TODAY – EXPORT INSPECTIONS, CROP PROGRESSS

Wheat prices overnight are down 5 in SRW, down 3 3/4 in HRW, up 1 3/4 in HRS; Corn is down 5; Soybeans down 2 3/4; Soymeal up $0.09; Soyoil down 0.67.

Markets finished last week with wheat prices down 15 3/4 in SRW, down 1 1/2 in HRW, down 4 3/4 in HRS; Corn is down 7 3/4; Soybeans down 19 1/2; Soymeal down $0.10; Soyoil down 2.01.

Chinese Ag futures (SEP 21) Soybeans down 49 yuan ; Soymeal up 24; Soyoil up 86; Palm oil up 126; Corn down 9 — Malasyian Palm is down 59. Malaysian palm oil prices overnight were down 59 ringgit (-1.38%) at 4215 ahead of a key report that will probably show reserves in second-biggest grower Malaysia climbed in July.

Midwest corn, soybean and winter wheat forecasts: West: Isolated to scattered showers through Friday. Temperatures above normal through Thursday, near normal Friday. East: Isolated to scattered showers through Friday. Temperatures above normal through Thursday, near normal Friday. 6 to 10 day outlook: Isolated showers Saturday-Sunday. Mostly dry Monday-Wednesday. Temperatures near to below normal Saturday-Sunday, near to above normal northwest and near to below normal southeast Monday-Tuesday, near to above normal Wednesday.

The player sheet for 8/6 had funds: net buyers of 3,500 contracts of SRW wheat, buyers of 4,000 corn, buyers of 3,500 soybeans, sellers of 0 soymeal, and buyers of 1,500 soyoil.

Preliminary changes in futures Open Interest as of August 6 were: SRW Wheat up 3,064 contracts, HRW Wheat up 1,043, Corn down 21,602, Soybeans up 2,353, Soymeal up 1,755, Soyoil down 1,137.

There were no changes in registrations. Registration total: 0 SRW Wheat contracts; 0 Oats; 0 Corn; 0 Soybeans; 388 Soyoil; 155 Soymeal; 1,288 HRW Wheat.

TENDERS

- SOYBEAN SALE: The U.S. Department of Agriculture confirmed private sales of 131,000 tonnes of U.S. soybeans to China for delivery in the 2021/22 marketing year that begins Sept. 1, 2021.

- WHEAT AND BARLEY PURCHASE: Tunisia’s state grains agency is believed to have agreed to purchase soft milling wheat and animal feed barley in an international tender which closed on Friday

- WHEAT PURCHASE: The Taiwan Flour Millers’ Association purchased an estimated 48,000 tonnes of milling wheat to be sourced from the United States in a tender which closed on Friday

PENDING TENDERS

- WHEAT TENDER: A South Korean flour mill issued a tender to buy an estimated 135,100 tonnes of milling wheat sourced from different origins

- WHEAT TENDER: Jordan’s state grain buyer issued a tender to buy 120,000 tonnes of milling wheat which can be sourced from optional origins

- WHEAT TENDER: Bangladesh’s state grains buyer issued an international tender to purchase 50,000 tonnes of milling wheat

- WHEAT TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) said it will seek 80,000 tonnes of feed wheat and 100,000 tonnes of feed barley to be loaded by Nov. 30 and arrive in Japan by Jan. 27, via a simultaneous buy-and-sell (SBS) auction that will be held on Aug. 18.

- WHEAT TENDER: A government agency in Pakistan issued an international tender to purchase and import 400,000 tonnes of wheat,

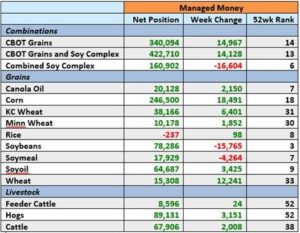

COMMITMENTS OF TRADERS MANAGED MONEY TRADERS NET POSITIONS

CROP SURVEY: Analysts See Lower Corn Yields Ahead of WASDE

U.S. 2021-22 corn yields seen cut to 177.4 bu/acre vs the USDA’s July est. of 179.5 bu/acre, according to the avg in a Bloomberg survey of as many as 27 analysts.

