SOYBEANS

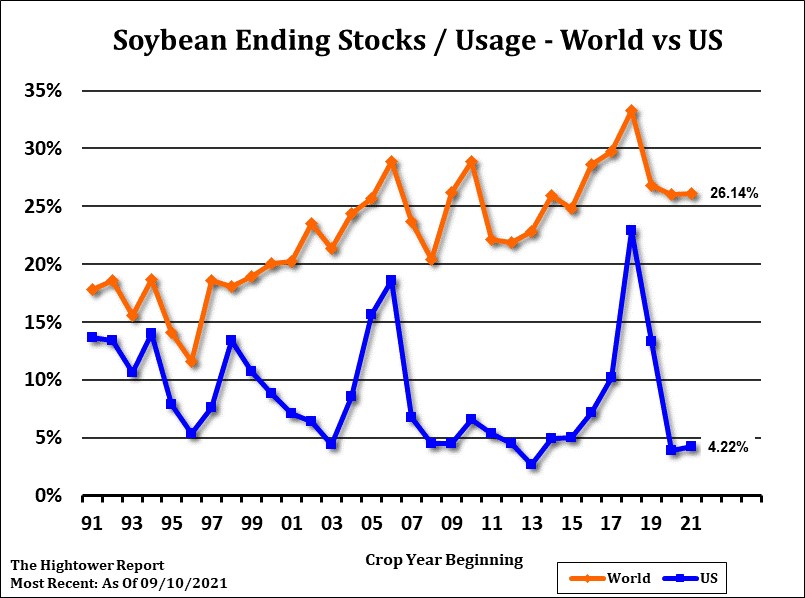

Soybean futures ended lower. SX made new lows for the move. Funds were net sellers of 8,000 contracts. Selling accelerated below 12.31 support. USDA was closed for holiday. Market hopes that there will be new US soybean sales to China soon. Most still feel China will take 30 mmt of US soybean vs 35 last year. Latest USDA export sales report showed China soybean commit near 12.4 mmt with 6.9 in unknown. US soybean harvest is expected to be near 48 pct done versus 39 average. Most look for USDA to increase US 2021/22 soybean carryout tomorrow. Most look for the US crop near 4,400 mil bu, crush near 2,200, exports 2,020 and end stocks near 300 vs USDA 185. Soybean will need to see increase China buying US soybean and lower 2022 South America crops for prices to turn higher. Despite higher energy prices, soyoil is see some long liquidation before USDA report. SMZ also made new lows and near 317.1. BOZ ended lower despite higher China soyoil prices and higher energy prices. Most see USDA increase US 2020/21 soyoil carryout to 2,183 mil lbs vs 1,858 in Sep and 2021/22 1,683 vs 1,478 in Sep.

CORN

Corn futures ended higher. There may have been some liquidation of long wheat short corn spreads going into tomorrows USDA report. US cash corn basis is firming where harvest has advanced the most. US farmer remains a reluctant seller of new corn. Most are in good financial situation and feel tight World supplies could increase prices later. USDA was closed due to holiday today. Trade is hoping US corn export s will increase post USDA report and post US harvest. US corn harvest is expected to be near 46 pct done versus 32 average. Most look for USDA to lower US 2021/22 corn carryout tomorrow. Still lack of new China buying US corn suggest to some that the domestic basis may need to trade higher to buy corn from farmers versus higher futures. Most look for the US crop near 15,000 mil bu, ethanol use near 5,300, feed and residual 5,700, exports near 2,600 and end stocks near 1,300 vs USDA 1,408. Managed funds were net buyers of 2,000 corn contracts. CZ tested initial support near 5.31. Resistance is near 5.40. Post USDA and harvest, trade expected futures to trade South America weather, China corn demand, other buyers demand for US corn and US Dollar and inflation changes impact on corn prices direction.. China has 11.9 mmt of US corn export commit with 2.1 mmt in unknown. Some feel China may be done buying US corn for now. Others feel China could increase US purchases due to higher China domestic corn prices lower hog producers margins. It is also rumored that China corn reserve stocks may be low. US domestic end users continue to be scale down buyers for 2022 and 2023 needs.

WHEAT

Wheat futures closed marginally lower. There may have been some liquidation of long wheat and short corn positions going into tomorrows USDA report. Trade expects USDA to lower US 2021 wheat crop and end stocks on tomorrows report. Still a few could see US final exports lower than USDA current estimates which could offset the lower crop. USDA should drop World wheat total supply. World wheat milling supplies are near record low. This should be supportive to higher wheat futures. Oat futures continue to trade to new highs. Averages trade guess US 2021/22 wheat carryout near 576 mil bu vs 615 in Sep. Range of guesses is 470-638. World wheat end stocks is estimated near 280.8 mmt vs 283.2 in Sep. Range is 278-284. Some could see USDA lower Canada crop from 23 mmt. Some could see final Russia crop below USDA 72.5 mmt. USDA est EU crop at 125 mmt. EU wheat prices traded lower overnight due to profit taking. Still talk of lower World wheat milling supplies should support prices.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.