CORN

Prices were $.07 – $.09 lower closing near session lows. July-24 was back testing its 100 day MA support at $4.58 ½. Upside target of $5.03 represents a 38% retracement from June-23 high to Feb-24 low. Dec-24 challenged support at $4.81 which was previous resistance at the March high. The best planting progress this week has been in the WCB. Once this last rain event clears a dryer pattern is expected to set up late this week thru the middle of next week allowing planting operations to accelerate. Ethanol production was disappointing falling to 965 tbd last week, below expectations. Daily corn usage at 13.8 mil. bu. was below the 14.75 needed to reach the USDA forecast of 5.40 bil. bu. With the lower than expected production however stocks fell more than expected to 24.2 mb, the lowest since the end of 2023. Implied gasoline demand rose 2% last week to 8.797 tbd, however was still down 5.4% from YA. Export sales tomorrow are expected to range between 25 – 50 mil. bu. With new crop carryout forecasts ranging from 2.0 – 2.5 bil. bu. it’ll be hard to rally prices much further without a more significant weather issue in the US or sharply lower production forecasts in SA. New crop exports will largely be driven by SA production.

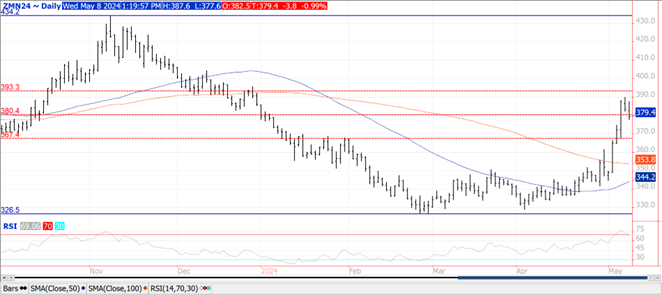

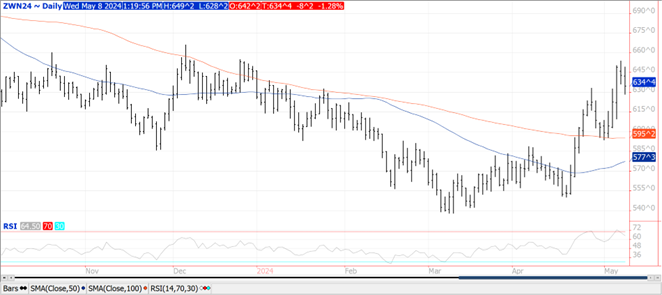

SOYBEANS

Prices were lower across the board today with several contracts closing near session lows. Beans were down $.16 – $.20, meal was $3 – $4 lower, while oil fell 70 – 80 points. July beans violated near term support at $12.40, next support is the 100 day MA at $12.18 ¾. Inside trade today for Nov-24 beans. July-24 meal seems to be consolidating at midday near $380, the 50% retracement between the Nov-23 high and Feb-24 low. Resistance for July-24 oil comes in at last week’s high just below $.46. After a few days of drying, heavy rains are expected once again for RGDS in Southern Brazil starting Thurs. thru Monday. Another 2-6” are expected causing renewed flooding concerns before a dryer pattern sets in next week. The death toll from earlier flooding has now topped 100 while access to ports in Rio Grande is being compromised due to road and railway closures. Late maturing crops in Central Argentina may be vulnerable for a damaging frost early next week. Brazil expects to export 13.2 mmt of soybean in May, down 8.5% from May-23. Meal exports are expected to reach 2.34 mmt, up slightly from 2.28 mmt from YA. US export sales tomorrow are expected to range from 10 – 26 mil. bu. for beans, 100 – 350k tons of meal and 0 – 12k tons of oil. New crop carryout estimates range from 315 – 550 mil. vs. the current 23/24 forecast of 340 mil.

WHEAT

Prices were lower across all 3 classes with KC and MGEX down $.12 – $.16 while Chicago was off $.08 – $.09. Chicago July-24 rejected its first move back above $6.50 yesterday, however held support above $6.25 today. July-24 MGEX held support above $7. Russia was the lowest offer at $255/mt FOB, for Egypt’s recent wheat tender for June shipment. Final sale results expected later today. Russia lowered their wheat export tax 3% to 3,171 roubles/mt for the period ending May 21st. A crop tour in OK projects winter wheat production just over 89 mil. bu. with an average yield of 33.7 bpa, above the 28 bpa yield obtained the last 2 years. SovEcon reports Russian wheat stocks at the end of April at 27.5 mmt, exceeding the historical average by 65%. Export sales tomorrow are expected to range from 6 – 24 mil. bu.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.