SOYBEANS

Soybeans traded higher but ended off session highs. Traders want to see lower US 2021 crop and higher demand before trading over key resistance. SU was near 14.06. Range was 13.91 to 14.24. Some feel

Dry US 2 week upper Midwest weather could force SU over 14.50. Sundays US Midwest 2 week weather forecast will be key for prices. This week, China reported soybean stocks increasing despite better crush margins. China pork imports slowed due to lower domestic hog prices. Q2 China pork production surged. Q2 China economy slowed from fast Q1 start. Dry Canada prairie weather continues to push Winnipeg canola futures and Matif rapeseed futures higher. Some feel Canada canola crop could be 4-5 mmt below WOB est of 20.2. Managed funds were net buyers of 6,000 soybeans, 2,000 soymeal and 3,000 soyoil. We estimate funds to be net long 100,000 soybeans, 29,000 soymeal and 67,000 soyoil.

CORN

Corn futures ended lower. Longs liquidated after CU failed to trade over 5.70. CZ also failed to find new buying above 5.65. CU-CZ spread continued to lose on concern over US export demand and talk some of the east US Midwest corn crop could be harvested in September. Some feel lower Brazil crop and concern about Argentina exports logistics could switch 10 mmt or 400 mil bu of South America corn export demand to US. This week, WOB raised US 2021 corn crop to 15,165 mil bu vs 14,990 est in June. This due to higher acres. WOB left US corn yield near 179.5 which would be a new record. Pro Farmer est US corn yield based on current crop ratings near 177.6. That would take 160 mil bu off the est 2021/22 carryout of 1,432. Some are est US 2021/22 corn exports at 2,900 vs WOB 2,500. That could drop the carryout another 400 mil bu from 1,272. Some feel this should eventually trade CU over 6.00. WOB lowered World 2020/21 corn trade from 187 mmt to 183. Brazil was lowered to 28 mmt vs 33. Argentina was raised to 35.5 from 34. Ukraine was left at 23 mmt. WOB has 2021.22 World corn crop at 1,195 mmt vs 1,120 this year. Exports were raised to 199 mmt. End stocks were raised to 291 vs 279 this year. Hard to overcome these numbers unless 2020/21 US exports are too low and end stocks are too high.

WHEAT

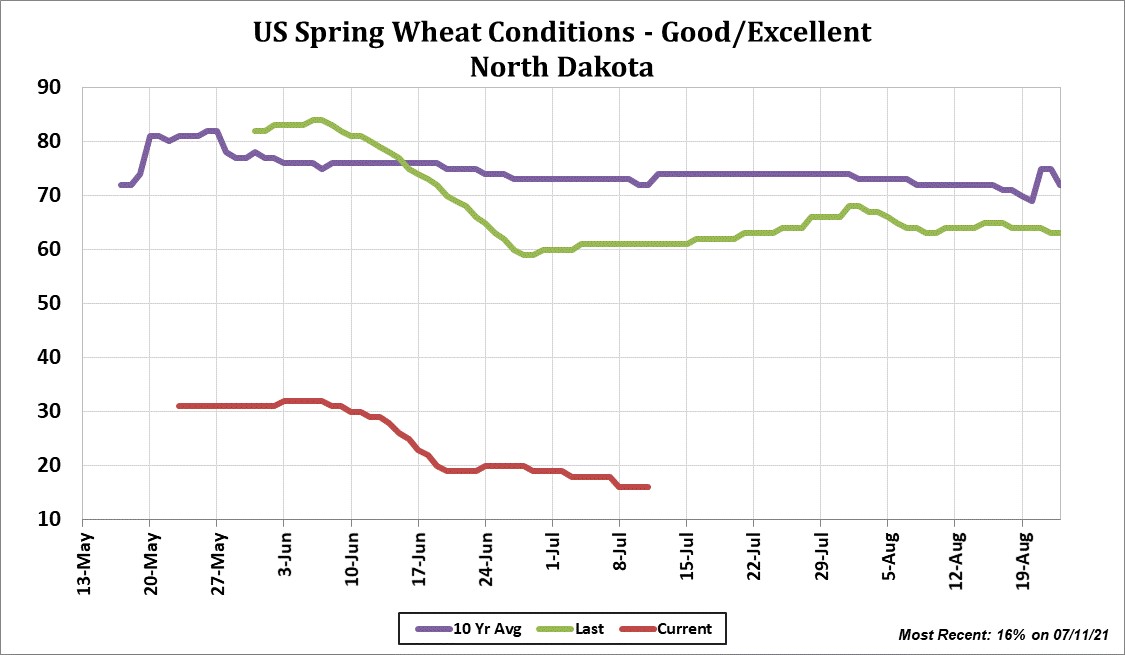

Wheat futures ended higher. Dry weather across NA HRS crop areas pushed MWU to new higher. This is the first time MWU has traded over 9.00 since October, 2012. WU ended near 6.92. Range was 6.70-6.94. 6.94 is near the July 1 high. WU saw the biggest weekly gain in 4 years. KWU is near 6.51. Range was 6.37 to 6.60. NASS est US HRW crop near 805 mil bub vs 659 last year. End stocks near 365 vs 426 ly. Drop is HRS crop could increase HRW domestic use. NASS est US SRW crop near 362 mil bu vs 266 ly. End stocks are est near 105 vs 85 ly. China surprised the market today by buying US SRW. NASS est US HRS crop near 305 mil bu vs 530 ly. End stocks near 237 vs 302 ly. IKAR est Russia wheat crop near 81.5 mmt vs 83.5 previous and WOB 85.0. Lower US, Canada and Russia crops could tighten World supplies. WOB est World crop near 792 mmt vs 775 ly. Exports at record 204 mmt. End stocks near 291 mmt vs 290 ly. Canada could be 21 vs WOB est of 31.5.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.