SOYBEANS

Soybeans trade was mixed. News that China could take more soybeans in 2021/22 offered support. Lower than WOB est of US 2021 soybean crop also offered support. Long holiday weekend and a wetter US Midwest noon weather forecast also limited new buying. CBOT will be closed Monday due to holiday. Tuesday trade could be volatile depending upon US Midwest weather forecast. Rally in Dalian soymeal futures pushed crush margins to positive. Informa adopted US 2021 87.5 planted soybean acres. Their July 1 yield is 50.5 which suggest a crop near 4,379 mil bu vs WOB 4,575. Informa est Brazil soybean crop at 139.0 mmt vs WOB 137.0. They est Argentina at 44.5 vs WOB 47.0. Canada canola futures continue higher. Informa dropped Canada canola crop 1 mmt to 19.8. NASS est of US 2021 soybean acres and June 1 stocks were lower than expected. Nearby soybean futures range was 13.26-14.80. US May census soybean exports were 46.6 mil bu or 8 above inspections. Sep-May census exports are 132 mil bu above inspections.

CORN

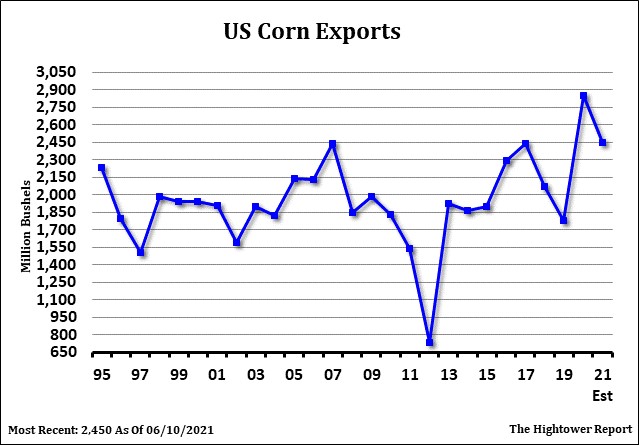

Corn futures traded lower. Fact that US Ag China attaché lowered China 2021/22 corn imports from 26 mmt to 20 is offering resistance to corn futures. This despite a 2 week US north plains and NW cornbellt warm and dry forecast. There is talk that China has bought 12.0 mmt US corn already and 6.0 mmt from Ukraine and 1.0 mmt from Brazil. China does have an additional 7.0 mmt of corn TRQ for imports. Key could be if China hog numbers rebound from this years lows. The amount of corn China buys from US will be key to if prices trend higher from here or lower. Informa adopted US 2021 92.7 planted corn acres. Their July 1 yield is 176.0 which suggest a crop near 14,874 mil bu vs WOB 14,990. WOB July S/D can adjust corn harvested acres and yield. Informa also lowered Brazil corn crop to 87.0 mmt vs WOB 98.5. Ukraine increase their corn crop to 37 mmt vs 30 ly. US May census corn exports were 334 mil bu or 20 above inspections. Sep-May census exports are near 2,148 or 173 mil bu above inspections. US court of appeals vacated a Trump ruling allowing for E15 summer gas sales. Some feel impact on corn demand could be small. NASS est of US corn acres and June 1 stocks were lower than expected. Nearby corn futures range was 6.36-7.44. Tuesday US Midwest July weather forecast will be key to prices.

WHEAT

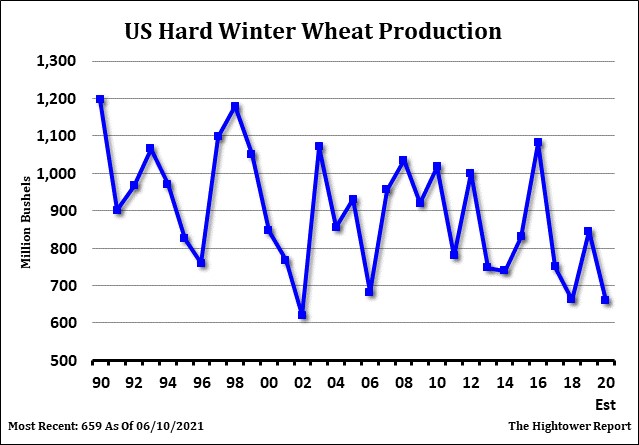

Wheat futures traded lower. Chicago and KC wheat continues to follow US corn futures lower. MInn wheat maintained a large premium to Chicago and KC wheat due to concern about US and Canada HRS 2021 crops. There is debate about July US west Midwest weather but most weather maps agree that US north plains and Canada prairies will be mostly warm and dry. Informa est US 2021 all wheat crop at 1,797 mil bu vs WOB 1,898. They est winter wheat crop at 1,353 vs 1,309, HRW 804 vs 771, SRW 354 vs 335 and white winter 195 vs 202. NASS will release first spring wheat and durum crop est July 12. Informa est the HRS crop at 397 vs 586 ly and Durum 47 vs 69 ly. Those may be high. Informa dropped Canada wheat crop 1 mmt to 31.7. They raised EU crop 2 mmt to 137. They raised Russia wheat crop 3 mmt to 85. Kazakhstan wheat crop was lowered 1 mmt to 13. India wheat crop was lowered 3 mmt to 108.8. NASS US wheat acres and June 1 stocks were near trade est. Nearby Chicago wheat range this week was 6.27-6.83, KC 6.00-6.61 and Minn HRS 8.05-8.68.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.