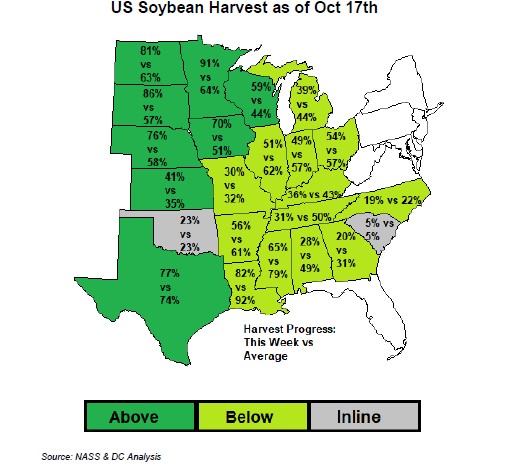

SOYBEANS

Soybean futures ended higher. SX ended near 12.29 and near the midpoint of a range between 12.00 and 12.50. Soyoil ended higher. Dalian soyoil and palmoil futures were higher. Soyoil also followed higher energy prices. Soymeal saw some short covering with Managed funds net short over 30,000 contracts. There were no new US soybean sales announced to China. Weekly US soybean exports reached level similar to last year. Still. Season to date exports are 50 percent of last year. USDA estimated that 60 pct of the US soybean crop was harvested. IL is 49, IA 70, AR 56, MN 91.US soybean board crush margins are highest in 3 years. Informa estimated US 2022 soybean acres at 87.3 mil vs 87.2 this past year. They estimated the crop near 4,455 mil bu vs 4,448 this past year. Some feel that might suggest prices could trend lower due to higher global 2022 supply and eventually limit new US 2022 acres. 25 pct of Brazil 2022 soybean crop is planted. This is ahead of last year.

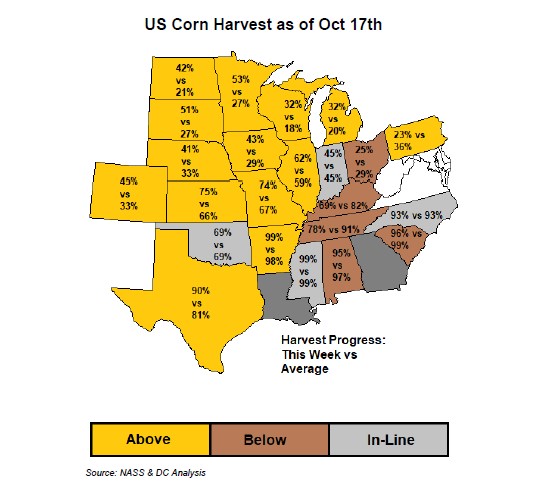

CORN

Corn futures ended lower. CZ ended near 5.30. Range was 5.29-5.37. CZ tested key resistance due to talk of higher ethanol margins, low US corn export prices and talk of lower US 2022 acres. USDA estimated that 52 pct of the US corn crop was harvested. IL 62, IA 43, MN 53, SD 51, OH 25. USDA rated the crop 60 pct G/E and unchanged from last week. OH 74, IN 69, IL 70, IA 63, MN 37, NE 69, SD 21 and ND 15. Most feel harvest yields support USDA October yield. Higher barge freight has weighed on domestic basis. Corn is still finding strong overhead resistance due to bearish USDA estimate of US 2021 supply and favorable start to Brazil 2022 crop. USDA est the Brazil corn crop at a record 118 mmt vs 86 last year. US corn export demand will also need to increase if prices are going to rally. Dalian corn futures made 2 month high. EU corn prices trended lower on better harvest weather. Informa estimated US 2022 corn acres at 92.3 mil vs 93.3 this past year. Some estimate lower corn acres due to high cost of planting especially fertilizer, energy and labor. Still they est US 2022 crop at 15,213mil bu with a record yield of 181.0. US 2022 sorghum acres were estimated at 6.8 mil vs 7.3 last year.

WHEAT

Wheat futures ended mixed. WZ ended unchanged and near 7.36. Range was 7.35-7.45. KWZ ended near 7.50. Range was 7.45-7.57. MWZ ended near 9.74. Range was 9.65 to 9.76. SRW export demand remains slow. KC futures may be gaining on Chicago due to long range US dry weather forecast and fact HRW 2022 prices are competitive to Black Sea prices. Record low World milling wheat stocks and fact Mid east and N Africa users are short helps MWZ. Russia wheat prices continue to trend higher on higher export tax. EU wheat prices need to rally to slow exports. Informa estimated US 2022 wheat acres near 48.8 mil vs 46.7 last year. Winter wheat acres are est near 34.1 vs 33.6 last year. US 2022 other spring acres were estimated at 12.7 vs 11.4 last year. This may be due to higher prices. Informa estimated US 2022 crop near 2,059 mil bu vs 1,646 last year. Informa estimated 2022 HRW crop at 783 mil bu vs 749 last year, SRW 345 vs 361 and HRS 550 vs 297. USDA est US 2022 winter wheat plantings near 70 pct. MO 35, KS 75, WA 93. USDA will issue first season crop ratings next week.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.