TODAY—STATS CANADA PLANTING REPORT—DELIVERABLE STOCKS—

Overnight trade has SRW Wheat up roughly 19 cents; HRW up 22; HRS Wheat up 13, Corn is up 16 to 12 cents; Soybeans up 17 to 10; Soymeal up $2.00, and Soyoil up 220 to 50 points.

Chinese Ag futures (September) settled up 46 yuan in soybeans, up 14 in Corn, up 33 in Soymeal, up 8 in Soyoil, and down 18 in Palm Oil.

Malaysian palm oil prices were up 118 ringgit at 4,012 (basis July) at midsession following rival vegoils

U.S. Weather Forecast: Concern remains for West Texas and the southwestern part of the Hard Red Winter Wheat Region due to the potential for very little rain in the next two weeks. Last evening’s GFS model run suggested greater moisture in the southwestern part of the Hard Red Winter Wheat Region, such as the Texas Panhandle and western Oklahoma, May 6 – 8. Significant rain in the Delta late Wednesday through Thursday will keep the need elevated in this region for drier conditions, especially due to the recent frequent rain.

South America Weather Forecast: Interior southern Safrinha corn areas of Brazil are still unlikely to receive much rain through at least the next seven to ten days. There will be some erratic showers; though, much of this will not be able to counter evaporation. Last evening’s GFS model run was notably wetter in Parana May 9 – 11.

The player sheet had funds net buyers of 18,000 contracts of SRW Wheat; net bought 60,000 contracts of Corn; net bought 16,000 Soybeans; bought 4,000 Soymeal, and; net bought 9,000 Soyoil.

We estimate Managed Money net long 48,000 contracts of SRW Wheat; net long 536,000 Corn; net long 223,000 Soybeans; long 58,000t Soymeal, and; net long 118,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures down roughly 8,800 contracts; HRW Wheat up 1,000; Corn down 27,600; Soybeans down 16,100 contracts; Soymeal up 1,600 lots, and; Soyoil down 7,400.

There were no changes in registrations—Registrations total 10 contracts for SRW Wheat; ZERO Oats; Corn ZERO; Soybeans 5; Soyoil 968 lots; Soymeal 175; Rice 1,013; HRW Wheat 1,291, and; HRS 235.

Tender Activity—Algeria seeks 50,000t optional-origin wheat—

U.S. corn planting 17% done, soy 8%; wheat ratings decline -USDA – Reuters News

U.S. Winter Wheat headed was 17% versus 10% last week, 20% a year ago, 23% average. U.S. Winter Wheat was rated 49% good to excellent (trade estimate was 52%) versus 53% a week ago and 54% a year ago; 32% fair (30% last week, 31% a year ago); 19% poor to very poor (17% last week, 15% a year ago).

U.S. Spring Wheat planted was 28% (trade estimate was 28%) versus 19% last week, 13% a year ago, 19% average. U.S. Spring Wheat emerged was 7% versus NA% last week, 4% a year ago, 5% average.

U.S. Corn planted was 17% (trade estimate was 17%) versus 8% a week ago, 24% last year, and 20% average. U.S. Corn emerged was 3% versus 2% a week ago, 3% last year, and 4% average.

U.S. Oats planted were 59% versus 50% a week ago, 52% last year, and 52% average. U.S. Oats emerged were 37% versus 31% a week ago, 31% last year, and 34% average.

U.S. Soybeans planted was 8% (trade estimate was 8%) versus 3% a week ago, 7% last year, and 5% average.

For the week ending Apr 22nd, Wheat exports are running unchanged versus a year ago, unchanged a week ago and versus the USDA forecasting a 2% increase on the year. Corn up 84% (up 84% last week); USDA up 50%. Soybeans up 65% (up 67% last week) with the USDA up 36% on the year

Wire story reports words like ‘unprecedented’ have sometimes been used within the last year to describe price action for Chicago-traded corn futures, but now that term almost underrepresents the situation given the scope of the rally over the last several weeks. Spring rallies hardly ever cause American farmers to significantly increase their corn acreage plans between March and June, but this year could be different given both how early it is and how much prices have surged.