- U.S. corn production seen at 14.97b bu, 194m bu lower that in July

- Ending stocks seen 162m bu lower at 1.27b bu

- Brazil corn production seen 5m tons lower at 88m tons

- U.S. soybean yields seen at 50.3 bu/acre vs 50.8 bu/acre

- Production seen 43m bu lower and ending stocks seen slightly higher at 157m bu

Brazil 2020/21 Soybean Sales 81.9% Done as of Aug. 6: Safras

Brazil 2020/21 soybean sales at 81.9% as of Aug. 6, compared with 95.7% a year ago, consulting firm Safras & Mercado says in emailed report.

- 5-year average is 83.5%

- Advanced sales for 2021/22 season are at 23.7%, compared with 43.3% a year earlier and a 5-year average of 20.6%

Corn, Soy Plantings in Brazil Could Rise 4-5% in 2022: Corteva

Corn and soy plantings in Brazil could be up 4%-5% in 2022 on strong demand, Corteva CEO Jim Collins says on second-quarter earnings call Friday.

- U.S. corn and soy acreage could also see a modest increase, Collins says

- Company sees global growth in organic seed sales into 2022, with U.S., Latin America, EMEA as primary drivers

- Company is beginning to deploy analytics on freight and logistics costs

- Despite continued challenges with cost inflation, “we believe global demand will ultimately drive growth into 2022 and beyond as local economies recover from the pandemic-related shutdowns,” Collins says

- Collins declined to give more details on succession process for new CEO

China July Soybean Imports 8.674m Tons: Customs

General Administration of Customs says on website.

- Soybean imports YTD rose 4.5% y/y to 57.627m tons

- Edible vegetable oil imports in July 826,000 tons

- Edible vegetable oil imports YTD rose 21.7% y/y to 6.619m tons

- Meat (including offal) imports in July 854,000 tons

- Meat (including offal) imports YTD rose 3.3% y/y to 5.932m tons

CORN/CEPEA: Prices follow opposite trends between regions surveyed, but devaluations prevail

Corn deals are currently halted in the Brazilian market, and prices are following opposite trends between the regions surveyed by Cepea, but devaluations have prevailed. On the average of the regions surveyed by Cepea, the prices paid to corn farmers (over-the-counter market) between July 29 and August 5 dropped by a slight 0.1%; in the wholesale market (deals between processors), values decreased by 0.8%. At B3, corn futures decreased too.

PORTS – The gap between domestic prices and the price for export is keeping liquidity low at the Brazilian ports. While in August 2020, corn prices at the port of Paranaguá (PR) were higher than that in northern Paraná, by 5 Reais/bag, this month (until August 5), corn prices have been 23 Reais/bag higher in northern PR than at that port.

CROPS – The dry weather in most Brazil has favored the harvesting, but still concern agents about crops’ conditions, majorly in southern Brazil. In Paraná, according to Seab/Deral, 10% of the state area had been harvested until August 2. Of the crops to be harvested, 53% are in bad conditions; 41%, in average conditions; and only 6%, in good conditions.

SOYBEAN/CEPEA: Brazil exports the highest volume of soybean meal in 17 years

The international demand for the Brazilian soybean meal increased again in July, boosting the national exports of this by-product to the highest volume since 2004. This scenario resulted in higher export premiums, lower supply from the industry to the domestic spot market and meal valuations in Brazil.

According to data from Secex, in July, Brazil exported 1.987 million tons of soybean meal, the highest volume since June 2004, when shipments to the international market surpassed two million tons. This year (between January and July), the Brazilian exports of soybean meal have totaled 10.15 million tons, 0.5% down from that in the same period of 2020, according to Secex.

