TODAY – WEEKLY ENERGY PRODUCTION AND STOCKS REPORT

Wheat prices overnight are up 4 3/4 in SRW, up 6 in HRW, down 3 3/4 in HRS; Corn is up 3 1/4; Soybeans down 3 3/4; Soymeal up $0.16; Soyoil down 0.57.

For the week so far wheat prices are up 15 3/4 in SRW, up 16 1/2 in HRW, down 7 1/4 in HRS; Corn is up 16 3/4; Soybeans down 8 1/4; Soymeal up $0.48; Soyoil down 2.04. For the month to date wheat prices are up 25 3/4 in SRW, up 7 1/4 in HRW, up 62 1/2 in HRS; Corn is down 19 1/2; Soybeans down 14 1/4; Soymeal down $10.40; Soyoil up 0.60.

Chinese Ag futures (SEP 21) Soybeans down 44 yuan ; Soymeal up 6; Soyoil up 68; Palm oil up 48; Corn up 3 — Malasyian Palm is unchanged. Malaysian palm oil prices overnight were unchanged at 4151 with signs of weakening exports from Malaysia, the world’s second-biggest grower.

Midwest corn, soybean and winter wheat forecasts: West: Isolated showers far north Tuesday-Wednesday. Mostly dry Thursday-Friday. Scattered showers Saturday. Temperatures near to above normal north and near to below normal south Tuesday, near to above normal Wednesday-Saturday. East: Isolated showers far north Tuesday, northwest Wednesday. Scattered showers east late Thursday-Friday. Scattered showers Saturday, mostly north. Temperatures near to above normal Tuesday, near to below normal Wednesday, near normal Thursday-Friday, near to above normal Saturday. 6 to 10 day outlook: Scattered showers east Sunday. Scattered showers Monday-Thursday. Temperatures near to above normal Sunday-Thursday.

The player sheet for 7/20 had funds: net buyers of 2,000 contracts of SRW wheat, buyers of 10,000 corn, buyers of 9,000 soybeans, buyers of 2,000 soymeal, and buyers of 2,500 soyoil.

There were no changes in registrations. Registration total: 0 SRW Wheat contracts; 0 Oats; 0 Corn; 13 Soybeans; 388 Soyoil; 175 Soymeal; 1,288 HRW Wheat.

Preliminary changes in futures Open Interest as of July 20 were: SRW Wheat up 3,558 contracts, HRW Wheat up 2,702, Corn up 627, Soybeans up 680, Soymeal down 2,644, Soyoil up 212.

TENDERS

- WHEAT TENDER: A group of importers in Thailand has issued an international tender to purchase up to 138,000 tonnes of animal feed wheat

PENDING TENDERS

- WHEAT TENDER: Bangladesh’s state grains buyer issued an international tender to purchase 50,000 tonnes of milling wheat

- WHEAT TENDER: Bangladesh’s state grains buyer issued another international tender to purchase 50,000 tonnes of milling wheat

- WHEAT TENDER: The Ethiopian government issued an international tender to buy about 400,000 tonnes of optional-origin milling wheat

- SOYBEAN TENDER: South Korea’s Agro-Fisheries & Food Trade Corp. issued an international tender to purchase around 7,600 tonnes of soybeans free of genetically modified organisms for arrival between Aug. 20 and Oct. 20. Deadline for price offers is July 21.

- WHEAT TENDER: A government agency in Pakistan has issued an international tender to purchase and import 500,000 tonnes of wheat

ETHANOL: U.S. Weekly Production Survey Before EIA Report

- Production seen slightly higher than last week at 1.042m b/d

- Stockpile avg est. 21.377m bbl vs 21.134m a week ago

LIVESTOCK SURVEY: U.S. Cattle on Feed Herd Seen Down 1% Y/y

July 1 herd seen falling y/y to 11.319m, according to a Bloomberg survey of eight analysts.

- Marketings seen rising 2.2% y/y

- June placements seen down 6% y/y

Canada Lowers Crop Estimates as Hot, Dry Weather Bakes Prairies

Hot and dry conditions in Western Canada are causing “significant uncertainty” in estimating crop yields during the growing season, Agriculture and Agri-Food Canada said on Tuesday.

- Total principal field crop production in the 2021-22 crop year was lowered to an estimated 95.3 million metric tons vs last month’s estimate of 96.1m

- Grain and oilseed production pegged at 87.7m vs prior estimate of 88.7m

- Pulse and special crop output forecast at 7.6m, up from 7.5m tons in June est.

- Carry-out stocks of grains and oilseeds seen at 8.7m tons vs 9.4m

- Drought in Saskatchewan and Alberta could put further downward pressure on 2021-22 durum production

EU Soft Wheat Exports at 371k Tons in Season Through July 18

Soft wheat shipments during the season that began July 1 amounted to 371k tons as of July 18, compared with 794k tons in the same period a year earlier, the European Commission said Tuesday on its website.

