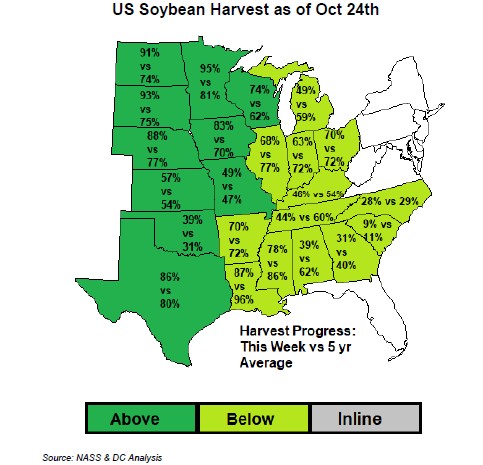

SOYBEANS

Soybean ended unchanged. SX range was 12.30-12.46. Failure of SX to trade over 12.50 may have triggered some long liquidation. Higher energy prices and talk of inflation may have helped soybean prices. China and US held their second high level trade meeting. Purpose was to try to work closer on macroeconomic policies and broaden communication. US/China Phase 1 trade deal expires Dec 31 with China behind in buying US Ag goods. Noon US GFS model is wetter for US Midwest and Delta later this week. Next week looks drier. USDA est US soybean harvest near 73 pct vs 60 last year. AR is 70, IL 68, IA 83, NE 88 and ND 91. Some estimate that there is 16.7 million soybean acres yet to be harvest. Good South America weather continues to suggest a 2022 Brazil soybean crop near 144 mt and Argentina 51. Brazil truckers remain on strike.

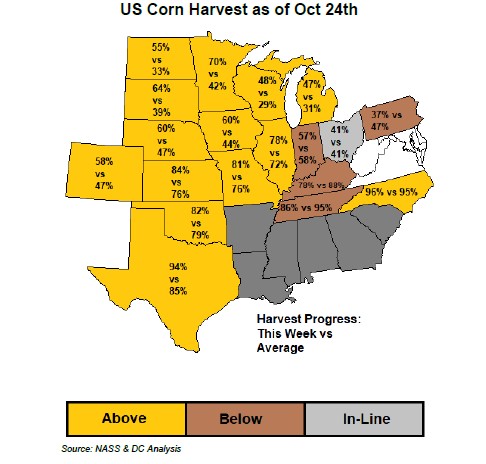

CORN

Corn futures ended higher. CZ tested the 100 day moving average resistance near 5.45.There was talk of increase consumer buying. Open interest continues to slowing increase suggest new longs and increase farmer selling. Corn market saw different news today. USDA estimated US corn harvest near 66 pct done vs 70 average. There is talk of some stress to remaining IL corn crop due to wet weather. IL harvest is 78, IN 57, OH 41, MI 47, MO 81, IA 60, MN 70, SD 64 and NE 60. Some est that there is still 26.1 million US corn acres yet to be harvested. EU corn prices are higher as rains have return to slow harvest. 32 pct of Ukraine corn crop is harvested with higher yields suggesting a crop over 40 mmt vs USDA 38. USDA est Brazil corn crop at 118 mmt and Argentina 53. China and US held their second high level trade meeting. Purpose was to try to work closer on macroeconomic policies and broaden communication. US/China Phase 1 trade deal expires Dec 31 with China behind in buying US Ag goods. China domestic corn prices are near 10.32. China continues to sell wheat from reserve and buy EU wheat for feed. All signs of lower corn stocks for feeding. There has been talk as to why China is not buying US corn and importing lower prices corn to help hog producers. Noon US GFS model is wetter for US Midwest and Delta later this week. Next week looks drier.

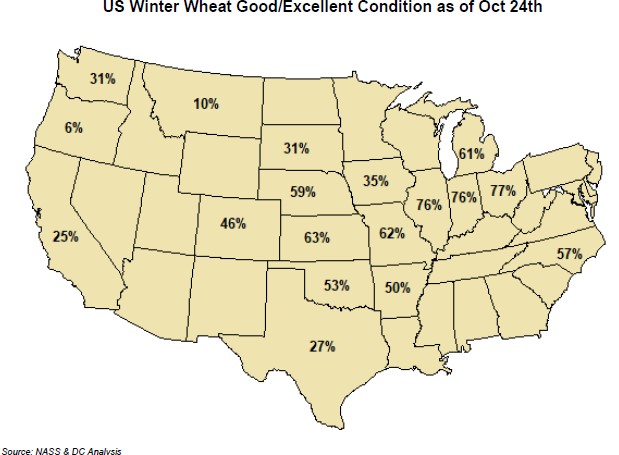

WHEAT

Wheat futures had a real roller coast ride today. Wheat futures ended lower. US Dollar was higher. WZ ended near 7.52 with range 7.47-7.65. KWZ ended near 7.74 with range 7.66-7.90. MWZ ended near 10.21 with range 10.16-10.47. Wheat futures have been supported by higher EU and Russia prices. There is talk that EU may have oversold wheat exports. Lower quality wheat has been a buy for China. There is also talk the Russia wheat prices are trending higher due to higher export tax. Russia domestic prices are higher than export with farmers selling wheat domestically versus for export. USDA estimated that 80 pct of US winter wheat crop was planted. Crop was rated 46 pct G/E vs 41 last year and 60 expected. KS was 63, OK 53, MO 62, OH 76, OR 6 and WA 32. US weather forecast suggest good US south plains next week. Russia remains dry. Long range US and Russia winter wheat weather forecast suggest dry 2022 spring and simmer. WZ had a negative close, failing to trade over 7.60 resistance and closing below Monday’s low.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.