SOYBEANS

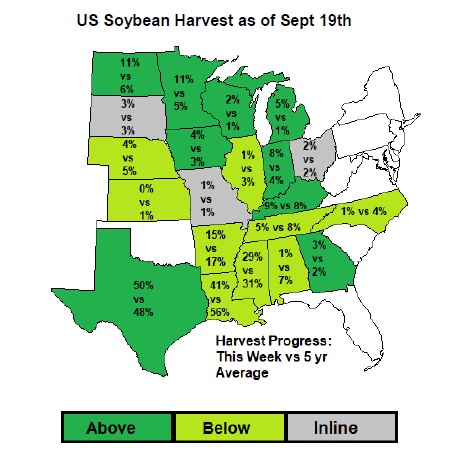

Talk that China was back buying a few US gulf soybean cargoes helped support soybean futures. USDA increased US soybean rating 1 pct to 58 G/E vs 63 ly. USDA NASS soybean yield was 50.6 vs 50.0 in August and 47.4 ly. IL rating jumped from 61 pct G/E to 75. USDA est US soybean harvest 6 pct done vs 6 average. USDA est IL soybean yield at record 64 vs 59 last year. USDA est IA soybean crop 61 pct G/E. USDA NASS est IA 2021 soybean yield near 59 vs 53 ly. Feels like soybean futures may be oversold and near value if some US gulf elevators open soon and China returns to the US soybean market. SX ended near 12.74.SX managed to hold 12.50 support. Range was 12.57 to 12.75. Some feel X could find resistance over 13.00 during US harvest and until US gulf elevators reopen. BOZ range was 54.18 to 55.50. First resistance is near 57.50. SMZ found support near 340. First resistance is 345.

CORN

Corn futures ended lower. Managed funds continues to liquidate longs during US harvest and slow start to US export year. USDA increased US corn rating 1 pct to 59 G/E vs 61 ly. USDA NASS corn yield was 176.3 vs 174.6 in August and 172.0 ly. IL rating jumped from 62 pct G/E to 74. USDA estimated US corn harvest 10 pct vs 4 last week and 9 average. USDA est IL corn yield at record 214 vs 192 last year. USDA est IA corn crop 58 pct G/E. USDA NASS est IA 2021 corn yield near 198 vs 193 ly. Feels like Managed funds may continue to liquidate net corn long until demand improves and US gulf export return. Highest rated corn states are KY, WI, IL, MI and OH. Lowest rated states are IA, MN, ND, and SD. Corn harvest is near 28 pct in KY, MO 17, IN 9, NE 7 and MN 6. Dry 2 week US Midwest forecast should speed harvest. Some feel US Farmer will deliver corn on existing contracts, sell a few more bushels where yields are record and store the rest. Some fear harvest could be close to doe in east before the gulf reopens, US domestic crushers continue to bid up for bushels before harvest. CZ range 5.00 to 5.40.

WHEAT

Wheat futures ended lower. Funds continue to add to their new net short position on lower US export demand than last year and fact US export prices are still a premium to other World sellers. Some also link drop in prices to needed rains falling in Russia. US south plains are still dry. USDA estimated that 21 pct of US winter wheat crop is planted. KS is 13, OK 15, CO 48, NE 35 and TX 20. OH is 7, IN 6. WA 21 and OR 7. US wheat prices are not yet competitive but questions over EU quality and Russia export tax could shift some milling quality demand to US HRW. WZ ended near 6.90. Range 6.86 to 7.01. WZ rejected 7.20 with support near 6.80 then 6.70. KWZ ended near 6.90. Range 6.86 to 7.01. KWZ rejected 7.20 with support near 6.80 then 6.70 then 6.50. MWZ ended near 8.87. Range 8.81 to 8.94. MWZ rejected 9.00 with support near 8.60.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.