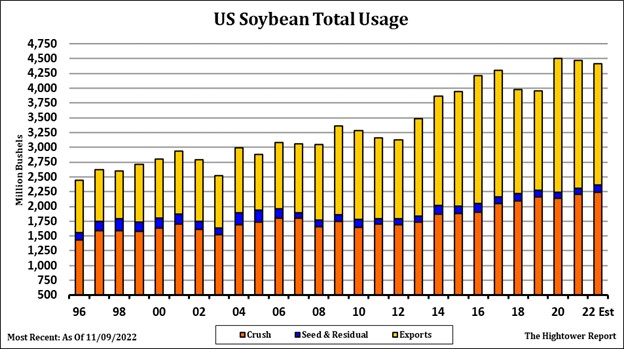

SOYBEANS

Soybeans, soymeal ended higher. Soyoil ended lower. As expected, US Fed Chairman comments today was more dovish. This rallied US stocks quickly and offered support to most commodities. SF traded over 14.75 and SMF over 417. Some of the buying was linked to hope that China may eliminate some of its strict Covid lockdown policy. There was also talk that US Congress could pass legislation to avoid a US RR strike. Trade is also waiting for EPA to propose the amount of renewable fuels that oil refiners must blend their 2023 fuel mix. Argentina weather remains dry. Most of Brazil weather is favorable. Argentina farmer is a slow seller of cash despite the new soya peso deal. US domestic soymeal basis is weakening as US soybean crush increases. Farmer consultant suggested US farmers increase 2022 crop cash sales and 2023. Normal World 2023 weather could increase US 2023/24 soybean carryout to closer to 400 mil bu which could be negative futures. Trade estimates US weekly soybean export sakes near 550-1,000 mt vs 690 last week.

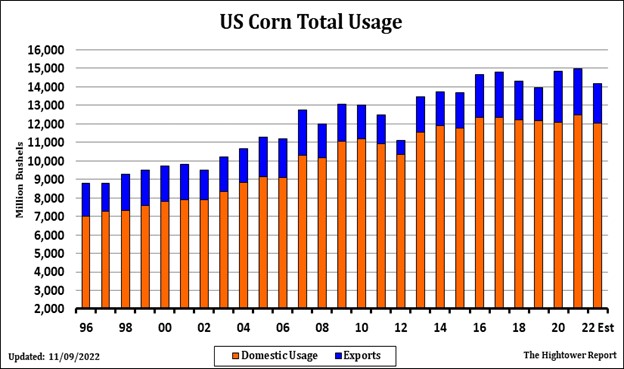

CORN

Corn futures ended higher. CH ended near the upper end of the recent trading range. Open interest continues to slide lower. This may be due to lack of farmer selling and reduced managed fund longs due to lower demand for US export. Talk of increase US south plains wheat feeding could also lower corn demand. Weekly US ethanol production was down from last week and last year. Stocks were up from last week and last year. Drop is domestic driving could be slowing ethanol production. This could drop final corn use for ethanol 50 mil bu. There was also talk that US Congress could pass legislation to avoid a US RR strike. Trade is also waiting for EPA to propose the amount of renewable fuels that oil refiners must blend their 2023 fuel mix. Argentina weather remains dry. Most of Brazil weather is favorable. Argentina farmer is a slow seller of cash. Farmer consultant suggested US farmers increase 2022 crop cash sales and 2023. Normal World 2023 weather could increase US 2023/24 corn carryout to closer to 2,000 mil bu which could be negative futures. Trade estimates US weekly corn export sales near 475-1,000 mt vs 1,850 last week.

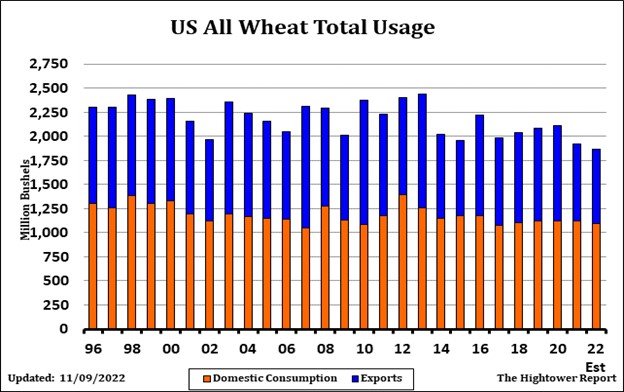

WHEAT

Wheat futures are trying find support on talk of additional winter wheat feeding in the West, oversold tech picture and record Managed fund net Chicago wheat short. What happens with RR and Congress will be key. Sentiment today is Congress will intervene. HRW basis continues slippage to end the month with millers having good stocks, RR strike unknown and talk that EU wheat is being imported to US East Coast. SRW basis firmer given lack of farmer selling and tight stocks. NSW basis remains firm with RRs 30-45 days behind on applications. Argentina and US south plains remain dry. Russia wheat export prices still lowest to World buyers. Trade estimates US weekly wheat export sakes near 300-625 mt vs 511 last week.

See more market commentary here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.