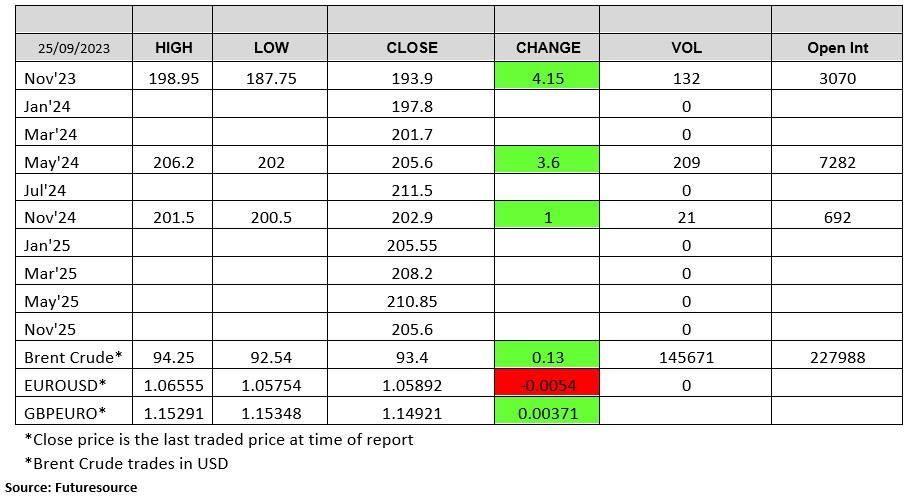

SOYBEANS

Soybeans traded lower. Concern about the pace of US soybean exports and new sales could lower final exports, approaching US harvest weighing on basis, spreads and futures and new soyoil lows weighed on soybean futures. SX range this week was near 12.71-13.08. Highs were hit on talk of lower US final soybean crop. Some feel that next week USDA could lower US soybean crop rating another 1 pct. Informa raised their estimate of the US 2021 soybean crop to 4,381 mil bu vs USDA 4,374. Informa also estimated US 2022 soybean acres at 86.6 vs 87.4 this year. Their US 2022 soybean crop is estimated near 4,420 mil bu vs USDA 4,374 this year. Late start to US 21/22 soybean export year has some lowering their estimate of US soybean exports. USDA is 2,090 mil bu vs 2,260 ly.

CORN

Corn futures ended lower. CZ ended near 5.27. For the week, CZ range was 4.93-5.37. Corn futures tested the highs on talk that current crop ratings, dry end to the season and talk of increase diseases could drop final US corn yield below 170. This triggered new fund buying. Still approaching US harvest offered resistance today to both basis and futures. 2 week US Midwest forecast of warm and dry weather should speed harvest. Key to prices could be harvest yield talk and how much corn farmers sell at current prices over what they have already contracted. Some feel USDA could drop next weeks US corn crop rating another 1 pct. US corn harvest should be 8-9 pct done. Informa estimated US 2021 corn crop near 15,046 mil bu vs USDA 14,996. Informa also est US 2022 corn acres near 94.3 vs 93.7 ly. Some feel given talk of higher expenses, prices will have to rally higher to get those acres. Informa est US 2022 corn crop near 15,537 mil bu vs USDA 14,996 last year. Debate continues concerning US 21/22 corn exports. USDA is 2,475 mil bu vs 2,745 last year. Some were as high as 2,900 due to lower Brazil supplies. Late start to US export program could reduce China buying to 16 mmt or 635 mil bu vs 21 mmt or 835 last year.

WHEAT

Sometimes it feels like wheat futures take one step up and 2 steps down.Today, wheat futures ended lower. WZ ended near 7.05. This weeks range was 6.71 to 7.16. High Dollar offers resistance. Talk of lower Canada, EU and Russia wheat supplies and exports offers support. Fact that US export prices are still a premium to other sellers offers resistance. Talk that a combination of an 18 year weather cycle, PDO readings and strengthening La Nina could keep US HRW areas warm and dry this fall, this winter and next spring. Some feel all this could lead to a warmer and drier US 2022 summer. There could also be a more normal north US plains and Canada weather in 2022. La Nina could dry down Australia crop vs this years record. Informa est US 2022 all wheat acres 48.5 vs 47.0 this year. They estimated USA 2022 wheat crop at 2,037 mil bu with winter 1,391 vs 1,324 this year. HRW 797 vs 785, SRW 349 vs 362, HRS 506 vs 329, Durum 83 vs 31 and White 303 vs 201.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.