TODAY—WEEKLY ETHANOL STATS—USDA MONTHLY S/D REPORT—

Overnight trade has SRW Wheat up roughly 4 cents; HRW up 3 cents; HRS Wheat up 7, Corn is up 5 to 2 cents; Soybeans up 29 to 11; Soymeal up $5.00 to $3.00, and Soyoil up 70 to 30 points.

Chinese Ag futures for (September) settled up 87 yuan in soybeans (at U.S. $26.30), up32 in Corn (at $11.27), up 83 in Soymeal (at $528), up 224 in Soyoil (at 63.58 cents), and up 206 in Palm Oil.

Malaysian palm oil prices were up 174 ringgit at 4,524 (basis July) at midsession, a record high.

U.S. Weather Forecast: The most significant changes of rainfall in last evening’s GFS model run were in the May 19 – 23 timeframe. Last evening’s run was notably wetter in much of the Corn Belt, Delta, and Oklahoma and the evening run was notably drier in western and southern Texas and in Georgia and South Carolina.

South America Weather Forecast: Last evenings GFS model run in South America showed no significant rainfall changes in week 1. In week 2, rainfall was increased from northeastern Argentina into Rio Grande do Sul, Brazil May 20-21. Amounts were also increased from far southern Brazil into western Mato Grosso do Sul of Brazil May 21-23.

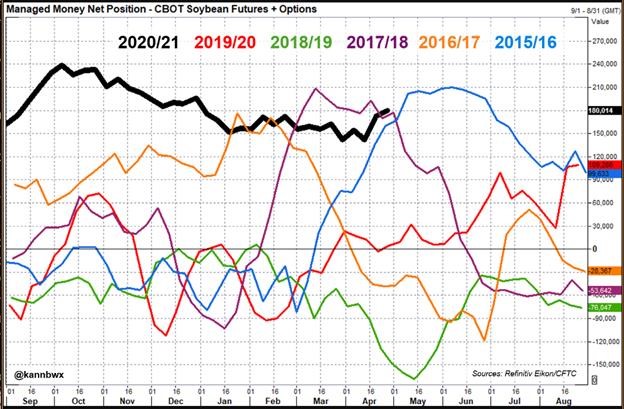

The player sheet had funds net buyers of 5,000 contracts of SRW Wheat; bought 11,000 Corn; bought 15,000 Soybeans; net bought 7,000 Soymeal, and; bought 4,000 in Soyoil.

We estimate Managed Money net long 16,000 contracts of SRW Wheat; net long 378,000 Corn; long 212,000 Soybeans; long 62,000t Soymeal, and; net long 91,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures down roughly 4,200 contracts; HRW Wheat up 1,200; Corn up 6,200; Soybeans up 3,700 contracts; Soymeal up 7,300 lots, and; Soyoil up 1,400.

Deliveries were 35 Soymeal; 38 Soyoil; 30 Rice; ZERO Corn; 11 HRW Wheat; ZERO Oat; ZERO Soybeans; ZERO SRW Wheat, and; ZERO HRS Wheat.

There were changes in registrations (Soybeans down 55; Soymeal up 35; Rice up 11; HRW Wheat down 6)—Registrations total 68 contracts for SRW Wheat; 16 Oats; Corn ZERO; Soybeans 143; Soyoil 1,055 lots; Soymeal 210; Rice 1,546; HRW Wheat 1,283, and; HRS 521.

Tender Activity—Japan seeks 122,180t optional-origin wheat—Egypt bought 10,000t optional-origin sunoil—

China 2021/22 corn output seen up 4.3% -agriculture ministry – Reuters

China’s 2021/22 corn output is expected to rise by 4.3% on increased acreage and yields, the agriculture ministry said on Wednesday. China was expected to produce 271.81 million tonnes of corn in the 2021/22 year, up from 260.67 million tonnes a year ago, the Ministry of Agriculture and Rural Affairs said in a report. This year’s corn planting acreage was seen up 3.4% at 42.67 million hectares, as farmers were willing to expand the planting area on better benefits, the ministry said in the monthly China Agriculture Supply and Demand Estimates (CASDE).

