China’s Progress on U.S. Trade Deal Slows Again In May

Wheat prices overnight are up 3 3/4 in SRW, up 4 in HRW, up 28 3/4 in HRS; Corn is down 4 1/4; Soybeans down 17; Soymeal down $0.25; Soyoil down 1.18.

For the week so far wheat prices are up 3 in SRW, down 2 1/2 in HRW, up 30 in HRS; Corn is down 13 1/2; Soybeans down 10 1/4; Soymeal down $0.67; Soyoil up 0.77.

For the month to date wheat prices are up 1 1/2 in SRW, down 7 1/4 in HRW, up 62 3/4 in HRS; Corn is up 7 1/4; Soybeans down 70 1/2; Soymeal down $21.10; Soyoil down 2.04.

Chinese Ag futures (SEP 21) Soybeans up 74 yuan ; Soymeal up 2; Soyoil up 130; Palm oil up 80; Corn down 4 — Malasyian Palm is down 6.

Malaysian palm oil prices overnight were down 6 ringgit (-0.18%) at 3385 bouncing back on an overnight jump in soybean oil prices and signs of a recovery in shipments from second-biggest grower Malaysia.

Midwest corn, soybean and winter wheat forecasts: West: Scattered showers south Monday. Isolated showers Iowa Tuesday night. Mostly dry Wednesday. Scattered showers Thursday-Friday. Temperatures below normal Monday-Tuesday, near to above normal Wednesday-Friday. East: Scattered showers Monday. Scattered showers northwest Tuesday-Thursday. Scattered showers Friday. Temperatures near to below normal through Wednesday, near to above normal Thursday-Friday. 6 to 10 day outlook: Scattered showers Saturday-Sunday. Isolated showers Monday-Wednesday. Temperatures near to below normal Saturday-Tuesday, near to above normal Wednesday.

The player sheet for 6/21 had funds: net buyers of 500 contracts of SRW wheat, sellers of 4,000 corn, buyers of 6,500 soybeans, sellers of 1,000 soymeal, and buyers of 9,000 soyoil.

Preliminary changes in futures Open Interest as of June 21 were: SRW Wheat down 6,527 contracts, HRW Wheat down 1,982, Corn down 17,518, Soybeans down 3,713, Soymeal down 595, Soyoil down 7,188.

There were no changes in registrations. Registration total: 20 SRW Wheat contracts; 16 Oats; 0 Corn; 13 Soybeans; 768 Soyoil; 442 Soymeal; 1,249 HRW Wheat.

TENDERS

- SOYBEAN SALE: The U.S. Department of Agriculture said exporters sold 336,000 tonnes of U.S. soybeans for delivery to China during the 2021/2022 marketing year, following a Reuters report on Friday on the largest sale to the country in 4-1/2 months.

- SOYBEAN SALE: Exporters also sold 120,000 tonnes of U.S. soybeans to unknown destinations for delivery during the 2021/2022 marketing year, the USDA said.

PENDING TENDERS

- WHEAT TENDER: Bangladesh’s state grains buyer issued an international tender to purchase 50,000 tonnes of milling wheat

- WHEAT TENDER: Jordan’s state grain buyer issued international tenders to buy a total 120,000 tonnes of milling wheat which can be sourced from optional origins

- WHEAT TENDER: Turkey’s state grain board TMO has issued an international tender to purchase a total of about 395,000 tonnes of red milling wheat

U.S. Inspected 1.481m Tons of Corn for Export, 175k of Soybean

In week ending June 17, according to the USDA’s weekly inspections report.

- Soybeans: 175k tons vs 130k the previous wk, 256k a yr ago

- Corn: 1,481k tons vs 1,611k the previous wk, 1,306k a yr ago

- Wheat: 549k tons vs 500k the previous wk, 686k a yr ago

China soybean imports rise 11% during Jan-Jun, with possible weak demand for 2021/22 U.S. soybeans – Refinitiv Commodities Research

China soybean imports totaled 9.0 million tons in May, lower than last May. On the other hand, June imports are projected at 11.6 million tons, the all-time high monthly imports, primarily due to massive arrivals of Brazilian soybeans (11.4 million tons). In addition, 8.3 million tons of soybeans have departed from the loading ports and will arrive in China in July. According to Refinitiv’s trade flows, majority of imports in June/July will be originated from Brazil. Meanwhile, China resumes soybean imports from Argentina and Uruguay in June/July after negligible imports over the past half year.

Total imports during the first half of 2021 are projected at 46.9 million tons, compared 42.4 million tons for last year’s same period (up 11%). After taking into account rapid imports in the first six months and currently fast deliveries of Brazilian soybeans, China’s demand for the U.S. new crop soybeans that will be harvested in late August/early September will likely be much weaker than a year ago.

Indonesia’s new palm oil levy likely to lift exporters’ profit margin

Indonesia’s decision to change the levy structure for palm oil exports is expected to improve profit margin for exporters, Indonesia Palm Oil Association (GAPKI) said, though other groups felt the frequent changes in rules are hurting demand.

