SOYBEANS

Soybeans ended higher. Trade will be watching US harvest yields, demand for US 2021 soybean supplies and South America weather for future direction. 13.00 is strong overhead resistance. 12.50 could be key support. End users are suggested to use break in prices to add to 2022 needs. Trade estimates US weekly soybean export sales near 700-1,200 mt vs 903 last week. Trade estimates US Sep 1 soybean stocks near 174 mil bu vs 525 ly. Trade still hearing WCB US soybean harvest yields better than expected. Oct soymeal deliveries could be small. There are 365 Oct soyoil lots registered for delivery.

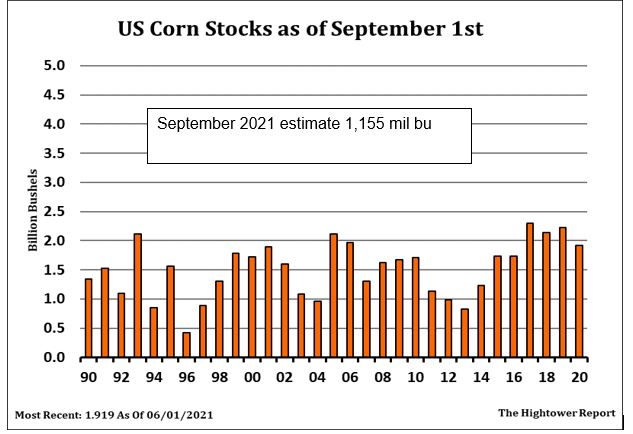

CORN

Corn futures ended higher. Bears feel that slow demand for US corn exports continues to offer resistance near 5.40-5.50 CZ. Bulls feel talk of lower US final corn yield and potential drop in US 2021/22 corn carryout will continue to support CZ through harvest and could push futures higher post harvest. Some US domestic end user locations are beginning to push basis higher due to slow farmer selling additional bushels above previous sold contracts. Trade estimates US weekly corn export sales near 400-900 mt vs 373 last week. Some estimate China corn import needs to total near 20 mmt. They have bought 10 mmt from US and 4 mmt from Ukraine. This could limit new US purchases unless they want to add to Reserves. Some feel Canada may need to rail 4 mmt of US corn to satisfy demand. Most feel final US corn exports should be closer to 2,600 vs USDA 2,475 and 2,745 last year. Weekly ethanol production was down from last week but above last year. Stocks were near last week but up from last year. Margins remain positive. Trade estimates US Sep 1 corn stocks near 1,155 mil bu vs 1,919 ly.

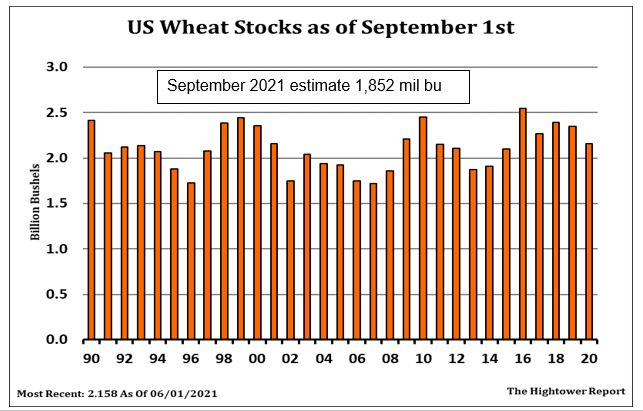

WHEAT

Wheat futures ended mixed. Talk of lower global wheat supply for exports including Canada, Russia and EU offers support. Thursday USDA estimate of US Sep 1 wheat stocks and final US 2021 wheat crop could be supportive. Higher US Dollar and rising end users cost of production and uncertain US food demand offers resistance. Dru areas of US south plains will see needed rains. US north plains, PNW, Canada prairies, east EU and most of the Black Sea remains dry. La Nina could suggest drier US south Plains and SRW crop areas in 2022. Trade estimates US weekly wheat export sales near 250-550 mt vs 356 last week. Trade estimates US Sep 1 wheat stocks near 1,852 mil bu vs 2,158 ly. Wheat crop 1,680 mil bu vs 1,697 in Sep.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.