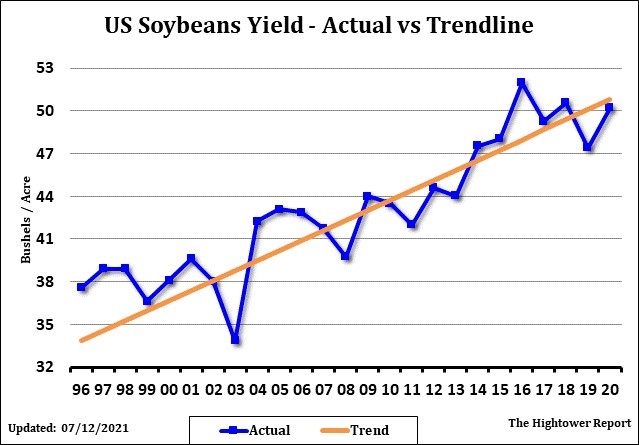

SOYBEANS

Soybeans traded higher. SU ended near 13.85. Range was 13.66 to 13.88. SU traded over 50 day moving average. 14.31 is key resistance. Trade expects no August soybean deliveries, 200-400 soymeal and

500-750 soyoil. US west Midwest remains warm and dry through the weekend. Temps moderate Aug 1-3 but ridge returns Tue-Sat. More are doubting USDA US 50.8 yield. A 1.8 drop in the yield would wipe

out the US 2021/22 carryout. Weekly US old crop soybean export sales dropped 3 mil bu. New crop increased 11 mil bu. Total old crop commit is near 2,274 vs 1,712 last year. USDA 2021/22 goal is 2,270 vs 1,679 ly. Some could see exports closer to 2,250. Talk of US soybean crushers taking downtime in August due to a lack of soybean supply could increase final carryout close to 160 vs USDA 135. USDA est of US 2021/22 soybean carryout near 155 with some now closer to 120, Key will be China demand and US August weather and final crop size.

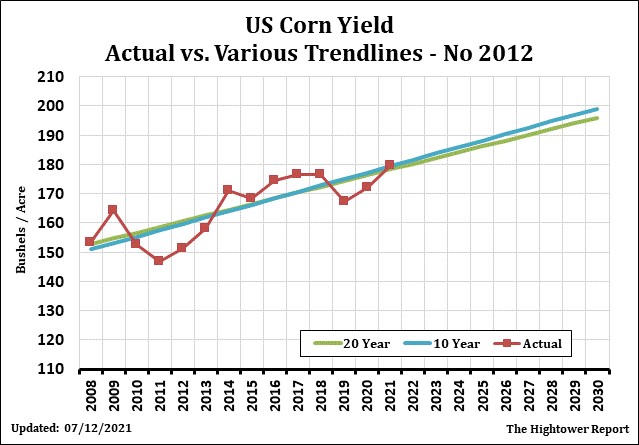

CORN

Corn futures traded higher. CU ended near 5.58. Range was 5.46 to 5.59. CZ ended near 5.56. Range was 5.46 to 5.57. Sep corn has had a crazy ride from the May high near 6.60 to May low near 5.20 to a June high near 6.40 to a early July low near 5.20 to now near 5.58. There is strong resistance near 5.60, then 5.80 then 5.88. Need to trade over those levels to turn market into a bull. East Midwest bears feel prices are too high given prospects of record yields. West Midwest bulls feel prices are too low given crops rated below average esp in ND,SD and MN. Key could be IA weather and yield. Some feel end users may not be covered after August and need a bearish USDA report to add coverage. This could offer support near 5.20. Farmers are unwilling eellers which could offer resistance near 6.00. Some analyst look for USDA to lower US corn yield to 177 vs 179.5 and add 300 mil bu to 2021/22 demand. This could finally push CU over 6.00. For now Managed funds are bearish and willing to sell rallies thinking US crop is ”made”. Weekly US old crop corn sales dropped 4 mil bu. New crop increased 21 mil bu. Total old crop commit is near 2,742 mil bu vs 1,719 last year. USDA goal is 2,850 vs 1,777 last year. USDA 2021/22 goal is 2,500 with most feel that could increase 300 mil bu. That could drop US 2021/22 carryout to near 1,130.

