TODAY—- EXPORT SALES, COMMITMENTS OF TRADERS

Wheat prices overnight are up 4 1/4 in SRW, up 4 1/4 in HRW, up 8 1/4 in HRS; Corn is up 10 3/4; Soybeans up 12 1/2; Soymeal up $0.03; Soyoil up 0.94.

For the week so far wheat prices are up 17 1/4 in SRW, up 15 1/4 in HRW, up 58 1/4 in HRS; Corn is up 15 3/4; Soybeans up 43; Soymeal down $0.37; Soyoil up 4.09. For the month to date wheat prices are up 17 in SRW, up 15 1/4 in HRW, up 58 1/4 in HRS; Corn is up 16; Soybeans up 43 1/4; Soymeal down $3.60; Soyoil up 4.10.

Chinese Ag futures (SEP 21) Soybeans down 39 yuan ; Soymeal down 20; Soyoil down 38; Palm oil down 22; Corn down 12 — Malasyian Palm is down 22.

Malaysian palm oil prices overnight were down 22 ringgit (-0.53%) at 4136 on expectations that stockpiles may hit an eight-month high in No. 2 grower Malaysia, with traders weighing a potential move by Indonesia to cut its export levy.

Midwest corn, soybean and winter wheat forecasts: West: Mostly dry through Saturday. Isolated showers Sunday. Scattered showers Monday. Temperatures near to above normal Thursday, above to well above normal Friday-Monday. East: Scattered showers south and east Thursday. Mostly dry Friday-Sunday. Scattered showers Monday. Temperatures near to above normal Thursday-Friday, above to well above normal Saturday-Monday. 6 to 10 day outlook: Scattered showers Tuesday-Saturday. Temperatures above to well above normal Tuesday-Friday, above normal Saturday.

The player sheet for 6/3 had funds: net sellers of 6,000 contracts of SRW wheat, sellers of 12,500 corn, sellers of 7,500 soybeans, sellers of 2,000 soymeal, and sellers of 6,500 soyoil.

Preliminary changes in futures Open Interest as of June 3 were: SRW Wheat up 4,286 contracts, HRW Wheat down 2,366, Corn down 8,551, Soybeans up 1,844, Soymeal up 1,716, Soyoil up 542.

There were no changes in registrations. Registration total: 20 SRW Wheat contracts; 16 Oats; 0 Corn; 13 Soybeans; 968 Soyoil; 442 Soymeal; 1,249 HRW Wheat.

TENDERS

- FAILED FEED WHEAT TENDER: Indonesia’s state procurement agency Bulog is believed to have made no purchase in an international tender for about 240,000 tonnes of animal feed wheat which closed on Monday.

- WHEAT BRAN TENDER: Jordan’s state grains buyer has issued an international tender to purchase 20,000 tonnes of wheat bran.

PENDING TENDERS

- WHEAT TENDER: Bangladesh’s state grains buyer issued an international tender to purchase 50,000 tonnes of milling wheat.

- MILLING WHEAT TENDER: Iranian state agency the Government Trading Corp (GTC) has issued an international tender to purchase about 60,000 tonnes of milling wheat.

- SOYOIL, SUNOIL TENDERS: Iran’s state purchasing agency GTC has issued international tenders for the purchase of 30,000 tonnes of soyoil and 30,000 tonnes of sunflower oil.

China to Continue Strong Wheat Imports Despite Bumper Harvest

China is likely to continue its robust imports of wheat in the current marketing year that began in June due to strong demand for animal feed and as the grain is used to substitute expensive corn, China National Grain and Oils Information Center said in a report Friday.

Palm Oil Reserves in No. 2 Grower May Climb to Eight-Month High

Palm oil inventories in Malaysia probably swelled to an eight-month peak in May as production in the world’s second-biggest grower advanced and exports stagnated.

Stockpiles gained 5.2% from a month earlier to 1.63 million tons, according to the median of 11 estimates in a Bloomberg survey of analysts, traders and plantation executives. That’s a third monthly increase.

