeans down 75 yuan ; Soymeal down 6; Soyoil down 30; Palm oil down 2; Corn down 4 — Malasyian Palm is up 98. Malaysian palm oil prices overnight were up 98 ringgit (+2.86%) at 3519 on track for its first weekly advance since early June on expectations of higher exports from second-biggest grower Malaysia, and support from strong soybean oil and petroleum prices.

Midwest corn, soybean and winter wheat forecasts: West: Scattered showers through Monday. Temperatures near to above normal through Friday, near normal Saturday, near to below normal Sunday-Monday. East: Scattered showers northwest Thursday. Scattered showers Friday-Monday. Temperatures near to above normal through Monday. 6 to 10 day outlook: Scattered showers Tuesday-Saturday. Temperatures near to below normal southwest and near to above normal elsewhere Tuesday-Wednesday, near to below normal Thursday-Saturday.

The player sheet for 6/24 had funds: net sellers of 6,000 contracts of SRW wheat, sellers of 2,500 corn, sellers of 6,500 soybeans, sellers of 6,500 soymeal, and buyers of 3,500 soyoil.

Preliminary changes in futures Open Interest as of June 24 were: SRW Wheat down 7,789 contracts, HRW Wheat up 369, Corn down 19,750, Soybeans up 1,190, Soymeal down 2,462, Soyoil down 7,034.

There were changes in registrations (-50 Soyoil). Registration total: 20 SRW Wheat contracts; 16 Oats; 0 Corn; 13 Soybeans; 718 Soyoil; 442 Soymeal; 1,249 HRW Wheat.

TENDERS

- SOYBEAN SALES: Exporters sold 132,000 tonnes of U.S. soybeans to China and 260,000 tonnes to unknown destinations, all for delivery in the 2021/2022 marketing year, the U.S. Department of Agriculture said.

- WHEAT PURCHASE: Japan’s Ministry of Agriculture sought 159,665 tonnes of food-quality wheat from the United States and Canada in a regular tender.

PENDING TENDERS

- WHEAT TENDER: Bangladesh’s state grains buyer issued an international tender to purchase 50,000 tonnes of milling wheat

- WHEAT TENDER: The Taiwan Flour Millers’ Association issued an international tender to purchase 55,000 tonnes of grade 1 milling wheat to be sourced from the United States

- WHEAT TENDER: Turkey’s state grain board TMO issued an international tender to purchase a total of about 395,000 tonnes of red milling wheat

- WHEAT TENDER: Jordan’s state grain buyer issued a tender to buy 120,000 tonnes of wheat, with a bidding deadline of July 6

- WHEAT TENDER: The Ethiopian government issued an international tender to buy about 400,000 tonnes of optional-origin milling wheat

CROP SURVEY: U.S. 2021 Corn Area Seen Rising to 93.8M Acres

U.S. farmers seen planting 2.6m acres more of corn this year than previously expected, according to the avg est. of as many as 30 analysts surveyed by Bloomberg.

- Soybean planting seen at 89.1m acres, a rise of 1.5m acres from the USDA’s March projection

- Wheat area seen at 46m acres vs 46.4m

- U.S. June 1 corn stocks seen at 4.13b bu, a decline of 870m bu from the same period a year ago

- Soybean stocks seen at 770m bu vs 1.38b bu

Russia Raises Wheat Export Tax to $41.30/Ton for Next Week

Russia’s wheat export customs duty will rise to $41.30/ton from $38.10/ton currently, the Agriculture Ministry said Friday on its website.

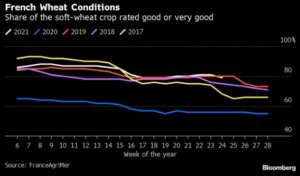

French Wheat Ratings Edge Lower; Barley Harvest Starts: AgriMer

The amount of France’s soft-wheat crop rated in good or very good condition fell to 79% in the week to June 21, down slightly from the prior week, FranceAgriMer data showed on Friday.

- Winter-barley was 1% harvested, versus 2% a year earlier

Malaysia’s June 1-25 Palm Oil Exports 1,174,350 Tons: AmSpec

Shipments during the period rose 6% from 1,107,570 tons exported during May 1-25, according to AmSpec Agri on Friday.

