SOYBEANS

Soybeans traded higher. Overnight prices initially traded higher after US weekend weather was warm and dry. Wetter and cooler EU model weighed on prices. Talk of China having interest in US Jan-Mar soybeans and a drier noon central Midwest GFS model forecast helped SU trade from 13.36 to 13.62. Soyoil was supported by higher palmoil prices. Weekly US soybean exports were near 9 mil bu vs 5 last week and 18 last year. Season to date exports are near 2,132 mil bu vs 1,426 last year. USDA goal is 2,270 vs 1,679 last year. Trade still looks for US 2020/21 soybean carryout near USDA 135. Some could see US 2021/22 carryout lower than USDA 155 and closer to 120 due to higher demand. China talking like US relations were at a stalemate offered resistance. A more positive meeting later raised hope China will begin to buy US Ag goods based on the Phase 1 trade deal.

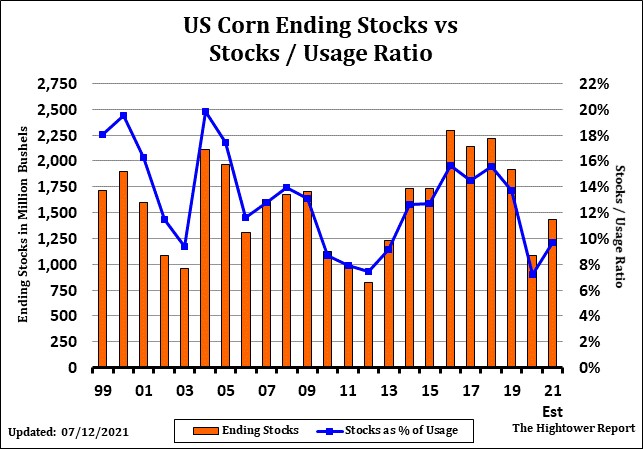

CORN

Corn futures managed small gains in lite volume. Overnight prices initially traded higher after US weekend weather was warm and dry. Wetter and cooler EU model weighed on prices. A drier noon central Midwest GFS model forecast helped CU trade from 5.36 to 5.51. Some feel USDA NASS could drop weekly US corn crop ratings 1-2 pct. Noon maps took out 1.00-2.50 inch rains of rain out of the heart of the Midwest and moved farther south. This and hot temps the first part of the week could deplete topsoil moisture levels. China tightening grip on property, education and food delivery monopoly reform and hard rhetoric against US before planned talks is weighed on equity and commodity markets. Chinese Vice Foreign Minister Xie Feng said during talks Monday with U.S. Deputy Secretary of State Wendy Sherman that the two countries ‘ relationship “is now in a stalemate and faces serious difficulties. Weekly US corn exports were near 41 mil bu vs 42 last week and 33 last year. Season to date exports are near 2,412 mil bu vs 1,470 last year. USDA goal is 2,850 vs 1,777 last year. Trade still looks for US 2020/21 corn carryout near USDA 1,082. Some could see US 2021/22 carryout lower than USDA 1,432 and closer to 970 due to higher demand. Rebound is US stocks and lower US Dollar may be helping corn.

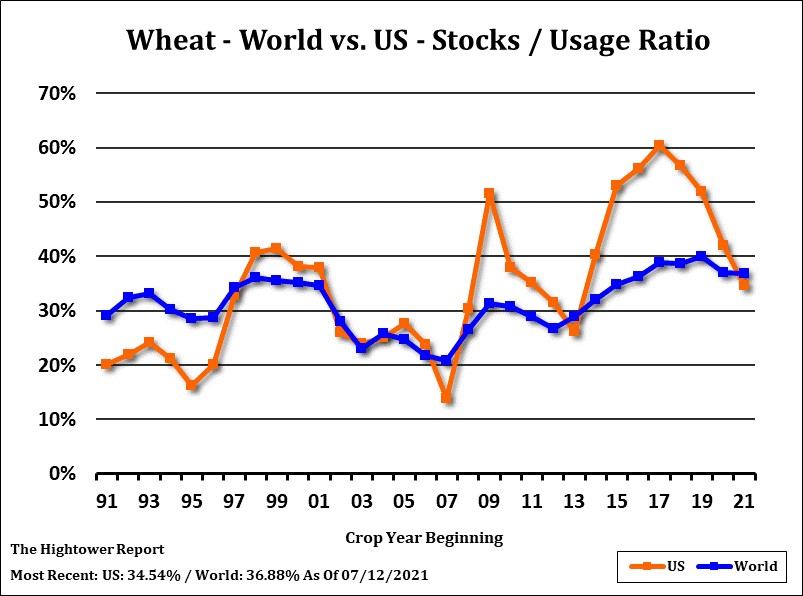

WHEAT

Wheat futures traded lower. WU ended near 6.77. Range was 6.65 to 6.84. KWU ended near 6.38. Range was 6.31 to 6.49. MWU ended near 8.78. Range was 8.70 to 8.88. Weekly US wheat exports were near 17 mil bu vs 19 last week and 20 last year. Season to date exports are near 123 mil bu vs 152 last year. USDA goal is 875 vs 992 last year. Trade still looks for US 2021/22 carryout lower than USDA 665 and closer to 580 due to lower supplies. Trade estimates that US winter wheat harvest should be near 84 precent vs 73 last week. US spring wheat rating could drop 1 pct to 10 from 11 last week, US spring wheat harvest is estimated near 4 pct. There remains talk that Canada wheat crop could drop to 21.0 mmt vs USDA 31.5. Russia crop could be 80 mmt vs USDA 85.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.