The major destination for the Brazilian soybean meal in July was Indonesia, which imported 301.97 thousand tons of the product (15.2% of the total volume exported in the month), followed by Thailand (13.5%). Other significant destinations were Vietnam (9.9%), Spain (9.1%), Germany (8.3%), South Korea (7.9%), the Netherlands (7.1%) and France (5.7%). Other 23 countries purchased, altogether, 23.3% of the total amount exported last month.

SOY OIL – On the other hand, for soy oil, prices have resumed dropping. Although the domestic demand for the production of biodiesel continues high, food processors have been cautious about purchases, waiting for prices to decrease. Besides, the international demand for this Brazilian by-product has weakened.

In July, Brazil exported the lowest volume of soy oil since February/21, of 98.46 thousand tons, 35.93% below that shipped in June and 12.79% less than the volume exported in July/20. This year, soy oil exports have reached 782.4 thousand tons, 0.82% down from that in the same period last year (Secex).

SOYBEAN – Soybean prices swung over the last seven days. The low inventories from the 2020/21 season, the US dollar appreciation against the Real, and increases in the export premiums pushed up prices on some days. On the other hand, some Brazilian farmers, aware of crops’ good development in the United States, increased supply in the domestic spot market, boosting liquidity, largely for exports, which pressed down values on some days.

However, in July, the Brazilian exports of soybean were the lowest since March/21, totaling 8.66 million tons, 21.78% less than that shipped in June and 13% down from that in July/20. China, the major destination for the Brazilian soybean, reduced imports from Brazil by 18% between June and July – this year, China has reduced purchases from Brazil by 22.6%. Besides, the Brazilian exports of soybean to the Netherlands decreased by 33.72% between June and July and by 62.6% between July/20 and July/21, according to data from Secex.

Russia’s grain export estimates for July by Sovecon consultancy

Russia’s July exports of wheat, barley and maize (corn) are estimated at 1.9 million tonnes, unchanged from June, the Sovecon agriculture consultancy said.

Russian Wheat Exports Fall 25% So Far This Season: Agency

Wheat shipments for the 2021-22 season totaled 2.8m tons as of Aug. 5, the Federal Center of Quality and Safety Assurance for Grain and Grain Products said on its website, citing inspections before exports.

- That means wheat exports totaled about 1.1m tons in the week to Aug. 5, compared with about 700k tons a week before

- Exports of all grains are at 3.5m tons so far this season

India’s sunflower oil imports could jump to record as prices dip below soyoil

India’s imports of sunflower oil could rise to a record in 2021/22 as potential bumper crops in Russia and Ukraine pull prices below rival soyoil, making it lucrative for price-sensitive buyers from the subcontinent, industry officials said. India is the world’s biggest importer of edible oils and higher purchases of sunflower oil could help exporters such as Argentina, Russia and Ukraine to dispose of surplus output. Higher sunflower oil imports could cap India’s purchases of soyoil and palm oil, however, and weigh on prices of those commodities.

India to Spend $1.5B to Boost Oil Palm Plantation to Cut Imports

India will invest more than 110 billion rupees ($1.5 billion) to help farmers expand oil palm plantation in a bid to trim its reliance on imports, Prime Minister Narendra Modi said.

- The country can grow oil palm in north eastern states and Andaman & Nicobar Islands, Modi said at a farmers’ event

- The move will help create jobs in food processing and transport sectors

U.S. Beef Production Falls 1.1% This Week, Pork Rises: USDA

U.S. federally inspected beef production falls to 523m pounds for the week ending Aug. 7 from 528m in the previous week, according to USDA estimates published on the agency’s website.

- Cattle slaughter down 1.2% from a week ago to 641m head

- Pork production up 0.7% from a week ago, hog slaughter rises 0.6%

- For the year, beef production is 4.5% above last year’s level at this time, while pork is 0.9% below

India Cumulative Monsoon Rainfall 4% Below Normal as of Aug. 8

India has so far received 502.4 millimeters of rains during the current monsoon season, which runs from June through September, compared with a normal of 525.1 millimeters, according to data published by the India Meteorological Department on Aug. 8. The eastern and northeastern region got 13% below normal rains. Rainfall in the southern peninsular region was at 9% above normal.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.