Brazil Second Corn Crop Estimate Cut to 65.3m Tons: Agroconsult

That’s a 1.4% reduction from 66.2m tons estimated in May and a drop of 22% versus the initial forecast in January, Agroconsult said in report.

- Average yield seen at 74 bags per hectare versus 94.1 bags in 2019-20

- Areas most affected by adverse weather were Goias, Minas Gerais, Parana, Mato Grosso do Sul states with yields declining above 30% y/y

- Some areas had also pollination issues, high level of plagues

- Corn exports seen falling to 24m tons versus 35m in previous crop

EU Lowers 2021 Soft-Wheat, Corn and Barley Crop Estimates

The downgrades come amid lower grain production expectations for countries including Poland and Romania, while French prospects have improved, according to a report from the European Commission.

- EU’s soft-wheat harvest estimated at 125.8m tons, down from a May estimate for 126.2m tons

- Top producer France is seen with an above-average harvest of 35.9m tons, while Poland has below-average crop of 9.5m tons

- Outlook for wheat exports to third countries kept steady at 30m tons

- Stockpile estimate cut to 10.1m tons, from 10.8m tons

- Barley crop estimate lowered to 53.5m tons, from 54.5m tons

- Corn crop estimate lowered to 70.6m tons, from 71m tons

- Rapeseed crop estimate little changed at 16.71m tons

U.S. Hog and Pig Inventory Fell 2.2% Y/y; Est. -2.3%

The hog herd totaled 75.653m head on June 1, according to the USDA report released Thursday on its website.

- Sows retained for breeding totaled 6.23m head, a 1.5% decline from year ago

- Pig crop fell to 33.584m from 34.644m last year

- Pigs per litter fell to 10.95 from 11 last year

IGC Now Sees Small Rise in Global Grain Stockpiles in 2021-22

World grain stockpiles in the 2021-22 season are now estimated at 597m tons, the International Grains Council said in an emailed report.

- That’s up from a May estimate for 595m tons and would put inventory 2m tons higher y/y

- Increase comes amid bigger harvests of corn, oats and minor grains

- Estimate for China’s total grain imports pared to 47.5m tons, down 0.2m tons from May

U.S. Barge Shipments of Grain Fell 3% Last Week: USDA

Shipments along the Mississippi, Illinois, Ohio and Arkansas rivers declined in the week ending June 19 from the previous week, according to the USDA’s weekly grain transportation report.

- Barge shipments of corn fell 12% from the previous week

- Soybean shipments up 11% w/w

- Figures in thousands of tons:

Strong Winds Worsen Dry Soil Conditions for Saskatchewan Crops

Some farms in the Canadian prairie province received much-needed rain in the past week, but most need more to sustain crop and pasture growth, Saskatchewan government said Thursday.

- Strong dry winds in many areas caused crop damage, dried soil further and delayed herbicide application, weekly crop report shows

- Weed growth is beyond the point of control in many areas

- Topsoil moisture is declining due to “very high temperatures and non-stop winds,” report says

- Few areas received enough rain to alleviate stress caused by extremely dry conditions

- 2% of cropland topsoil moisture is rated at surplus, 56% adequate, 36% short, 6% very short

- Still, crop development is normal in most areas, though oilseeds are behind

- 62% of fall cereals, 81% of spring cereals, 70% of oilseeds and 81% of pulse crops are at normal stage development

- Flea beetle damage is reported in most regions, affecting some canola development

- Damage from isolated reports of frost is not yet known, with canola the crop of most concern

- Cutworm, gopher and root rot diseases have also been reported

Malaysian palm giant IOI says to assist if U.S. probes alleged forced labor

Malaysian palm oil company IOI Corporation said on Friday it had been made aware of a letter from the U.S. Customs and Border Protection (CBP) about opening an investigation into allegations of labor abuses at the company.

According to IOI, CBP in the letter to a labor activist acknowledged the receipt of a petition providing information on alleged forced labor conditions at the company and found it sufficient to open an investigation.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.