by market analysts Stephen Platt and Mike McElroy

Price Overview

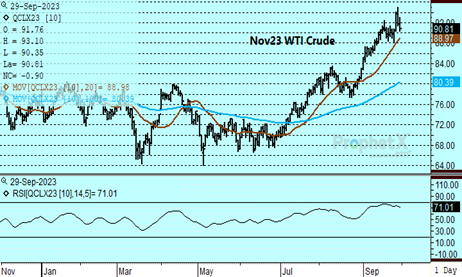

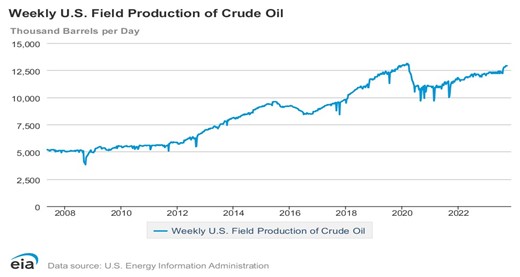

After reaching a high of 95.03 basis November early yesterday, prices have fallen sharply to settle at 90.71 today for a loss of 92 cents, putting the market back into its previously established range of 88-92. The lack of upside follow through reflects fear that the lower differential of WTI to Brent and recent strength in the backwardation will reduce export demand while seasonal maintenance at refineries will limit throughput in October. In addition, rising production in the US despite lower rig counts has also been apparent, reaching 12.9 mb in the latest reporting week and approaching the record high of 13.0 mb/d reached in March of 2020. Economic uncertainty remains in the background with the threat of a US governmental shutdown and high interest rates weighing on the domestic economy. Doubts over the Chinese economy persist with manufacturing and retail sales falling in September. With Golden Week in China now starting, travel trends and spending in early October will be watched closely for their impact on demand.

Growing concerns over inventories at Cushing, bans on Russian fuel oil exports to combat rising consumer prices, production cuts by Saudi Arabia, and favorable margins overseas continue to underpin values. Fear of a short squeeze ahead of the November crude expiration on October 20th is also limiting downside movement and will continue to be a constructive influence given the trend downward in inventory levels and the perception that stocks at Cushing are at minimum operating levels. For November crude, support is near the 20-day moving average at 89.00 down to 88.00 until a more substantial recovery in Cushing crude stocks is realized.

Natural Gas

Early weakness based on an overall negative fundamental news stream was unable to be maintained as the market recovered to put in a new high for the week before settling at 2.929 basis November for a loss of 1.6 cents on the day. Yesterday saw strenght in spite of a slightly bearish stock build that came it at 90 bcf compared to estimates near 88. A bounce in production back above 103 bcf added to the list of negatives, but the market shrugged it off as the settlement through the 9-day moving average yesterday brightened the technical picture. Today’s action again saw a settlement above that level along with a move through trendline resistance off the August highs. This keeps the near term bias higher, with the next key level at 3 dollars. A settlement above there could see follow through that would find initial resistance in the 3.07-308 area. A turn lower will find support at 2.915 and then 2.85.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.