The world’s largest palm oil exporter will cut the ceiling rate for crude palm oil (CPO) levies to $175 per tonne from $255, Finance Minister Sri Mulyani Indrawati said on Monday, after facing criticism from stakeholders. (Full Story)

The export levy begins when the reference CPO price is at $750 per tonne, with a $20 increase for every $50 rise in the price. The maximum tariff for when CPO prices are above $1,000 will be flat at $175, the finance minister said.

The previous regulation stipulated a $15 levy increase for every $25 jump in crude palm prices.

Brazilian soybean exports in June slow down pace and are below 2020, says Secex

The average daily shipment of soybeans from Brazil slowed, reaching 582,000 tons by the third week of June, a volume already below the 606.74 thousand tons per day of the same month last year, federal government data showed Monday.

By the previous week, the world’s largest producer and exporter of the oilseed shipped 637.56 thousand tons per day, still exceeding the June 2020 average, said the Secretariat of Foreign Trade (Secex).

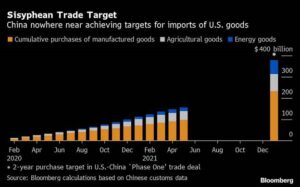

China’s Progress on U.S. Trade Deal Slows Again In May

China’s imports of American goods slowed again in May, putting the purchase targets agreed with the U.S. in the 2020 trade deal even further out of reach.

China bought almost $10 billion worth of manufactured, agricultural and energy goods from the U.S. in May, the lowest monthly total since October 2020. That took total imports to almost $157 billion since January 2020, 41.4% of the targets the two nations agreed at that time.

China’s Hog Herd Has Almost Recovered From African Swine Fever

- Pig population near normal levels, agriculture ministry says

- Pork prices have plunged this year amid rebuilding of herds

China’s hog population rose 24% in the year through May and has now almost fully recovered from the recent resurgence in African swine fever, according to the country’s agriculture ministry.

Herd sizes are close to normal for this time of year, Xin Guochang, an official at the ministry’s animal husbandry bureau, said in an interview on state television. Meanwhile, around 3.5 million of low-productivity breeding sows were culled in the first five months of the year, he said, which should lead to an improvement in herd fertility.

Canadian Crops Need Timely Rains to Offset Dry Conditions: Govt

Dry conditions affect much of Canada’s agricultural areas and timely rains are needed to reach expected yields, Agriculture and Agri-Food Canada said in a monthly report.

- The most significant concerns about dry conditions are in Manitoba and southern Saskatchewan

- Total grains and oilseeds production pegged at 88.7m metric tons in 2021-22 crop year, down from 90.4m in 2020-21

- Canola acreage forecast 4% higher y/y as farmers expand at the expense of wheat, forages and summer fallow

- Moisture across Western Canadian canola acreage is patchy, some areas “extremely dry”

- Pulse and special crops output forecast at 7.5m tons in 2021-22, down from 8.5m tons in 2020-21

- All principal field crop production pegged at 96.1m tons in 2021-22 vs 99m tons y/y

- Exports expected to drop to 51.9m tons in 2021-22 vs 59m in 2020-21

- Carry-out stocks for all principal field crops forecast at eight-year lows by end of the 2020-21 due to record exports, despite record production

U.S., Brazil expected to constrain ethanol output in coming months

The United States and Brazil, the world’s top two ethanol producers, are expected to hold down production in coming months because of the surging cost of corn and sugar.

Tight corn and sugar supplies are passing through to ethanol costs, making producers reluctant to raise production, and boosting gasoline prices as well. The United States and Brazil are the linchpins of worldwide ethanol supply, accounting for 75% of global ethanol exports last year, according to S&P Global Platts Analytics.

U.S. gasoline prices on average are above $3 per gallon for the first time since 2014, American Automobile Association data shows, while prices in Brazil are at 5.40 reais per liter ($4.06 per gallon) in June in Sao Paulo state, near all-time highs.

Ethanol usually helps lower gasoline prices, said Scott Irwin, a professor at the University of Illinois, as it tends to be an inexpensive source of needed octane for gasoline. However, at current market prices, ethanol is actually adding to gasoline’s cost.

WHEAT/CEPEA: International devaluations and dollar depreciation press down values in Brazil

Wheat prices dropped sharply in the Brazilian market last week, influenced by international devaluations and the dollar depreciation against the Real, which reduces the import value.

Still, Cepea collaborators have reported that the wheat from last season still available in the market may not be enough until the harvesting begins. Thus, the imports pace continues fast.

Between June 11 and 18, the prices paid to wheat farmers (over-the-counter market) dropped by almost 7% in Paraná and 6.16% in Rio Grande do Sul. On the other hand, in Santa Catarina, values increased by a slight 0.17%. In the wholesale market (deals between processors), prices decreased by 3.66% in Paraná, 2.7% in São Paulo, 1.48% in Rio Grande do Sul and 1.43% in Santa Catarina. Still, the current price levels are higher than that last year, in nominal terms. The dollar dropped by 1% between June 11 and 18, to 5.07 BRL on Friday, 18.

