CORN

Prices were $.01 – $.02 lower today with spreads widening. July-24 is back below its 100-day MA however held support at this week’s low at $4.54 ¼. Next support is the 50-day MA at $4.47 ¼. Dec-24 held support just above this week’s low and 100 day MA at $4.77. Overnight rains in Iowa spread across N IL and IN earlier today while heavy rains and some damaging storms occurred across the South. Best planting progress this week has been in the WCB. Old crop exports at 35 mil. bu. were in line with expectations. YTD commitments at 1.875 bil. bu. are up 24% from YA, vs. the USDA est. of up 26%. Once again Mexico was the largest buyer with 7.5 mil. bu. In addition, the USDA announced the sale of 132k (5.2 mil.) to Mexico split up between old and new crop. The Rosario Grain Exchange lowered their Argentine production forecast 2.5 mmt to 47.5 mmt, well below the USDA est. in April of 55 mmt, however in line with the BAGE at 46.5 mmt. US corn acres in drought dropped 5% last week to only 14%, down from 29% YA and well below the peak of 70% last June. At this point the market is less concerned about planting progress falling behind normal and more impressed with building subsoil moisture ahead of the US growing season.

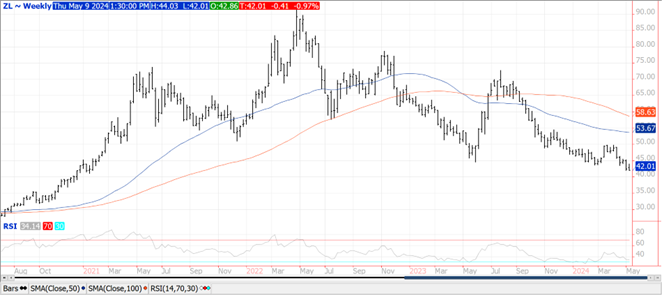

SOYBEANS

Prices were lower across the board with beans down $.13 – $.20, meal was $3 – $6 lower, while oil plunged over a $.01. July beans slipped back below its 100 day MA and established a new low for the week. Nov-24 beans hovered near $12 into the close. July-24 meal held above this week’s low at $367.70. July-24 oil plunged to its lowest level in over 3 years despite exports at the high end of expectations. The recent collapse in prices has made US bean oil more competitive in the global vegetable oil trade and as a feedstocks in the production of biofuels. Rains return to RGDS in Southern Brazil thru early next week causing renewed flooding concerns. Bean exports at 16 mil. bu. were in line with expectations. YTD commitments at 1.556 bil. are down 16.5% from YA, vs. the USDA forecast of down 15%. Meal sales at 209k tons were in line with expectations. Spot board crush margins jumped $.10 today to $.96 ½ with meal PV increasing to 63.6%. Despite flooding rain, harvest in RGDS is estimated to have advanced 2% in the past week to 78%. China imported 8.6 mmt of soybeans in April, up 18% from YA, however YTD imports at 27.1 mmt are still down 3% YOY. The RGE held their Argentine production forecast steady at 50 mmt. The market seems to be shrugging off news that a strike in Argentina has halted grain and oilseed crushing plants and ports. No results yet from Egypt’s GASC’s vegetable oil tender. US soybean area in drought fell 6% to 11%, well off the 52 week high of 63% last June-23.

WHEAT

All classes managed to hold on to gains into the close, however all three settled $.10+ off the highs from earlier. Export sales at 16.5 mil. bu. (15 mil. 24/25 MY) were in line with expectations. As the old crop 23/24 MY winds down YTD commitments at 692 mil. are down less than 1% from YA vs. the USDA forecast of down 6.5%. US winter wheat area in drought was unchanged at 28%. Spring wheat area in drought plunged 12% to only 15%, the lowest since last June. Results from Egypt’s GASC recent wheat tender were announced after yesterday’s close. Of the 420k mt of wheat purchased, 320k was from Russia at $255/mt FOB and 60k from Romania at $259.90/mt FOB. On a CIF basis final cost ranged from $278.40 – $279.60/mt. Russian media is reporting their Ag. Ministry fears crops have been severely impacted from recent frosts. While no specific production forecasts have been issued, talk seems to center on 85 – 87 mmt, vs. the April USDA forecast of 91.5 mmt.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.