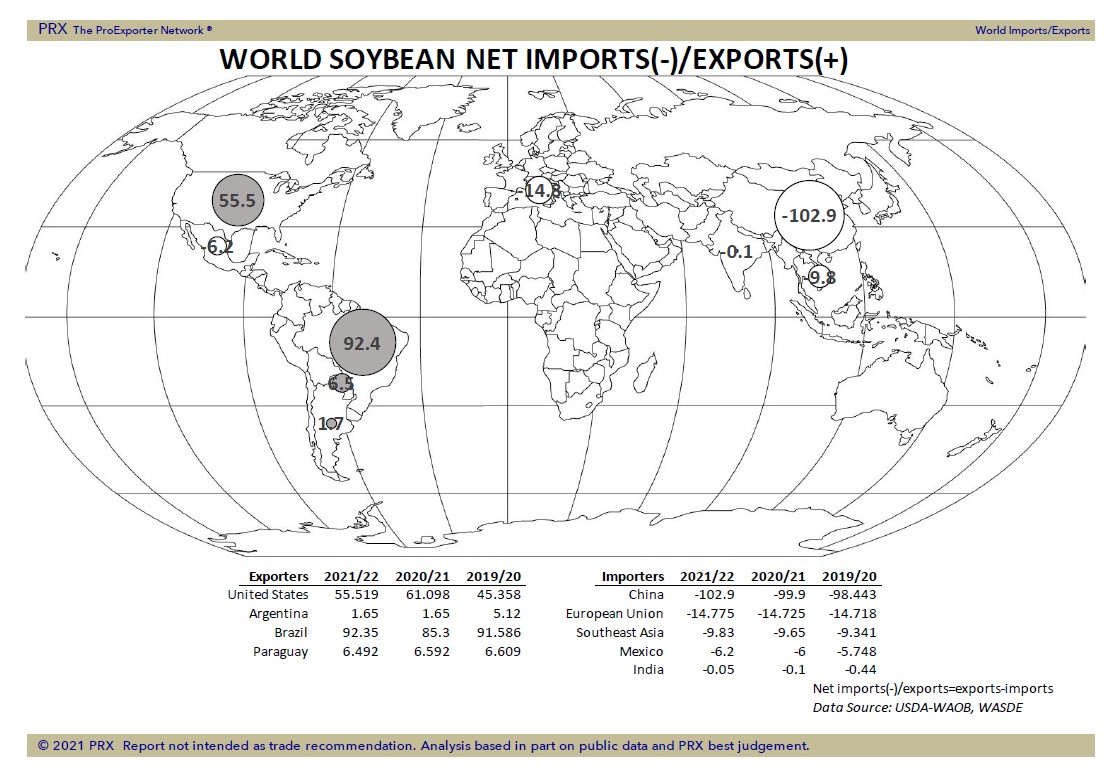

SOYBEANS

Soybeans ended higher. A hot and dry US west upper Midwest weather forecast for late next week may have triggered new buying. SU is back near 13.94. Talk of drier US upper Midwest weather could be offering support to a low volume and very volatile trade. SU has filled the gap from July 6 rain event and is near the 50 day moving average. Weekly US soybean export sales are estimated near 100-900 mt vs 182 last week. Trade est US June NOPA soybean crush near 159.5 mil bu vs 163.5 in May and 167.3 last year. Some feel crush may have slowed due to lower soymeal demand. Canada and Matif canola oil prices continue to trend higher which supports soyoil which supports soybean. Some est Canada RSO crop near 16 mmt vs USDA 20.2.

