TODAY—WEEKLY DELIVERABLE STOCKS—

Overnight trade has SRW Wheat up roughly 5 cents; HRW up 4; HRS Wheat up 4, Corn is up 6 cents; Soybeans up 18 to 10; Soymeal up $4.50, and Soyoil up 35 to 5 points.

Chinese Ag futures (September) settled up 34 yuan in soybeans, down 1 in Corn, up 46 in Soymeal, up 104 in Soyoil, and up 126 in Palm Oil.

Malaysian palm oil prices were up 2 ringgit at 3,712 (basis July) at midsession supported by rising exports.

U.S. Weather Forecast: Frosts and freezes in the mornings Tuesday through Thursday will still lead to crops getting burned back from the Hard Red Winter Wheat Region and West Texas through the Corn Belt and far northern Delta and into Virginia and northern North Carolina.

Last evening’s GFS model run was notably wet in the Northern Plains May 2 – 4. A weather disturbance is likely with some precipitation in the region which will be beneficial due to the ongoing drought

South America Weather Forecast: In Brazil, net drying is likely through the next seven days from Rio Grande do Sul through western Minas Gerais raising concerns for production in this area due to the monsoonal rainfall ending in much of Brazil at the end of April.

Conditions in Argentina will be mostly good; though, rain Wednesday through Saturday will lead to some fieldwork delays and may slow crop maturation.

The player sheet had funds net even in SRW Wheat; net bought 12,000 contracts of Corn; net bought 7,000 Soybeans; bought 4,000 Soymeal, and; net sold 1,000 Soyoil.

We estimate Managed Money net long 1,000 contracts of SRW Wheat; net long 426,000 Corn; net long 172,000 Soybeans; long 52,000t Soymeal, and; net long 96,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures down roughly 1,300 contracts; HRW Wheat down 2,600; Corn down 9,500; Soybeans up 8,600 contracts; Soymeal down 1,400 lots, and; Soyoil down 6,200.

There were no changes in registrations—Registrations total 10 contracts for SRW Wheat; ZERO Oats; Corn ZERO; Soybeans 5; Soyoil 968 lots; Soymeal 175; Rice 1,013; HRW Wheat 1,291, and; HRS 235.

Tender Activity—France looks to import 45,000t Romanian wheat—Japan seeks 85,110t optional-origin wheat—

U.S. corn planting 8% complete, soybeans 3% -USDA – Reuters News

U.S. Winter Wheat headed was 10% versus 5% last week, 13% a year ago, 14% average.

U.S. Winter Wheat was rated 53% good to excellent (trade estimate was 52%) versus 53% a week ago and 57% a year ago; 30% fair (30% last week, 30% a year ago); 17% poor to very poor (17% last week, 13% a year ago).

U.S. Spring Wheat planted was 19% (trade estimate was 17%) versus 11% last week, 7% a year ago, 12% average.

U.S. Corn planted was 8% (trade estimate was 9%) versus 4% a week ago, 6% last year, and 8% average.

U.S. Corn emerged was 2% versus NA% a week ago, 1% last year, and 1% average.

U.S. Oats planted were 50% versus 39% a week ago, 38% last year, and 42% average.

U.S. Oats emerged were 31% versus 24% a week ago, 16% last year, and 28% average.

U.S. Soybeans planted was 3% (trade estimate was 3%) versus NA% a week ago, 2% last year, and 2% average.

For the week ending Apr 15th, Wheat exports are running unchanged versus a year ago, unchanged a week ago and versus the USDA forecasting a 2% increase on the year. Corn up 84% (up 84% last week); USDA up 50%. Soybeans up 67% (up 70% last week) with the USDA up 36% on the year.

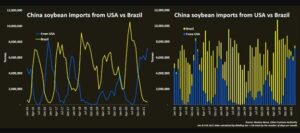

China’s March soybean imports from Brazil plunged as rain delayed some shipments from the world’s top exporter, but U.S. bean imports rocketed more than fourfold as delayed cargoes arrived, hitting the highest monthly total since December 2016. The world’s biggest buyer of soybeans imported 315,334 tonnes from Brazil in March, down 85% from 2.1 million tonnes a year earlier, data from the General Administration of Custom showed on Tuesday. The Brazilian imports were the lowest since January 2017. More than offsetting that slide, China imported 7.18 million tonnes of soybeans from the United States in March, up 320% from 1.71 million tonnes in the previous year.

Brazil has suspended import duties on soy, corn, soybean meal and soybean oil until the end of the year, the Agriculture Ministry said, as the country seeks to slow inflation fanned by rising global commodities prices. The Chamber of Foreign Commerce (Camex) had already authorized the suspension of the import tax on corn until March 31 of this year and soybean until January 15. The latest measure is likely to benefit U.S. grains producers, experts say, as Brazilian buyers had earlier focused on Mercosur producers who are already exempt from tariffs.

Russia exported 7.6 mln tonnes of wheat in Jan-Feb – Reuters News

—Russian exports of wheat increased to 7.6 million tonnes in the first two months of 2021 from 3.7 million tonnes a year ago, official customs data showed.

Ukraine’s government and sunflower oil producers agreed on Monday to limit 2020/21 sunoil exports to 5.382 million tonnes, aiming to avoid a jump in domestic sunoil prices due to excessive shipments overseas, producers and the government said. Ukraine is the world’s largest sunoil exporter and the government had said sunoil exports in the September 2020-August 2021 season might total around 5.52 million tonnes out of output of 5.92 million tonnes this season.

Soft wheat exports from the European Union in the 2020/21 season that started last July had reached 21.34 million tonnes by April 18, data published by the European Commission showed. That was down from 28.35 million tonnes cleared by the same week last season.

—EU 2020/21 barley exports had reached 6.42 million tons, against 6.34 million a year ago

—EU 2020/21 maize imports stood at 12.07 million tons, down from 16.73 million

European Union soybean imports in the 2020/21 season that started last July had reached 11.79 million tonnes by April 18, data published by the European Commission showed. That compared with 11.52 million tonnes cleared by the same week last season. However, the data was incomplete this week as figures for France only ran up to April 15, the Commission said.

—EU rapeseed imports in 2020/21 had reached 5.36 million tonnes, compared with 5.13 million a year ago.

—Soymeal imports so far in 2020/21 were at 13.52 million tonnes against 14.33 million a year earlier

—Palm oil imports were at 4.23 million tonnes versus 4.55 million a year ago.

European new-crop wheat futures rose on Monday, remaining near contract highs as weather concerns continued to underpin prices. September milling wheat settled up 0.25 euro, or 0.1%, at 207.00 euros ($249.00) a tonne. It earlier hit 208.50 euros, just below Friday’s life-of-contract peak of 209.50 euros. After frosts in France earlier this month were thought to have caused limited damage to wheat, attention has turned to dryness.

Japan’s usage of corn in animal feed fell to 48.2% in February, compared with 48.5% a year earlier, preliminary data from the Ministry of Agriculture, Forestry and Fisheries showed.

Morocco plans to increase customs duty on soft wheat and durum to help domestic farmers benefit from an expected better yield this year by cutting imports, its agriculture minister said. The wheat import duty has been suspended until May to ensure price stability and steady supply after Morocco experienced two years of consecutive drought.

Exports of Malaysian palm oil products for April 1 – 20 rose 10.8 percent to 813,946 tonnes from 734,463 tonnes shipped during March 1 – 20, cargo surveyor Intertek Testing Services said.

Malaysia’s palm oil exports during the Apr. 1-20 period are estimated up 10.2% on month at 820,979 metric tons, cargo surveyor AmSpec Agri Malaysia said.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.