SOYBEANS

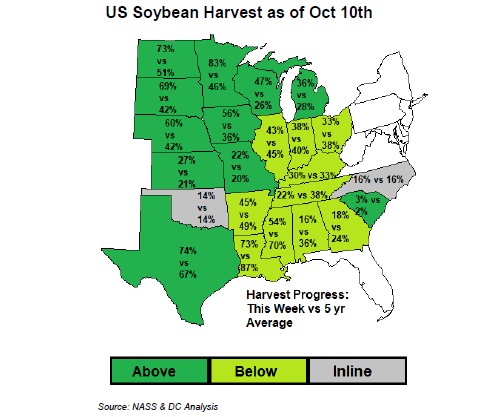

Soybeans traded lower but did manage to erase most of the losses into the close. SX finished near 11.95. Range was 11.84 to 12.11. Open interest has increased from 655,000 on Sep 13 to todays 759,100. Futures are oversold with new shorts added after the USDA Sep crop report. ISDA added to the bearish bias in their Oct report after increasing US 2021 crop and 2021/22 US and World end stocks. There is also talk that the final US 201 soybean crop could even be larger. USDA increased US soybean crop rating from 58 pct G/E to 59. 49 pct of the crop is harvested vs 40 last year. USDA did announce 330 mt US soybean were sold to China and 198 mt US soybean were sold to unknown. USDA est SU 2021/22 soybean exports near 2,090 mil bu vs 2,265 ly. USDA did raise US 2021/22 soybean crush 10 mil bu from 2.180 to 2,190 and vs 2.141 last year.. Increase was due to higher US domestic meal use and added to soyoil supply. Higher World rapeseed oil prices continues to support soyoil.

CORN

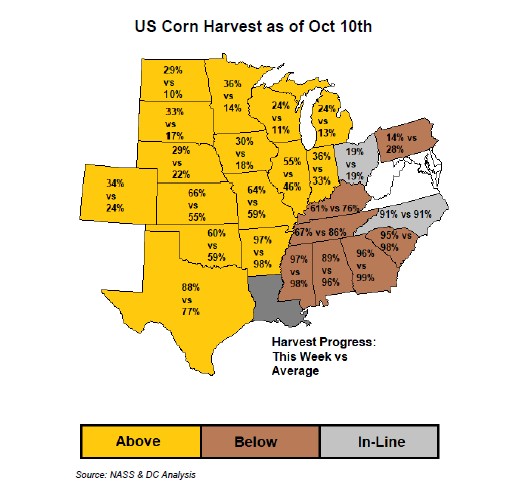

Corn futures closed lower. Managed funds increase selling below the 200 day moving average near 5.17. CZ ended near 5.12. Range was 5.02-5.25. Open interest has dropped from a high near 1,978,000 in Feb 2021 to near 1,400,000. Some of this is due to slowdown in US export traded and farmer selling. US Domestic cash basis is firming on a slowdown in farmer selling. Fact USDA estimated US 2021/22 corn carryout near 1,500 bu suggested to some that and harvest could limit new buying of futures. USDA estimates total US supply near 16,280 mil bu vs 16,055 last year. USDA did announce 161 mt US corn sold to unknown. Trade is still looking for additional corn sales to help support prices. USDA estimated US corn exports near 2,500 mil bu vs 2,753 last year. Some feel final exports could be closer to 2,700. USDA dropped US feed to 5,650 from 5,700. There are some that are concerned higher food and fuel inflated prices could reduce US disposable income and lower meat demand. USDA left US ethanol demand near 5.200 vs 5.032 last year. Margins are positive. Key will be EPA mandate and refiners waivers. Trend to green fuel vs fossil fuel should help ethanol demand. USDA est World corn trade near a record 202 mmt vs 178 last year. Still they raised end stocks from 297 mmt to 301 and vs 290 last year. USDA rated the US corn crop 60 pct G/E vs 59 last week. 41 pct of the crop is harvested vs 39 last year. Rains in the west could slow harvest. Drier weather in east could help harvest there.

WHEAT

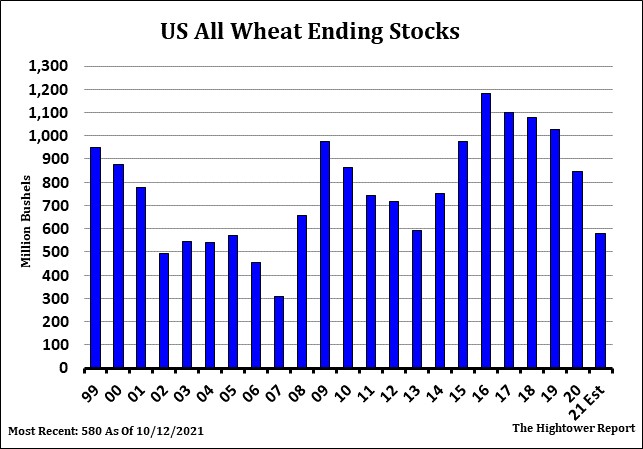

Wheat futures ended lower. WZ ended near 7.18. Range was7.12 to 7.37. KWZ ended near 7.21. Range was 7.16 to 7.42. MWZ ended near 9.48. Range was 9.35 to 9.59. Chicago wheat open interest has increased from a July low near 332,700 to 385,200. Managed funds continue to add to strength but also liquidate on weakness. Eu wheat futures traded lower on profit taking. USDA did lower the Canada crop and exports but raised EU, India and Australia to offset. Initial reaction to lower USDA US and World numbers was higher prices but todays commodity meltdown weighed on prices. IMF lowered World 2021 economic growth to 5.9 pct and estimated 2022 at 4.9 pct. Drop was due to supply chain disruptions and drop in global health. USDA estimated that 60 pct of US 2022 winter wheat crop was planted. US north plains are seeing good rains. US south plains 2022 forecast Is drier than normal. There is concern about quality of the 2021 EU wheat. Russia has also been trying to increase wheat exports before increase in export tax and Jan 1 export quotas. Some feel at current prices US 2022 HRW is competitive to buyers. USDA estimate of US carryout at 580 is the first time in 8 years that the carryout is below 600.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.