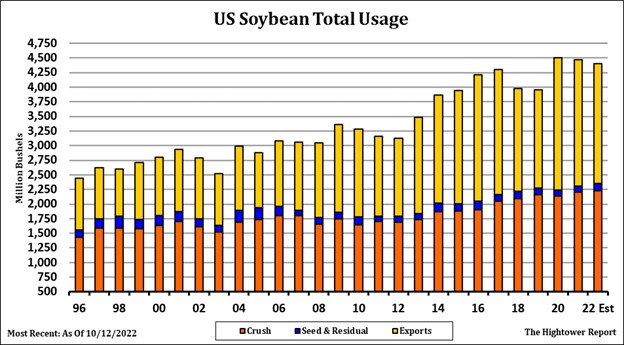

SOYBEANS

Soybeans ended higher on technical buying following better than expected weekly and daily US soybean export sales. Weekly US soybean sales were near 85 mil bu, mostly to China. Total commit is near 1,211 mil bu v s 1,068 ly. USDA goal is 2,045 vs 2,158 ly. Some could see final exports could be done 100- 150 mil bu. Talk of favorable 2023 South America weather could limit upside in futures. Higher US soybean crush margins is positive. River logistics problem is negative. C IL soybean yields are a little better than expected. USDA est US 2022 soybean crop at 4.313 mil bu vs 4.465 ly. Crush is est at 2,235 vs 2,204 ly. Total demand 4,402 vs 4.465 ly. Carryout only 200 vs 274 ly. Some est US 2023 crop near 4,617. Crush 2,355. Exports 2,030 and carryout 395. Since late July, SX range has been 13.50-15.00.

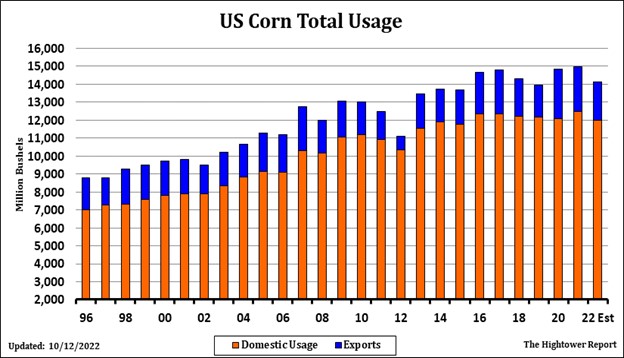

CORN

Corn futures ended higher. Higher commodity and equities may have helped corn futures. Weekly US corn exports sales were on the low side of estimates. US sales were 16 mil bu. Total commit is only 544 mil bu vs 1,137 ly. USDA goal is 2,150 vs 2,471 ly. Some could see final exports closer to 2,000. International Grain Council lowered World corn crop 2 mmt to 1,166. This due to lower EU crop. US Midwest 2 week weather should be mostly dry which should help harvest. NOAA 90 day weather calls for above normal temps in SW and far south. Rainfall could also be below normal on SW and far south. Talk of favorable 2023 South America weather could limit upside in futures. Slow US farmer selling is positive. River logistics problem is negative. USDA est US 2022 corn crop at 13,895 mil bu vs 15,074 ly. Feed/residual is est at 5.275 vs 5.715 ly. Ethanol use 5,275 vs 5,328 ly. Total demand 14,150 vs 14.956 ly. Some est US 2023 crop near 15,156, feed 5,650, ethanol 5,300 and exports 2,000. Carryout 1,918. Since early August CZ range has been 6.50-7.00. World 2022 crop is est 1,168 mmt 1,217 ly, exports 183 vs 203 and end stocks 301 mmt vs 307 ly.

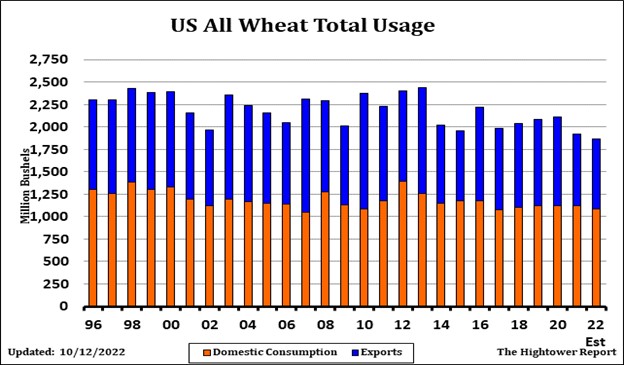

WHEAT

Wheat is wheat again ending higher along with most commodities. Since early Sep, WZ has been in a 8.00-9.00 range, KWZ 9.00-10.00 and MWZ 9.00-10.00. Final decision on Ukraine export corridor deal could rally wheat 1.00 or break wheat 1.00. KWZ support is 9.27. Resistance is 9.68. Weekly US export sales were only 6 mil bu. Total commit is 414 vs 453 ly. USDA goal is 775 vs 800 last year. 5 day US weather forecast has rain in US N plains and part of E KS, OK and E TX. USDA est US 2022 wheat crop at 1,650 mil bu vs 1,646 ly. Feed/residual is est at 50 vs 86 ly, food use 970 vs 972 ly. Exports 775 vs 800 ly. Total demand 1,863 vs 1,917 ly. Carryout at 576 vs 669 ly. Some est US 2023 crop near 1,907, total demand 1,924 and carryout 667.

See more market commentary here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.