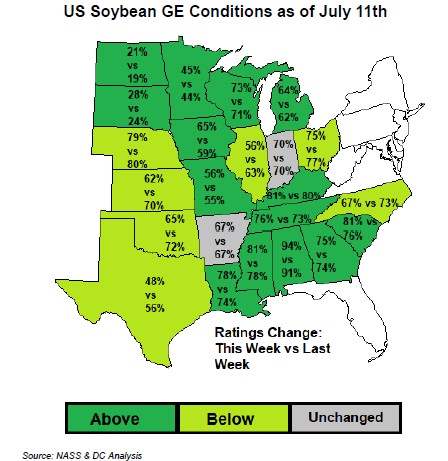

SOYBEANS

Soybeans traded higher. SU ended near 13.60. Range was 13.54 to 13.72. SU traded back over the 20 and 100 day moving average. Gap is near 13.86. 50 day is near 13.98. Need a drier and warmer LH July and August weather to trade near season highs. WOB dropped China soybean imports to 98 mmt. China June imports were 10.7 mmt. Season to date imports are 74.8 mmt or up 8 pct from ly. In order to get to USDA est, July-Sep exports would have to drop 21 pct from last year or drop 6 mmt. WOB dropped US 20/21 soyoil exports from 1,900 to 1,775. They est 21/22 exports at a 16 year low of 1,450. They also dropped 20/21 biofuel demand 200 to 9,600 but still est 21/22 at 12,000, That would be a record 46 pct of total soyoil production.

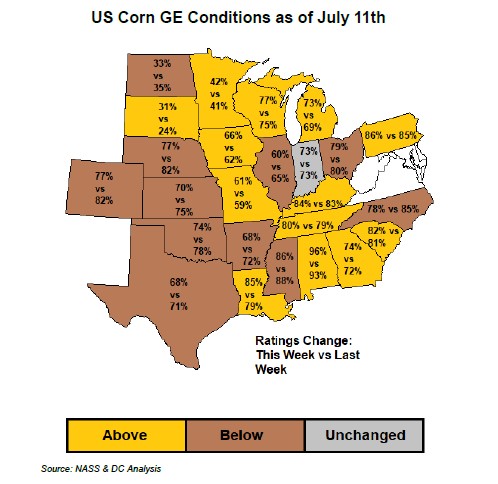

CORN

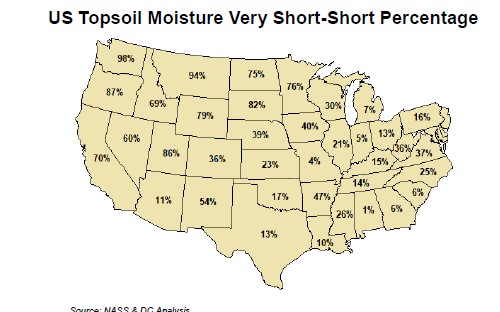

Corn futures traded higher. CN last trading day saw a range of 6.64 to new contract highs of 7.50. CU ended near 5.53. Some feel final US 21/22 corn demand will be higher than WOB July est. This leaves price direction up to final yield. Debate starts with WOB trend yield of 179.5. Some doubt fact NASS rates the crop at 65 pct G/E suggest a yield below 179.5 and even previous record of 2017 of 176.6. NASS raised ratings in IA, MI, MN, MO. Highest ratings are in IN, MI, NE,OH,TN and WI. How high are yields there? Lowest ratings are in MN, ND and SD. How low will yields be there? 26 pct of the crop is pollinating. Some feel LH July and FH August Upper US Midwest weather could be hot and dry. Most of the US crop may be pollinated by then. WOB est of US sorghum, oat and barley stocks to use ratio is record low. This could increase corn demand but also lower US 2022 corn acres in favor of these crops. A few Analyst estimate US 2021/22 carryout near 745-930 mil bu vs WOB 1,432. Some feel rally in corn prices after the report could suggest market already discount WOB estimate. CU back above 100 day moving average. Gap is between 5.70 and 5.88. Most gaps are filled. Still, it will take a weather rally or new China buying to push CU back over 6.00. 7.50 CN probably has US farmers too bullish especially in upper US west Midwest. Rumors that Cargill is talking a 182 US corn yield. Citadel is 180.

WHEAT

Wheat futures were mixed. WU was down 7 cents to 6.33. Range was 6.30 to 6.44. This week, NASS est US 2021 SRW crop at 362 mil bu vs 340 est and 266 last year. KWU was down 2 cents and near 6.13. Range was 6.03 to 6.18. NASS est US 2021 HRW crop at 805 mil bu vs 788 est and 659 last year. Fact US HRW fob export prices are near $289 vs Russia $237also weighs on prices. Egypt announced a tender for wheat East EU and Black Sea prices are the lowest. Lack of US wheat export demand offers resistance. WU failed to trade above Mondays highs and fill the gap near 6.48. MWU made new highs near 8.70 before closing near 8.61. Fact NASS est US HRS crop at only 345 mil bu vs 459 expected and 530 last year continues to support MWU. WOB failed to lower Canada crop as much as US. NASS dropped US HRS crop 41 pct. Similar drop in Canada would drop their crop from 31.5 mmt to 21.0. WOB 8 country stocks were down 5 mmt and stocks To use ratio was lowest in 14 years. Kazakhstan fired their Ag Minister For not doing enough for farmers during extreme heat and drought.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.