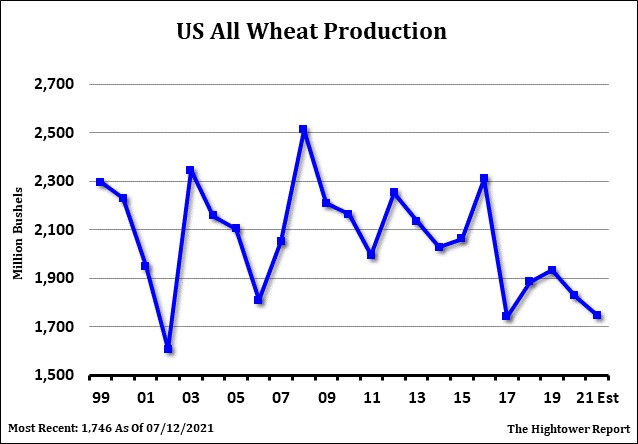

WHEAT

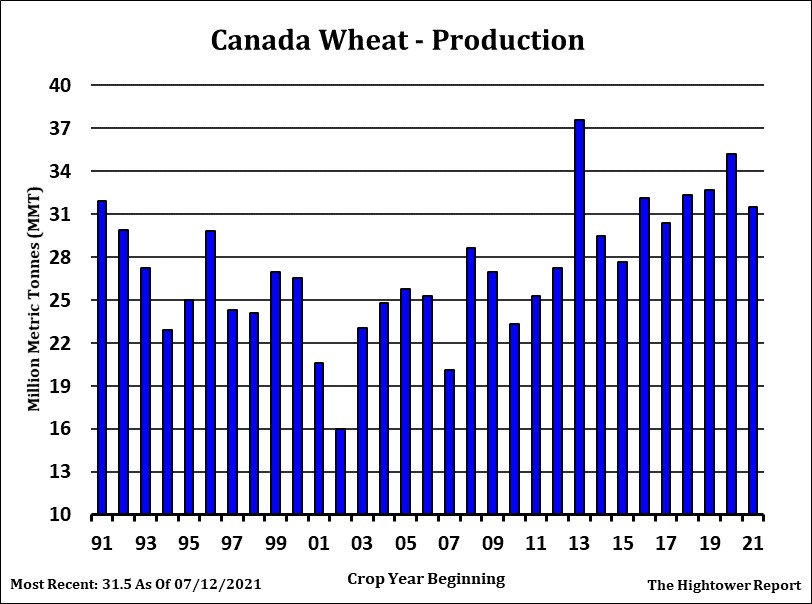

Wheat futures traded higher and may have been the leader in today’s grain and oilseed futures rally. Trade may be adding some supply premium on talk of near record low US spring wheat yields. Canada and Russia crop could also be lower than USDA July guess. IGC lowered World wheat crop 1 mmt to 788. They lowered US to 47.5 mmt from 51.1, Canada to 28.5 from 32.3 but raised EU from 136.0 to 137.7 Some feel Canada crop could be as low as 21 mmt. There is also concern about dryness across Argentina. Spring Wheat crop tour est ND yield near 29 vs USDA 28 and 49 last year. 2 previous day average was near 24-26. WU ended near 7.05. Range was 6.89 to 7.06. resistance is near 7.18. KWU ended near 6.74. Range was 6.58 to 6.77. KWU traded over key resistance. MWU traded near 9.18. Range was 9.06 to 9.28. Lower US crops could suggest US carryout closer to 580 mil bu from 665. Weekly US wheat sales were 19 mil bu. Total commit is near 299 vs 350 ly.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.