SOYBEANS

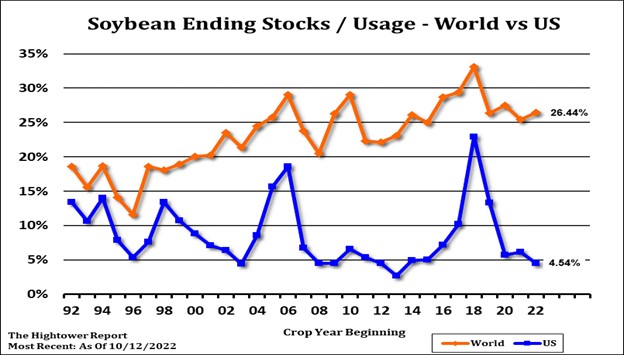

Soybean ended higher with SF testing 14.47. Bears are searching for reasons for higher prices. US soybean crush margins remain positive. Argentina is dry. Brazil truckers are blocking roads to key port in protesting recent Presidential election results. Soybeans futures are higher but product futures are mixed to lower. Talk that China may drop their restricted lockdown Covid policy is helping soybeans. Good weekly export inspections are also supportive but some feel future export shipments may begin to slow. Brazil weather looks favorable but trucks blocking key roads to ports in protest of election results could help US soybean export demand. USDA est US soybean harvest at 88 pct. Crop harvest is late in KY, MO, MI, NC and TN. Trade trying to figure out final US soybean export demand, impact higher interest rates will have on domestic demand and direction of US 2022/23 and 2023/24 soybean carryout. Higher carryouts could weigh on 2023 soybean futures but tight supplies could tighten spreads.

CORN

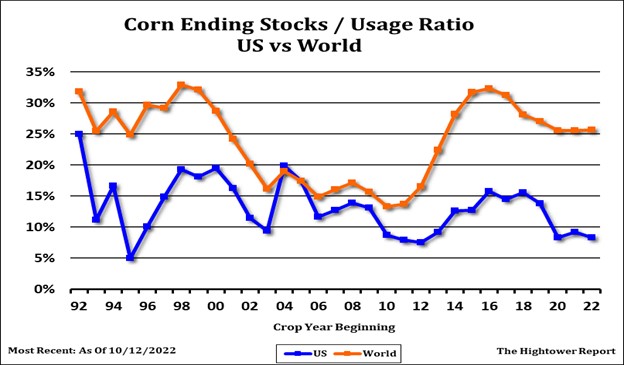

Corn futures may be following energies. Dec corn futures remain in a trading range supported by strong feeder and ethanol basis but almost equal resistance from low US Miss river water levels and weak basis. USDA est US corn harvest at 76 pct. Crop harvest is late in CO, IN, IA, MI, OH and WI. Trade trying to figure out final US corn export demand, impact higher interest rates will have on domestic demand and direction of US 2022/23 and 2023/24 corn carryout. Higher carryouts could weigh on corn futures but tight supplies could tighten spreads. Matif corn was dragged higher by wheat, but on thin volume. Three more vessels left Ukraine this morning but there are no reports of any inbound ships, and there is no cash market in the Black Sea. It is unlikely there will be anything definite new regarding the Ukraine corridor until the G-20 summit at the earliest, and as the biggest receiver of Ukraine corn, the EU will have noted that even with the corridor in operation, Ukraine only managed to ship 2 mmt of corn per month. So with a 22/23 import requirement of around 24 mmt, the EU will be hoping that the growing disruption and highway blockages in Brazil caused by Bolsanaro supporting truckers, will not last too long, as port arrivals are starting to be impacted (Paranagua is completely blocked which has pushed CBOT beans up 30¢). Some look for Ukraine harvest to be slowed due to high drying cost. Same group could see 2023 Ukraine acres down due to lack of seed, fertilizer and low grain prices.

WHEAT

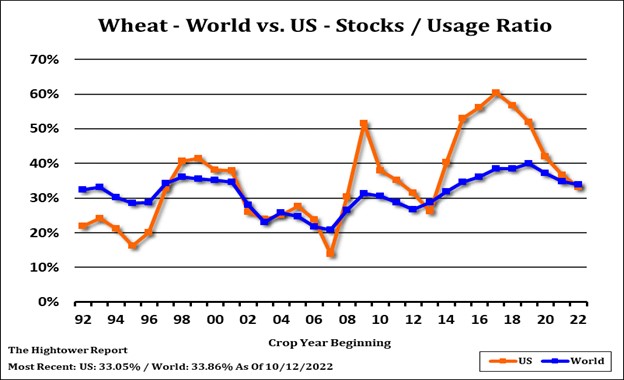

Wheat futures are mixed. Following drone strike on Russia ships in Crimea, Russia increase bombing key Ukraine infrastructure. Russia also announced an end to Ukraine export corridor. Russia then said that the deal was only suspended. According to Ukraine there are 218 vessels blocked, 22 loaded and wanting to leave, 95 left loaded waiting for inspections and 101 waiting for inspection to enter Ukraine ports for loading. USDA rated the 2023 US winter wheat crop 28 pct G/E and lowest ever for this week. TX is 5, OK 11 and KS 24. Argentina wheat crop is getting smaller due to dry weather. US south plains remains mostly dry. Matif rallied sharply in the last hour of trade. Early trade was flat as Ukraine would continue to ship grain from Black Sea ports. Putin’s statement that he would only consider a resumption of the grain deal after a full investigation into the Sevastopol attacks sent Matif higher. Rumors continued to circulate that GASC was in more direct discussions to buy wheat. Egypt’s trade ministry appeared to say that Egypt would import only another 1 mmt prior to the local harvest in April 2023.Argentina is reportedly ready to allow export license delays but with no details.

See more market commentary here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.