A crop rally in the U.S. is threatening to make essential food commodities dramatically more expensive, and the costs could soon spill over onto grocery store shelves. Wheat, corn and soybeans, the backbone of much of the world’s diet, are all surging to the highest since 2013 after gains last week had some analysts warning that a speculative bubble was forming. Bad crop weather in key producing countries is a major culprit. Dryness in the U.S., Canada and France is hurting wheat plants, as well as corn in Brazil. Rain in Argentina is derailing the soy harvest. Add to that the fears of drought coming to the American Farm Belt this summer. Meanwhile, China is gobbling up the world’s grain supplies, on track to take in its biggest haul of corn imports ever as it expands its massive hog herd.

North America’s freight rail customers, from grain shippers to logistics companies, are choosing sides as Canadian Pacific Railway Ltd and Canadian National Railway fight to buy Kansas City Southern. A takeout of KCS, would be the first major North American railroad combination in more than 20 years and create the first network to include the United States, Canada and Mexico. CN Canada’s biggest railroad, made an unsolicited $30 billion bid for KCS on Tuesday, topping CP’s agreed $25 billion bid, but CP said last week it was not considering raising its offer.

Grain exports from Ukraine are unlikely to exceed the volumes previously agreed with the government, Ukrainian grain traders union UGA said. Traders and the government have agreed that no more than 17.5 million tonnes of wheat and 24 million tonnes of corn could be exported from Ukraine in the 2020/21 season ending in June. “UGA does not see any preconditions for exceeding the export limits specified in the memorandum between the economy ministry and market participants in the current season. The rate of grain exports is much lower than last year. The economy ministry said last month the export of wheat this season could be less than 17.5 million tonnes. UGA said Ukraine was likely to export up to 16 million tonnes of wheat and no more than 22 million tonnes of corn this season.

Potential yields of this year’s winter grain crops in the European Union have declined slightly since March as cold and dry weather hampered development and also delayed sowing of spring varieties, the EU’s crop monitoring service said. The average soft wheat yield in this year’s European Union harvest is expected to reach 5.86 tonnes per hectare (t/ha), down from an initial projection of 5.89 t/ha in March. That would be 2.6% above last year’s level and 2.9% above the average EU soft wheat yield of the last five years.

Soft wheat exports from the European Union in the 2020/21 season that started last July had reached 21.68 million tonnes by April 25, data published by the European Commission showed

That was down from 29.50 million tonnes cleared by the same week last season

—EU 2020/21 barley exports had reached 6.51 million tonnes, against 6.45 million a year ago

—EU 2020/21 maize imports stood at 12.15 million tonnes, down from 17.29 million

European Union soybean imports in the 2020/21 season that started last July had reached 11.94 million tonnes by April 25. That compared with 11.82 million tonnes cleared by the same week last season.

European wheat futures jumped on Monday to set contract highs, boosted by surging U.S. futures as weather risks kept attention on tightening grain supplies. September milling wheat unofficially closed up 6.75 euros, or 3.0%, at 226.00 euros ($273.0) a tonne. The session high was a life-of-contract high of 228.00 euros.

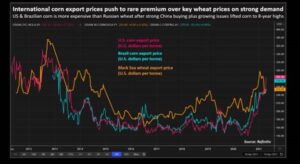

Asian feed manufacturers are switching to wheat in animal rations as multi-year high corn prices constrict demand for the yellow grain widely used to fatten hogs and chickens. Some of the world’s top corn buyers such as China, South Korea and Vietnam are buying more wheat from Australia and the Black Sea region in the months ahead as the landed cost of corn has climbed to a rare premium to wheat. Combined, those three countries are forecast to buy 26.4% of global corn imports this year, according to the U.S. Department of Agriculture, so any substitution for wheat could have a large impact on global grain trade flows.

Indonesia has set its crude palm oil reference price higher in May at $1,110 a tonne. This compares with April’s reference price of $1,093.83. This means that export taxes for crude palm oil in May will be higher at $144 per tonne, while export levies for the edible oil will be unchanged at $255 per tonne. The export tax in April for crude palm oil was at $116 per tonne.

Malaysia’s palm oil exports during the April 1-25 period are estimated up 10.1% on month at 1,116,919 metric tons, cargo surveyor SGS (Malaysia) Bhd. said.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.