Crude palm oil production rose 2.6% to 1.56 million tons, according to the survey, the highest level since October. Still, the pace of growth slowed from 7% in April and 28% in March, preventing a bigger rise in inventories of the tropical oil, used in everything from chocolate to lipstick and soap.

Malaysia’s Virus Surge Worsens Palm Oil Labor Shortage: CIMB

High Covid-19 cases in Malaysia will prolong a freeze on the intake of foreign workers and worsen labor shortages in the second-biggest producer, according to Ivy Ng, head of research at CGS-CIMB in Kuala Lumpur.

- This could create supply risks in 3Q, Ng said in a June 3 note

- A key concern is the declining y/y trend in Malaysian output, which is likely due to the “severe shortage” of foreign workers following a recruitment freeze since March 2020 because of the pandemic

- Aging palm trees due to slow replanting, as well as a lag in new planting and lower fertilizer application also contributing to weak supply

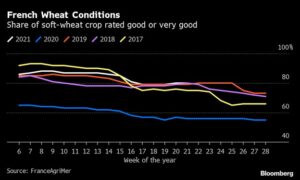

French Wheat, Corn Ratings Steady in Week to May 31: AgriMer

The amount of France’s soft-wheat crop rated in good or very good condition was flat at 80% in the week to May 31, and corn ratings were also unchanged, FranceAgriMer data showed on Friday.

Indonesia Mulls Changes to Palm Oil Duty to Boost Exports

The Indonesian government is in discussions to revise its palm oil export levy to boost shipments of the world’s most consumed vegetable oil, according to people with knowledge of the matter.

- The current maximum CPO levy of $255/ton is seen as too high and may be cut to $175, which will be imposed when the reference price exceeds $1,000/ton, said the people, who asked not to be identified as the information is private

- A minimum levy of $55/ton for CPO will be imposed if the reference price is set at $750/ton or less

- For every $50 increase in palm oil prices, the levy for crude products will be raised by $20/ton; the rate for refined or processed products will increase by $16/ton

- Revisions will be implemented after the finance minister signs the plan off, said the people, who say this may happen in mid-June

U.S. Crops in Drought Area for Week Ending June 1: USDA

The following table shows the percent of U.S. agricultural production within an area that experienced drought for the week ending June 1, according to the USDA’s weekly drought report.

France’s Rouen Grain Exports Triple in Week to June 2: Port

Grain shipments from France’s Rouen port totaled 136,835 tons, compared with 41,500 tons a week earlier, according to an emailed report. Soft wheat in tons

GRAIN EXPORT SURVEY: Corn, Soy, Wheat Sales Before USDA Report

Estimate ranges are based on a Bloomberg survey of five analysts; the USDA is scheduled to release its export sales report on Friday for week ending May 27.

- Corn est. range 350k – 1,600k tons, with avg of 844k

- Soybean est. range -100k – 600k tons, with avg of 319k

DOE: U.S. Ethanol Stocks Rise 3.2% to 19.588M Bbl

According to the U.S. Department of Energy’s weekly petroleum report.

- Analysts were expecting 18.951 mln bbl

- Plant production at 1.034m b/d, compared to survey avg of 1.022m

U.S. Barge Shipments of Grain Fell 16% Last Week: USDA

Shipments along the Mississippi, Illinois, Ohio and Arkansas rivers declined in the week ending May 29 from the previous week, according to the USDA’s weekly grain transportation report.

- Barge shipments of corn fell 15% from the previous week

- Soybean shipments down 9% w/w

Outlook for Agriculture Business Is Improving, Corteva CEO Says

The long-term outlook for agriculture is improving and will continue to do so beyond 2021, despite recent price volatility in corn and soy, Corteva Inc. Chief Executive Officer Jim Collins says Thursday at a conference.

Canada Farm Product Prices Surge 15% in March on Bullish Market

The Farm Product Price Index posted its biggest year-over-year gain since December 2011, Statistics Canada data shows Thursday.

Russia sets grain export taxes for June 9-15

Russia has set out its grain export taxes for June 9-15, the agriculture ministry said on Friday. The wheat export tax for the period will be at $29.40 a tonne, it said. For barley and maize the tax will be $39.60 and $50.00 a tonne respectively.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.