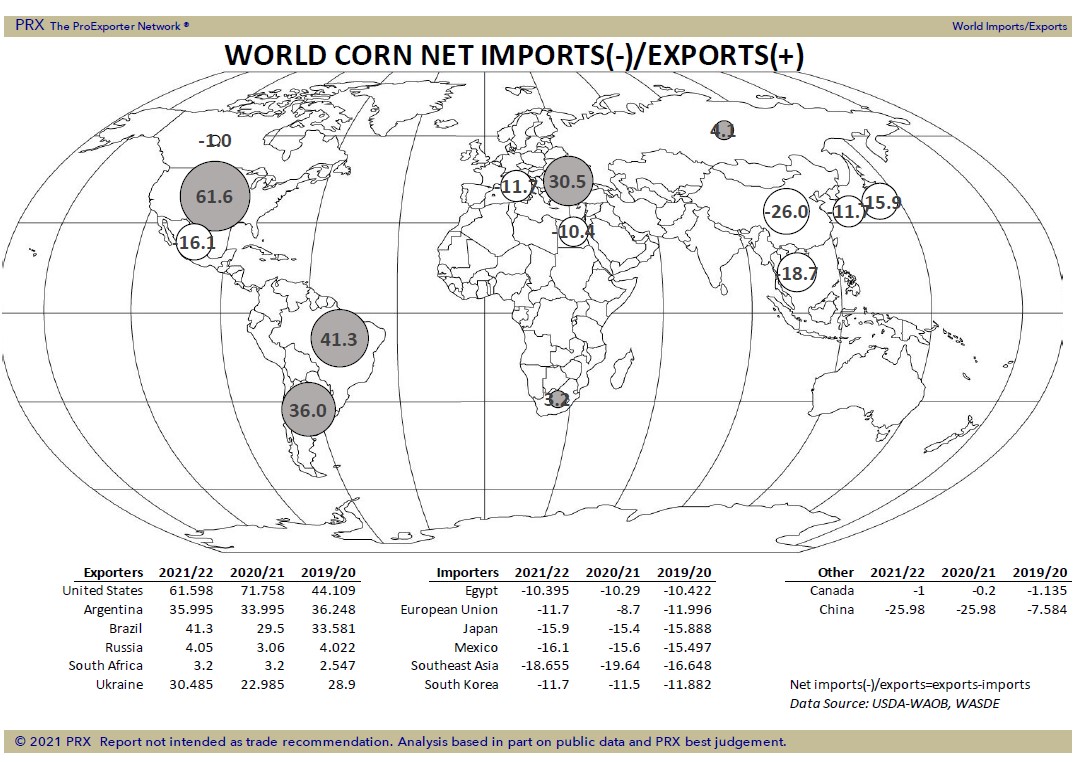

CORN

Corn futures traded higher. Talk of hot and dry upper US west Midwest weather late next week offset rains moving across parts of NE and IA. CU is back near the bottom of the July 6 gap. Need to trade near 5.88 to fill the gap. Weekly US corn export sales are estimated near 100-900 mt vs 371 last week. USDA est that South America will export 27 mmt of corn July-Sep. Some feel lower Brazil crop and struggling Argentina export logistics could suggest exports 10 mmt or 400 mil bu lower than USDA est. This could increase demand for US exports. Some feel market could be trading a 178 US corn yield which could be adequate for demand. Managed funds were net buyers of 14,000 corn. We estimate funds to be net long 226,000 corn. Grains open interest remains low. Managed funds may be waiting for more weather data and USDA August report to either add to longs or go short. There was some talk today that IL corn yield could be lower than expected. This and below average yields in MN, IA, SD and ND could drop US corn yield below 175. Some feel US 2021/22 corn carryout could be closer to 1,000 mil bu vs USDA 1,432. Each 1 bpa below 179 could reduce the carryout 90 mil bu.

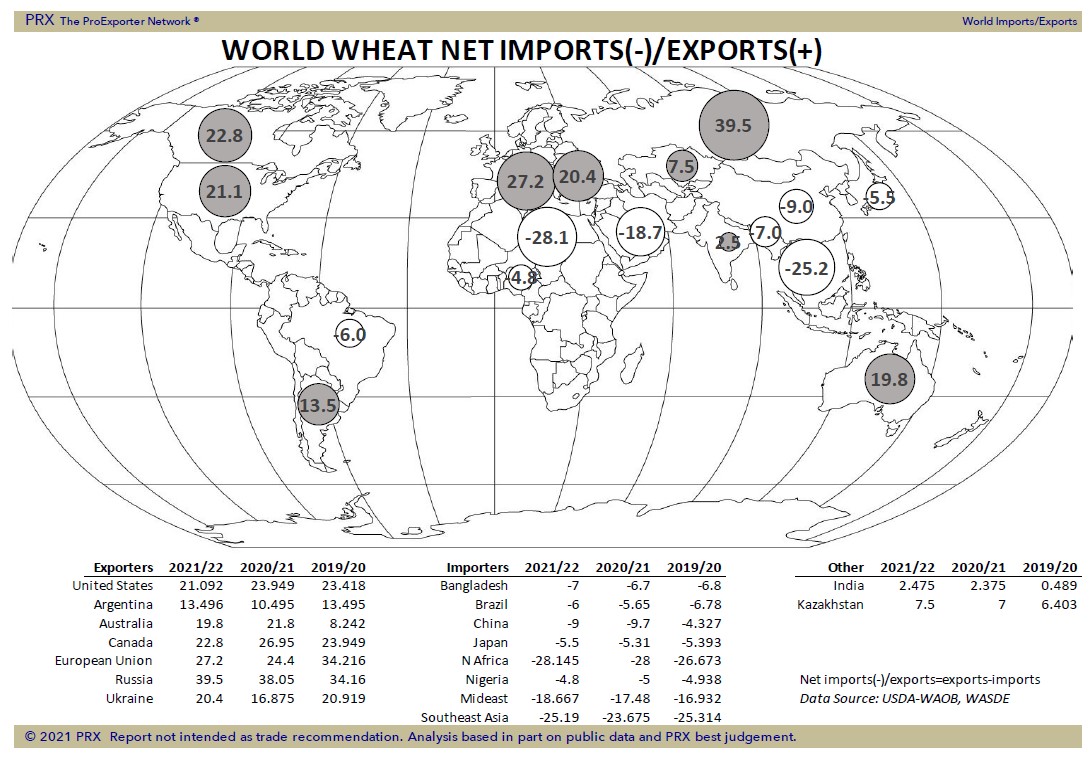

WHEAT

Wheat futures traded higher. Lower US Dollar and higher corn futures rallied wheat futures. WU is near 6.54, KWU is near 6.29 and MWU is near 8.72. WU is back over 6.40 and 6.50 resistance. Next level is near 6.62. KWU is also above 6.10 resistance. Next level is 6.40. MWU made new highs. Some look for MWU to test 9.50. Lower US/Canada wheat crops supportive. Canada wheat crop could drop to 21 mmt from USDA WOB 31.5. There is also talk that rain is delaying Europe wheat harvest and raising concern about quality. There is also talk that Russia wheat crop size is dropping due to hot/dry weather. US Millers need Q4 coverage. US bakers may be only 30-40 pct covered. Lower US 2021 spring crop could increase options on blends. Higher protein specs on spring wheat flour where possible and importing more Canadian. There could be enough wheat to grind domestically but a matter of price. Higher than average HRW and HRS basis levels has reduced buying. US soft white crop is also down from average.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.