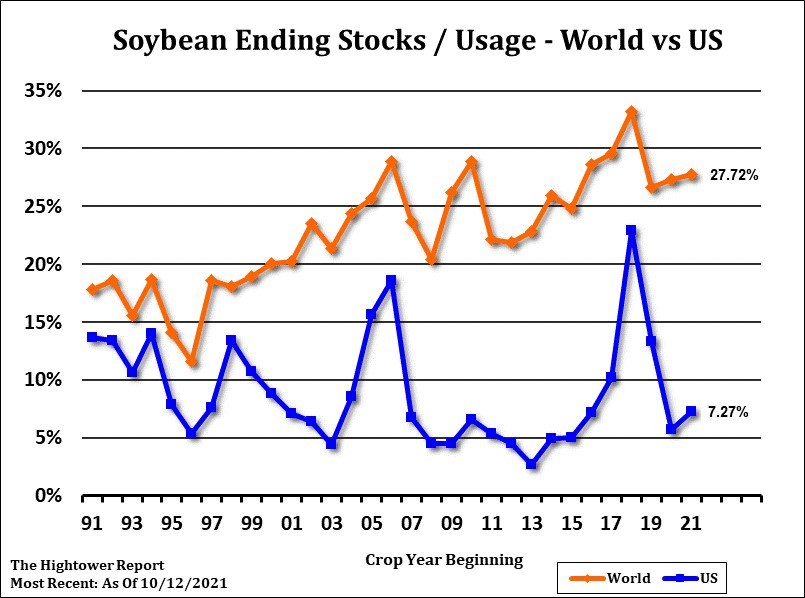

SOYBEANS

Soybeans and soyoil ended lower. Informa est US soybean yield unchanged at 51.5. Higher harvested acres would add only 6 mil bu to the crop. Still trade is concerned that USDA could drop export 50-70 mil bu. This could increase US 2021/22 soybean carryout closer to 400 mil bu. Weekly US soybean exports sales are estimated near 1,000-2,000 mt vs 1,183 last week. Commit is behind pace to reach USDA goal. Brazil soybean plantings are 52 pct, up 20 pct from last week and 42 pct last year. This could suggest Brazil could have soybeans for export as early as Jan. SF is near 12.43. This is near key support. USDA Nov crop report is Nov 9. Average trade guess for US 2021 soybean crop is 4,484 mil bu vs 4,448 in Oct. Range is 4,442 to 4,536. Trade est US 2021/22 soybean carryout at 362 vs USDA Oct 320. Range 310-449. Trade est World Soybean end stocks at 105.4 mmt vs 104.5 in Oct. Matif, Canada and Dalian canola futures continue to make new highs.

