TODAY—WEEKLY EXPORT INSPECTIONS—WEEKLY CROP PROGRESS/CONDITIONS—

Overnight trade has SRW Wheat up roughly 5 cents; HRW up 5; HRS Wheat up 3, Corn is up 9 cents; Soybeans up 12 to 9 cents; Soymeal up $2.50, and Soyoil up 10 points.

For the week, SRW Wheat prices were up roughly 15 cents; HRW up 22; HRS up 10; Corn was up 11 cents; Soybeans up 24 cents; Soymeal up $1.00, and; Soyoil up 330 points. Crushing margins were up 14 cents at $0.68 (July); Oil share up 2% at 40%.

Chinese Ag futures (September) settled down 50 yuan in soybeans, up 22 in Corn, up 41 in Soymeal, up 36 in Soyoil, and up 46 in Palm Oil.

Malaysian palm oil prices were down 40 ringgit at 3,676 (basis July) at midsession.

U.S. Weather Forecast: The United States remains mostly good for spring planting, although there will be some precipitation this week to disrupt field progress. Cold weather may damage some of the winter wheat in the southwestern Plains, northern Delta and North Carolina and Virginia, but losses should be quite low and mostly held to areas that are not key to U.S. production.

Concern about dryness will remain in West and South Texas, a part of the northern Plains, the Pacific Northwest and to some degree a part of northern and central Iowa to southwestern Wisconsin and southern Minnesota. Most of the dryness concerns will not be serious while temperatures are cool, but as soon as warming comes around at the end of April the situation will be of greater interest.

South America Weather Forecast: The bottom line for Brazil remains mixed with Safrinha corn and cotton benefiting from any rain that falls, but most of the rain that is advertised does not begin until late in the weekend leaving the door open for possible changes to next week’s outlook.

Argentina’s bottom line remains good for late season crops, but rain may slow some of the early season harvest and maturation pace. Summer crops will develop favorably, but there is need for drier weather to protect crop quality and to expedite harvest progress.

The player sheet had funds net sellers of 1,000 contracts of SRW Wheat; net sold 3,000 contracts of Corn; net bought 5,000 Soybeans; net even in Soymeal, and; bought 6,000 Soyoil.

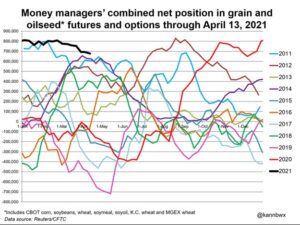

We estimate Managed Money net long 1,000 contracts of SRW Wheat; net long 414,000 Corn; net long 165,000 Soybeans; long 48,000t Soymeal, and; net long 97,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures up roughly 5,600 contracts; HRW Wheat down 1,100; Corn up 6,100; Soybeans up 7,500 contracts; Soymeal up 25 lots, and; Soyoil up 5,200.

There were changes in registrations (Soybeans down 10)—Registrations total 10 contracts for SRW Wheat; ZERO Oats; Corn ZERO; Soybeans 5; Soyoil 968 lots; Soymeal 175; Rice 1,013; HRW Wheat 1,291, and; HRS 235.

Speculators have been buying Chicago-traded corn since August when troubles began for the 2020 U.S. harvest, and that enthusiasm expanded even more last week as weather concerns are on the radar for the 2021 crop.

Russia’s grain export estimates for April by consultancy SovEcon – Reuters

Russia’s April exports of wheat, barley and maize (corn) are estimated at 2.2 million tonnes, down from 2.4 million tonnes in March, the SovEcon agriculture consultancy said.

All Ukrainian regions have started this year’s spring grain sowing campaign, seeding a total of 1.5 million hectares of wheat, barley, peas and oats as of April 15, or 20% of the expected area, economy ministry data showed. The campaign started a few weeks late due to lingering cold weather in most of the country. The overall grain area is likely to total 15.5 million hectares this year, including 7.6 million hectares of spring grains.

Ukraine’s 2021 grain harvest is likely to rise by 13% to 73.6 million tonnes thanks to favourable weather, analyst APK-Inform said. The consultancy said in a report that the harvest could include 27.6 million tonnes of wheat, 7.97 million tonnes of barley and 35.71 million tonnes of corn. It said a higher output would allow Ukraine to increase grain exports to 54.2 million tonnes in 2021/22 season from 45.6 million tonnes in 2020/21. APK-Inform further said that Ukraine could export 19.75 million tonnes of wheat, 4.32 million of barley and 29.50 million of corn.

Bid export prices for this year’s Ukrainian rapeseed have risen by $35 this week on fears over crop conditions across Europe and a possible smaller sowing area in Ukraine, analyst APK-Inform said. Rapeseed costs $560-$570 a tonne CPT (carriage paid to) Black Sea with the delivery in July-August as of Friday. Ukraine has already started the 2021 rapeseed sowing and the area could total 1 million hectares, 10% less than a year earlier.

Export prices for Ukrainian sunflower oil have risen by about $45 a tonne over the past several days amid fears over possible export curbs, analyst APK-Inform said. Ukraine’s government is considering imposing curbs on sunflower seed exports and establishing a licence requirement for sunoil exports in a move that has been criticised by traders and producers. APK-Inform said sunoil export asking prices had risen to $1,570-$1,580 a tonne FOB Black Sea as of Friday.

Ukraine is likely to harvest 16.4 million tonnes of sunflower seed in 2021, almost 15% more than in 2020, the consultancy said. APK-Inform said most of the output – 16.18 million tonnes – would be crushed in Ukraine, and 240,000 tonnes could be exported in the 2021/22 September-August season. The higher harvest will allow refineries to increase sunoil production by 16.5% to 7 million tonnes. Around 6.54 million tonnes of sunoil will be exported in 2021/22 versus 5.6 million tonnes in 2020/21.

The world’s top palm oil producer Indonesia exported 1.99 million tonnes of palm oil and its refined products in February, data from the Indonesia Palm Oil Association (GAPKI) showed. Exports dropped from 2.54 million tonnes in the same month last year due to high prices of the vegetable oil. Meanwhile, Indonesia produced 3.38 million tonnes of palm oil and kernel oils in February, down from a month earlier, taking the end-of-month stocks lower to 4.04 million tonnes.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.