Brazil Approves Over BRL250b in Agriculture Funding: Valor

Brazil’s Monetary Council approved the terms and conditions for the government’s agriculture financing program known as Plano Safra 2021/22, Valor Economico newspaper reports without citing how it obtained the information.

- Plan will be launched 8 days before the start of the program, on July 1

- Total funding to surpass 250b reais, around 6% up from last year

- Interest is also expected to rise by 0.25%-1.5% per year; in the previous 2020/21 crop season, interest rates varied from 2.75% to 7%

- Rural insurance budget will be 976m reais, lower than the 1.3b reais estimate

EU Wheat, Barley Crops Set for ‘Firmly’ Above-Avg. Yields: MARS

Yields for EU soft-wheat, barley and rapeseed crops should be “firmly” above the five-year average, the EU’s Monitoring Agricultural Resources unit wrote Monday in a report.

- Warmer temperatures and adequate moisture have improved the production outlook for winter crops and spring grains

- Yield outlook for French sugar beet crop revised lower due to impact of April cold snap

- See table with latest forecasts for 2021; yields in tons/hectare:

Heavy Ukraine Rains Put Record Wheat Yield at Risk: MARS

Ukraine had favorable weather through May, but recent stormy conditions are expected to lower wheat quality and quantity, the EU’s Monitoring Agricultural Resources unit said Monday in a report.

- Southern and eastern regions had torrential rain from May 29 to June 10

- Conditions are similar to those that triggered substantial yield loss in France in 2016 and the U.K. in 2012

- Winter barley should not be impacted, and close-to-record or record yields are expected

Algeria Wheat Yields Fall 29% Below Average on Drought: MARS

The combination of drought and hot temperatures sped up grain development in Algeria’s central-east region, worsening an unfavorable growing season, the EU’s Monitoring Agricultural Resources unit said in a report dated Monday.

- Wheat yields are estimated at 1.17 tons/hectare, 29% below the five-year average

- In Morocco, wheat and barley both have “very positive” prospects

Glencore’s Russian Unit Shipped 28,500 Tons of Wheat to Algeria

Glencore’s Viterra Rus, a member of the Union of Grain Exporters, shipped 28,500 tons of wheat with 12.5% protein to Algeria, the Russian union said in a statement.

- The delivery was made from the Taman grain terminal

- This is the first Russian shipment since the autumn of 2020, when Algeria tightened requirements relating to turtle bug damage

Ukraine wheat, corn, barley prices down over past week -APK-Inform

Ukrainian wheat export bid prices lost $8 a tonne over the past week thank to improved weather conditions in key producing countries, the APK-Inform agriculture consultancy said on Tuesday.

- Soft milling wheat with 12.5% protein was traded at $252 to $258 FOB Black Sea while feed wheat, which also lost $8 a tonne stood at $248-$253 FOB.

- Ukraine sold about 57 million tonnes of grain to foreign buyers in the 2019/20 season. The government has said exports could decline to 45.8 million tonnes in 2020/21 due to a weaker harvest. (Full Story) (Full Story)

- APK-Inform said 11.5% protein milling wheat bid prices for the 2021 harvest stood at $244-$252 a tonne FOB Black Sea and $228-$233 FOB Black Sea for feed wheat.

- Ukraine has said it can harvest up to 30 million tonnes of wheat this year versus 25 million tonnes in 2020.

- APK-Inform said corn bid export prices declined by $8 over the past week to $282-$292 FOB.

- The consultancy said new crop barley traded between $240-$245 a tonne FOB Black Sea with the delivery in July.

Olam Says Freight Cost Surge and Port Congestions are Headwinds

Logistical challenges affecting the container shipping sector and high freight costs are serious issues and headwinds for the industry, according to Olam International Ltd., one of Asia’s largest farm commodity traders and suppliers.

- Heavy congestions at origin as well as destination ports are a result of Covid-related disruptions that has taken out capacity, Chief Executive Officer Sunny Verghese said at a briefing in Singapore after the company’s rights issue announcement

- “It will take some time to work through,” he said

- Although it will have some influence on demand, there won’t be any significant impact on the company’s profitability as freight costs will be passed on to customers

Biggest Smithfield Pork Plant Delisted for Mexico Exports

Smithfield Foods Inc.’s largest pork-processing plant, located in Tar Heel, North Carolina, was delisted from being eligible to export to Mexico as of June 16, according to a notice on the U.S. Department of Agriculture website.

- Smithfield in a statement said it was working to resolve the matter

- Mexico is a top destination for U.S. pork exports

Smithfield Sued for Profiting From Covid Meat-Shortage Fears

- Advocacy group also cites Covid worker protection claims

- Meatpacking plants were early epicenters of the pandemic

A consumer advocacy group is suing Smithfield Foods Inc. for allegedly fueling fears of a meat shortage during the pandemic to boost demand and prices for its products.

Food & Water Watch filed a lawsuit on June 16 in Washington, D.C., claiming Smithfield, the top U.S. pork producer, sought to drive up demand even as it had ample reserves in cold storage and increased exports, mostly to China. The lawsuit also alleges the company misled the public about safety measures for its workers.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.