SOYBEANS

Soybeans ended marginally higher. Talk of dry and warm US Midwest and north plains 10 day weather outlook was supportive. Cooler with normal rains in the east 11-15 offered resistance. Slow US weekly export sales pace and lack of new China buying US offers strong overhead resistance. Need less than ideal US August Midwest weather to test resistance and make new highs. Bulls are suggesting to end users to buy futures after this weeks export sales data and into USDA August 12 report. 1.8 bushel drop in US 2021 yield would wipeout US 2021/22 soybean carryout. Trade est US weekly soybean export sales near 100-500 mt vs 238 last week. US soybean export commit is near 59 mmt vs 38 last year. USDA goal is 62 mmt vs 46 last year. USDA est total World soybean trade near 165 mmt vs 165 last year. China imports at 98 mmt vs 98 last year.

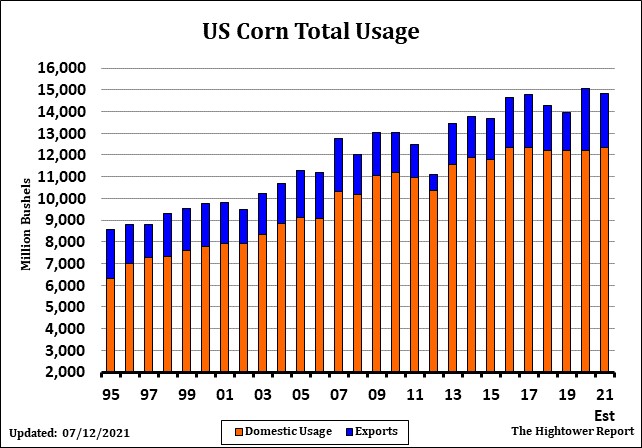

CORN

Corn futures ended mixed. CU was unchanged and near 6.49. Range was 5.45 to 5.54. CU-CZ spread is back to even on talk of early corn harvest in early Sep. this despite talk of no deliveries. Funds remain sellers of corn on rallies on feelings US crop is made, record east corn yields will offset drop in NW Midwest yields and need to see USDA WOB raise US 2021/22 corn demand and lower carryout before increase their net long position. US farmers has stopped selling but could have 12 billion bushels of corn to sell at harvest. They may have already sold 4 mmt. There remains heated discussion on US 2012 corn yield. USDA WOB is using a trend yield of 179.5. Some feel NASS/WOB could drop the August yield to closer to 177. That would drop the crop 375 mil bu or 2021/22 carryout from 1,432 to 1,057. If USDA is 300 mil bu to low on demand then carryout would be 757. A 181 yield would stop talk about food inflation even though prices go up daily due to higher labor, raw material and transportation cost. One commercial CEO suggested China could take 29-30 mmt corn imports with total feed grain a record 48-51 mmt. China is expected to take 18-24 mmt from US and 4-6 from Ukraine.

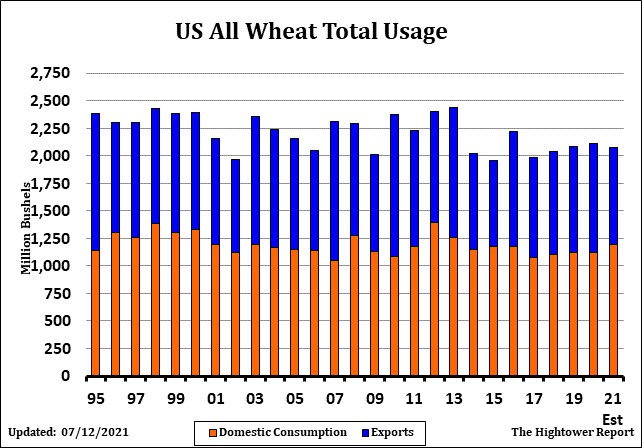

WHEAT

Wheat futures traded higher. WU ended near 6.88. Range was 6.73-6.96. KWU ended near 6.60 with range 6.40 to 6.60. MWU ended near 9.03. Range was 8.79 to 9.06. US north plains 10 day and 11-15 day weather outlook is for below normal rains and normal to above temps. The top story overnight was the first day report from this years US spring wheat crop tour. Tour participants surveyed 100 fields in south ND and came up with a yield of 29.5 which is 35 pct below 2019 (there was no tour last year due to Covid) and 32 pct below 5 year average. Crop scouts noted fields with drought stress and insects. MWU traded back over Tuesdays high. Key now is their enough concern over lower NW HRS crops to push prices back over 9.44 highs. Weekly US wheat export sales are est near 350-600 mt vs 473 last week. USDA est US exports near 23.8 mmt vs 27.0 ly. World trade is est at a record 204 mmr vs 201 last year. Talk of lower Canada, US and Russia wheat supplies could lower World exporters stocks to use ratio.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.