- Top destinations were Israel (76k tons), South Korea (46k tons) and the U.K. (45k tons)

- EU barley exports totaled 280k tons, compared with 587k tons the prior year

- EU corn imports totaled 461k tons, against 595k tons a year earlier

- NOTE: Click here for data on oilseed trade

- NOTE: Data for the prior season include trade for the U.K. until Dec. 31, 2020, when the country departed the EU customs union

Argentina urges people to ‘save water’ with Parana river at 77-year low

Argentina’s government has urged citizens to limit water use in a bid to alleviate pressure on the Parana River, a key grains thoroughfare that is at a 77-year low, a situation which is hampering shipments of cereals including soy and wheat. The Parana, which has its source in southern Brazil, flows through Argentina to the coast near Buenos Aires. It is the transportation route for 80% of country’s farm exports and a source of drinking water, irrigation and energy. On the banks of the Parana are important cities such as Rosario, Parana and Santa Fe. Rosario is the main agro-industrial hub and river port of Argentina, a leading global supplier of soy, corn and wheat to global markets.

Brazil’s July soy exports forecast raised to 9.437 mln T – Anec

- BRAZIL SOY EXPORTS SEEN REACHING 9.437 MILLION TNS IN JULY VERSUS 8.955 MILLION TNS FORECAST IN PREVIOUS WEEK – ANEC

- BRAZIL CORN EXPORTS SEEN REACHING 3.195 MILLION TNS IN JULY VERSUS 3.035 MILLION TNS FORECAST IN PREVIOUS WEEK – ANEC

Argentine farmers sell 25.1 mln tonnes of 2020/21 soybeans

Argentine farmers have sold 25.1 million tonnes of soybeans from the current 2020/21 crop year, after transactions were recorded over the last week for 660,400 tonnes, the Agriculture Ministry said on Tuesday in a report with data updated through July 14.

- The pace of soy crop sales is behind that of the previous season. At this point last year sales of 27.2 million tonnes of the oilseed had been registered, according to official data.

- The soy harvest in Argentina ended last month at 43.5 million tonnes, according to the Buenos Aires Grains Exchange. The 2019/20 harvest was 49 million tonnes, the exchange says.

- Foreign exchange from agricultural exports is key to Argentina’s economy, which has been battered by stagflation for two years, a situation exacerbated by the COVID-19 pandemic.

- With regard to corn, the ministry said sales of the 2020/21 crop, which is currently being harvested, have totaled 33.6 million tonnes, about 2.7 million tonnes more than those registered at this point in the last season.

- The exchange expects a 2020/21 corn crop of 48 million tonnes. As of last week harvesting was 62.4% complete, according to the exchange.

China to sell 23,488 tonnes of imported corn on July 23

China will auction 23,488 tonnes of corn imported from Ukraine at an auction on July 23, according to the country’s grain stockpiler Sinograin on Wednesday. The imported grain, stored at warehouses in Shandong and Guangdong provinces, was produced in 2020, according to a notice published on Sinograin’s website.

China expects bumper grain harvest as planting acreage rises

China forecasts a bumper harvest in 2021 as the country sees increasing summer and autumn grain planting acreage, the Ministry of Agriculture and Rural Affairs (MARA) said Tuesday. China has seen a stable increase in the planting acreage of autumn grain, which produces over 75 percent of the total grain in the country, MARA official Liu Lihua told a press conference. The planting acreage of autumn grain is expected to stand at 1.29 billion mu (86 million hectares) this year, with a particular increase in the cultivation of corn, said Liu. For summer grain, the acreage increased by 3.98 million mu this year, reversing the shrinking trend in the past five years, said Zeng Yande, an official with the MARA. Summer grain output recorded an all-time high of 145.8 million tonnes, up by 2.97 million tonnes from a year ago, data from the ministry showed. The yield of summer grain per mu reached 367.7 kilograms, marking a rise for three years in a row, the data showed. The country should speed up the harvest of autumn crops and prevent natural disasters to make sure that the grain output for the year maintains above the target of over 650 million tonnes, Liu said.

Chinese Corn Prices Buck Global Trend and Drop to November Low

- Weak market raises doubts over extent of future corn purchases

- North American futures buoyed by forecasts of more hot weather

Prices of corn in China, the world’s biggest importer, fell to the lowest intraday level since November this week, just as global crop futures climb on scorching, dry weather in parts of the U.S. and Canada.

