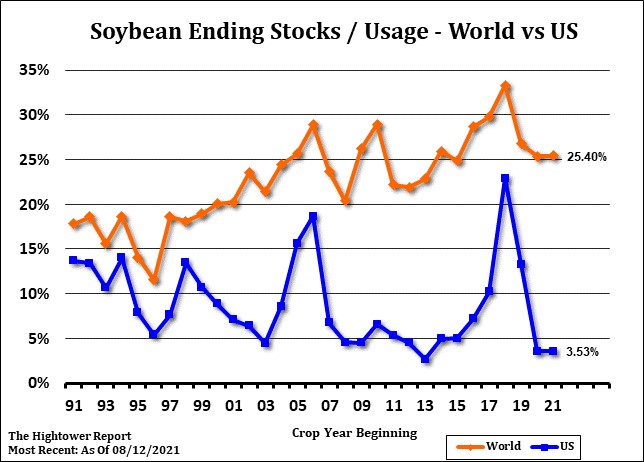

SOYBEANS

Soybeans traded lower as managed funds and professional traders liquidate net long positions. Much of the selling is linked to damage to US gulf export infrastructure. One elevator damage may take months to repair. Some need to clean up some flooding but most need power to be restored. Lack of commercial buying cash for export is also offering resistance to futures. Trade estimates weekly US soybean export sales near 725-1,400 mt vs 1,750 last week. Trade assumes despite slow US gulf exports US 20/21 and 21/22 soybean S/D will not change. Trade est US 20/21 soybean carryout near 180 mil bu vs USDA 160 due to lower final demand. Trade est US 2021 soybean crop near 4,350 mil bu vs USDA 4,339 and carryout near 150 vs USDA 155. Farm Futures est US 2022 soybean acres near 90.8 million vs 87.6 this year. USDA announced they will resurvey US 2021 soybean acres in the Sep 10 report vs Oct. Trade est US July soybean crush at 165 mil bu vs 162 in June and 184 last year.

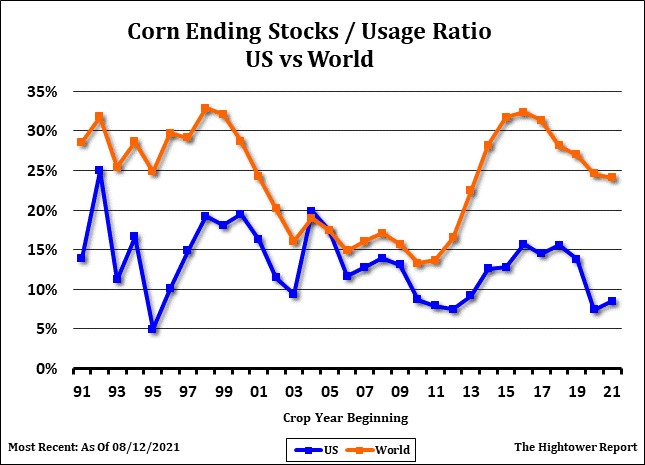

CORN

Corn futures ended lower as managed funds and professional traders liquidate net long positions. Much of the selling is linked to damage to US gulf export infrastructure. One elevator damage may take months to repair. Some need to clean up some flooding but most need power to be restored. Lack of Commercial buying cash for export is also offering resistance to futures. Trade estimates weekly US corn export sales near 850-1,600 mt vs 684 last week. Trade assumes despite slow US gulf exports US 20/21 and 21/22 corn S/D will not change. Trade est US 20/21 corn carryout near 1,200 mil bu vs USDA 1,117 due to lower domestic demand. Trade est US 2021 corn crop near 14,900 mil bu vs USDA 14,750 and carryout near 1,025 vs USDA 1,242. Key will be final exports. Some est US exports near 2,750 vs USDA 2,400. Farm Futures est US 2022 corn acres near 94.3 million vs 93.6 this year. USDA announced they will resurvey US 2021 corn acres in the Sep 10 report vs Oct. Some feel farmer crop insurance enrollment suggest US 2021 final corn acres near 94.4. Since the hurricane, CZ has dropped from 5.58 to 5.18. Open interest continues to decline due to reduced farmer selling and end users buying.

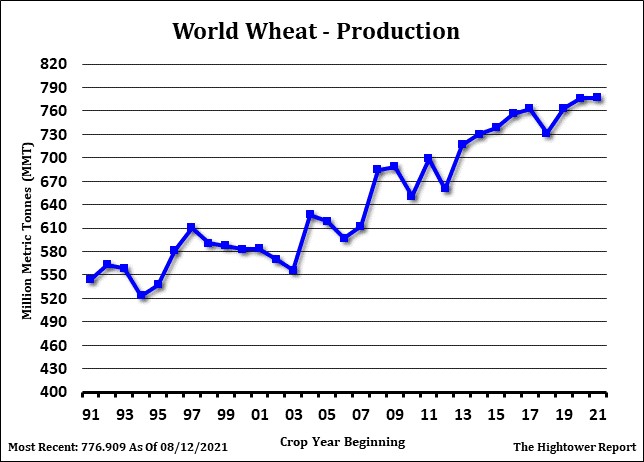

WHEAT

Wheat futures ended lower. Lower corn and soybean prices weighed on futures. Matif wheat futures traded lower on concern higher prices may reduce demand. Talk of lower Canada and Russia wheat crops has been offering support. Talk of rains in the Black Sea and Argentina plus drier EU harvest weather also offered resistance. WZ ended near 7.14 with range 7.09-7.29. KWZ ended near 7.07 with range 6.97 to 7.19. MWZ ended below 9.00 and near 8.98 with range 8.90-9.10. Weekly US wheat export sales are est near 200-450 nt vs 116 last week. Black Sea could see rains and exports price are below US HRW. US SRW is competitive to French low protein wheat. Farm Futures estimated US 2022 all wheat acres near 49.7 vs 46.7 this year. This could be negative to WN22. Talk of La Nina building in October could suggest drier than normal fall and spring US south plains weather.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.