SOYBEANS

Soybeans closed sharply higher on the session with an outside-day up which is a positive technical development. A continued strong advance in palm oil supported strength in the soybean oil. Strength in energy markets added to the positive tone for vegetable oil markets. Trade houses in Brazil see plantings near 36% complete as good weather continues to allow plantings at a faster than normal pace. Fears that very high crush margins will spark a sharp advance in soybean meal production helped to push meal lower after an early rally to the highest price level since September 30. For the weekly crop progress report, traders see soybean harvest at 74% complete, 71–77 range, as compared with 60% complete last week. Soybean export inspections for the week ending October 21 came in at 2,103,505 metric tonnes from trade expectations for 1.800-2.625 million tonnes. Cumulative inspections year-to-date are 8,129,440 metric tonnes which is 45.0% below last year. This is 14.3% of the USDA’s forecast for the 2021-22 marketing year versus the five year average of 19.3%. Along the Illinois River, soybean bids dropped by 15 cents.

CORN

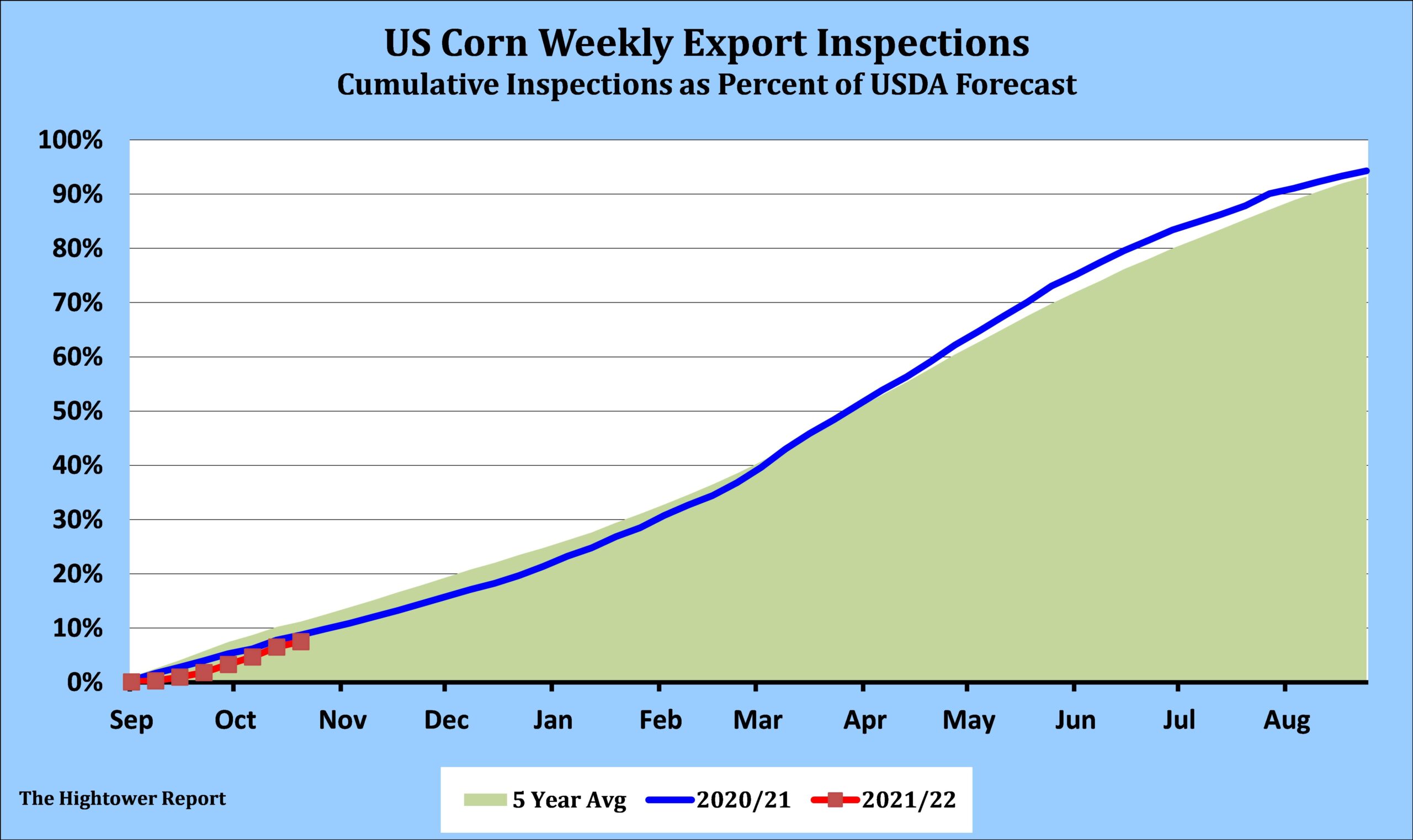

The early rally push the market up to the highest level since October 6, but weak export news and talk of the short-term overbought condition of the market helped to pressure. December corn closed near unchanged after choppy and 2-sided trade. For the weekly crop progress report, traders see corn harvest near 65% complete, 62–68 range, as compared with 52% last week. Higher gas prices should encourage increased ethanol production, but the higher US dollar is seen as a negative force. A more active weather system across the Midwest could slow harvest some, but traders do not see this is a significant longer-term factor. Corn export inspections for the week ending October 21 came in at 545,127 metric tonnes from trade expectations for 750,000-1.2 million tonnes. Cumulative inspections year-to-date are 4,712,999 metric tonnes which is 23.6% below last year. This is 7.5% of the USDA’s forecast for the 2021-22 marketing year versus the five year average of 11.2%. Along the Illinois River, corn bids fell by $0.21 a bushel.

WHEAT

December wheat managed to close higher on the day and near the middle of the 13 ¾ cent range. The early buying pushed the market up to the highest level since August 17. Kansas City wheat closed higher on the day after the early rally to a new contract highs for the second session in a row. Minneapolis wheat traded as high as $10.31 and new contract highs for the fourth session in a row. For the weekly crop progress report, traders expect winter wheat plantings to have reached 81% complete (78-85% range). For the first crop conditions update of the season, traders see 54% of the crop in good/excellent condition with a range of 49% to 62%. Wheat export inspections for the week ending October 21 came in at 140,413 metric tonnes from trade expectations for 150,000 to 450,000 tonnes. Cumulative inspections year-to-date are 9,478,304 metric tonnes which is 14.5% below last year. This is 39.8% of the USDA’s forecast for the 2021-22 marketing year versus the five year average of 39.8%.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.