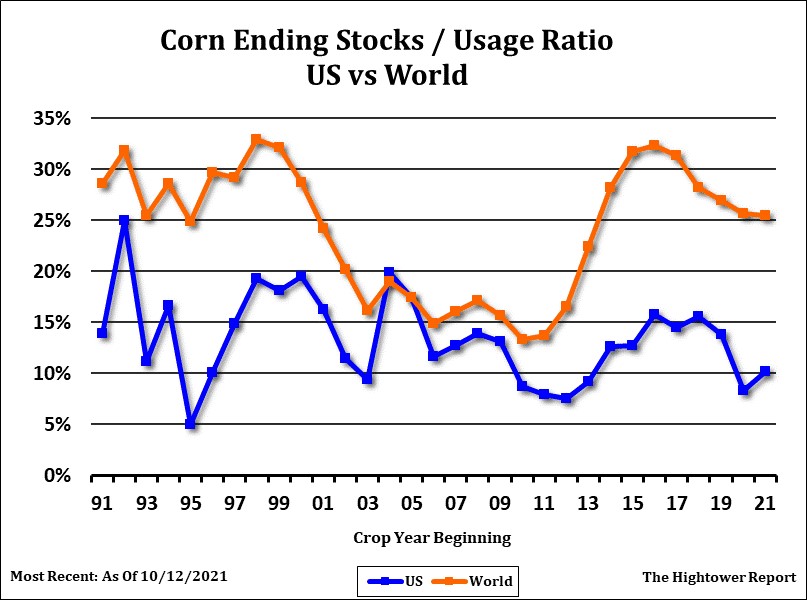

CORN

Corn futures ended lower. Informa est US corn yield near 178.7 which adds 185 mil bu to crop and carryout if USDA does not raise demand. Some feel final demand could be up 200-300 mil bu. Informa also raised World 2021/22 corn crop 9 mmt, 4.7 US, 3 Ukraine and 1.5 Argentina. Weekly US ethanol production was up 1 pct from last week and up 15 pct from last year. Stocks were up 1pct from last week and up 2 pct from last year. Margins remain positive. Cash basis to processors remain firm. Trade estimates that weekly US corn export sales will be near 700-1,400 mt vs 890 last week. Total commit remains below pace to reach USDA goal. CZ is near 5.64. Key support is near 5.43. Informa est US 2021 corn crop up 185 mil bu from USDA Oct guess. If USDA does not raise demand, the 185 added crop could be added to USDA 1,500 mil bu carryout. Trade est US 2021 corn crop 31 mil bu higher than USDA Oct. Trade estimates US 2021/22 corn carryout near 1,480 vs USDA 1,500. Range is 1,355 to 1,576. Trade estimates World corn end stocks near 301 mmt vs 302 in October. Range was 294-304. US 7 day Midwest weather is dry which should advance harvest. Day 8-10 brings rains back to the east Midwest.

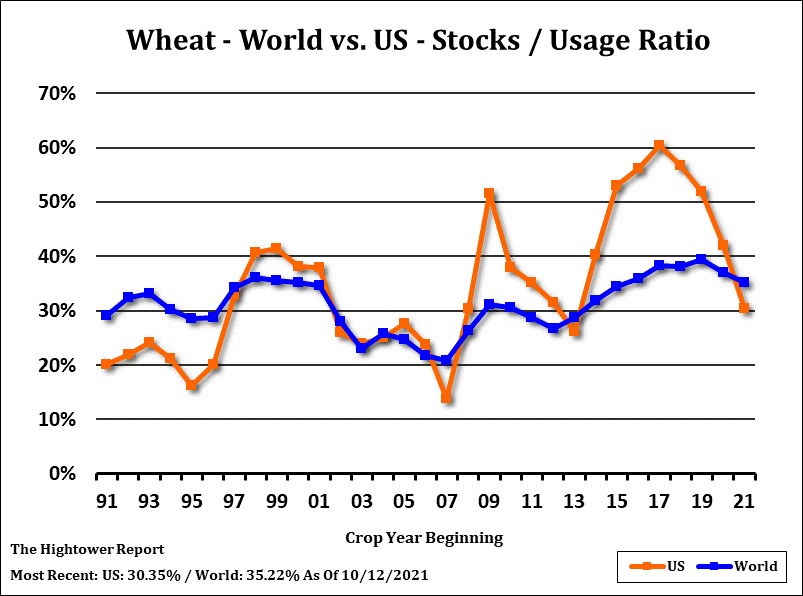

WHEAT

Wheat futures ended lower. Talk of lower US domestic spring wheat basis and fact US wheat export prices are a premium to Black Sea triggered some long liquidation. There was also talk that funds may be done buying wheat futures. Their buying from 7.20 WZ was linked in part to higher Russia and EU prices and concern about inflation. US farmers were encouraged to increase 2021, 2022 and 2023 cash sales at current prices. Weekly US wheat export sales are est near 180-500 mt vs 269 last week. Commit is running behind USDA goal. WZ is near 7.81, KWZ is near 7.90, MWZ is near 10.44. OZ is down to 7.54. Trade est US 2021/22 wheat carryout near 581 mil bu vs USDA 580. Range is 565-607. Trade also estimates World wheat end stocks near 276.5 mmt vs USDA 277.2. Range is 274-282. Informa est Canada 2022 wheat crop near 31 mmt vs 21 this year, US 56 vs 44, EU 139 vs 136 and FSU 138 vs 134. Key will be North Hemisphere 2022 weather. Most World wheat buyers remain short which could offer support on price breaks.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.