Futures on the Dalian Commodity Exchange sank to a low of 2,509 yuan a ton on Tuesday and traded at 2,515 yuan on Wednesday. They are down almost 15% from a record in January. Supplies seem plentiful for now as China has been importing hefty amounts of the grain and the harvest is looming in September. That raises questions over how much more foreign corn the country will buy.

China’s Deadly Floods Hit Pig Farms and Raise Swine Fever Risks

The heavy rains that pounded Henan province in central China will cause damage to some hog farms in the major pork-producing region and potentially trigger fresh cases of African swine fever.

- Small farmers will be severely affected by the torrential rains and there will be a “significant” short-term impact on logistics, including the transportation of hogs, according to Shanghai JC Intelligence, an agriculture consulting firm.

- A bigger worry is the potential outbreak of African swine fever, said Lin Guofa, a senior analyst at consultancy Bric Agriculture Group. Floods increase the risk of disease as the virus can be found in pig’s blood, feces and tissue. Healthy hogs may be infected through contact with sick pigs or contaminated feed and water.

Quality Issues

- Henan province is the country’s top wheat grower, accounting for nearly 30% of output, and the second-largest hog producer. It’s home to the world’s biggest pig farm operated by Muyuan Foods Co. and the planet’s top pork processor, WH Group. While Muyuan is closely watching the rain and says operations are normal, its shares tumbled almost 5% Wednesday to the lowest since November.

- The main wheat crop is already harvested, but rains have affected its quality, which will lead to higher imports.

- Henan is also the country’s largest egg producer, accounting for 15% of output. Heavy rains may push up egg prices, but the impact on corn and cotton will be muted, according to JCI. Corn is at a stage when it requires water, while the province’s cotton production represents less than 1% of the nation’s total.

China Still Far Behind to Buy Agreed Amounts of U.S. Goods

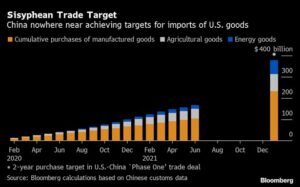

China’s imports of American goods sped up slightly in June but remain far behind the level need to meet the nation’s commitment to buy more American goods. China imported $11 billion worth of manufactured, agricultural and energy products from the U.S. in June, according to Bloomberg calculations based on data from the country’s customs agency. By the end of June, it had bought 44.4% of targeted goods set in the phase one trade pact with the U.S.

Manitoba Farmers Cut Cereal Crops for Feed Amid Drought Concerns

Some cereals are being cut for livestock in the Canadian Prairie province as drought concerns persist and crop-yield forecasts are lowered, Manitoba government says Tuesday.

- Spring cereals, canola and corn outlooks were downgraded this week due to drought concerns, weekly crop report says

- Canola crops are thin and pods are smaller than normal due to prolonged heat and drought

- Most soybean crops are fair to good but timely rain is needed to begin the pod-filling stage

- First cut of hay is largely complete and the usual second cut is not expected unless rains arrive and temperatures cool

- Grasshopper feeding has increased

- Two more rural municipalities, bringing the total to four, have declared states of agricultural disaster due to insects and a lack of rainfall over the past two weeks

Malaysia’s July 1-20 Palm Oil Exports 863,586 Tons: AmSpec

Shipments decline 7.9% m/m from 937,135 tons exported during June 1-20, according to AmSpec Agri on Wednesday.

Malaysia July 1-20 Palm Oil Exports -6.63% M/m: Intertek

Malaysia’s palm oil exports fell 6.63% m/m during July 1-20, according to Intertek Testing Services.

Bipartisan U.S. bill aims to eliminate corn ethanol volume mandate

A bipartisan group of U.S. senators introduced legislation on Tuesday that would eliminate a national mandate requiring oil refiners to blend corn-based ethanol into their fuel mix – a proposal that would slam corn growers and is likely to face vehement opposition from the farm lobby.

Republican Senator Pat Toomey from Pennsylvania and Democratic Senator Bob Menendez from New Jersey, part of the group introducing the bill, represent states with oil refineries that claim the mandates are expensive and threaten refinery jobs.

Lawmakers from both states have been pushing the Biden administration to relieve refineries of their obligations under the U.S. Renewable Fuel Standard, which was enacted to expand the market for U.S. renewable fuels and boost energy independence.

Democratic Senator Dianne Feinstein from California and Republican Senator Susan Collins from Maine joined Toomey and Menendez in introducing the bill. They say that other biofuels have lower greenhouse gas emissions, though ethanol proponents argue the product is a good option to help fight climate change now.

The senators claim the bill would help reduce carbon emissions from transportation fuels by removing volume requirements for corn ethanol, while leaving in place obligations for other biofuels and biodiesel. Under the RFS, refiners must blend some 15 billion gallons of ethanol into their fuel each year – a huge boost to the corn industry – along with billions of gallons of other types of biofuels.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.