Meanwhile, soybean acreage was seen down 5.4% from a year earlier, at 9.35 million hectares, as some farmers in main production areas switched to corn.

Growth of China’s soybean consumption and imports in 2021/22 was expected to slow as pig production levels gradually recovered to normal levels, the report said.

Union workers at Brazil’s Santos port on Tuesday delayed a possible strike until next month, amid demands to know how soon they will be vaccinated against COVID-19, a union official said. Union workers held a meeting on Tuesday to decide on whether to go on strike, with initial plans for a work stoppage this week.

- BRAZIL SOY EXPORTS SEEN REACHING 15.3 MLN TNS IN MAY VS 11.96 MLN TNS FORECAST IN PREVIOUS WEEK – ANEC

- BRAZIL SOYMEAL EXPORTS SEEN REACHING 1.8 MLN TNS IN MAY VS 1.67 MLN TNS FORECAST IN PREVIOUS WEEK – ANEC

Wire story reports market analysts predict both U.S. and Brazilian agencies on Wednesday will slash Brazil’s corn crop due to relentless dry weather in some key areas, though the expected cuts might not be big enough as May is forecast to be very light on the moisture. A smaller second corn harvest, the one Brazil most heavily exports, could drive even more business to the United States at a time when record purchases from China are anchoring the U.S. export program, a trend that is seen continuing into next year. Brazil’s increase in plantings of second corn, or safrinha, amid favorable prices was expected to offset some of the potential yield limitations from the later sowing, but the weather is not cooperating. The late start for safrinha means that ample rainfall is important this month, and the prospects do not look great.

Russia’s April exports of wheat, barley and maize (corn) are estimated at 2.1 million tonnes, down from 2.4 million tonnes in March, the SovEcon agriculture consultancy said.

Russian wheat export prices rose in the first 10 days of May, supported by higher prices in Chicago and Paris on corn supply concerns and despite low market activity during Russia’s May 1-10 official holiday, analysts said. Russian wheat with 12.5% protein loading from Black Sea ports for supply in June was at $278 a tonne free on board (FOB) at the end of last week, up $13 from late April, the IKAR agriculture consultancy. Sovecon, another consultancy, said that wheat prices rose by $4 to $274 a tonne, while barley was up $2 at $247 a tonne.

Russia wheat export pace has remained at 5-year lows since the government imposed a 50 euros per tonnes export tax for wheat in March.

Ukrainian grain exports have fallen by 24.1% to 39.6 million tonnes so far in the July 2020 to June 2021 season, agriculture ministry data showed on Wednesday. The exports included 15.3 million tonnes of wheat, 19.6 million tonnes of corn and 4.13 million tonnes of barley, the data showed.

Traders have used around 87% of the total wheat export quota of 17.5 million tonnes imposed for the whole 2020/21 July-June season.

- FRANCEAGRIMER KEEPS UNCHANGED MONTHLY FORECAST OF 2020/21 FRENCH SOFT WHEAT EXPORTS OUTSIDE EU-27 AT 7.55 MLN T

- FRANCEAGRIMER CUTS FORECAST OF 2020/21 FRENCH SOFT WHEAT ENDING STOCKS TO 2.6 MLN T FROM 2.7 MLN T LAST MONTH

- FRANCEAGRIMER CUTS FORECAST OF 2020/21 FRENCH BARLEY ENDING STOCKS TO 1.0 MLN T FROM 1.1 MLN T LAST MONTH

- FRANCEAGRIMER CUTS FORECAST OF 2020/21 MAIZE ENDING STOCKS TO 1.9 MLN T FROM 2.0 MLN T LAST MONTH

Euronext wheat rose on Tuesday, rebounding with U.S. futures as concern over tight corn supply continued to support grain prices. September milling wheat settled 3.25 euros, or 1.5%, higher at 226.75 euros ($275.68) a tonne.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.