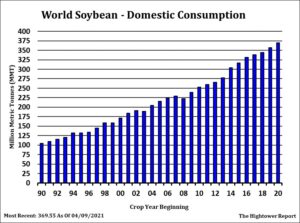

SOYBEANS

Soybeans traded higher. SN is near 15.69. SX is near 14.09. Talk of higher demand for US soybean crush and higher World vegoil prices helped push prices higher. New money continues to pour into the market on concern about US summer weather. USDA May supply and demand report is approaching. Trade looks for US 2020/21 soybean carryout to be near 118 mil bu vs USDA 120. Trade also est Argentina Soybean crop near 46.9 mmt vs USDA 47.5 and Brazil 136 vs USDA 136. Trade estimates US 2021 soybean crop near 4,431 mil bu vs 4.135 last year. This could be below forecasted demand especially if US crush increase due to increase soyoil demand. China came back from holiday and oilseed futures were sharply higher. Dalian soybeans were up 90 cents and near 25.45. Soyoil futures made new highs. EU rapeoil futures are trading near 75 cents versus 65 last week. Weekly US old crop soybean sales were near 165 mt vs 292 last week. Total commit is near 61.2 mmt vs 39.5 last year. USDA goal is 62.0 mmt vs 45.7 ly. China shipments are near 35.0 mmt with total commit at 35.7 mmt.

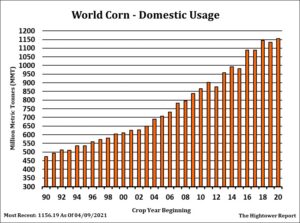

CORN

Corn traded higher. Continued concern about dry Brazil weather lowering their crop and increasing demand for US corn exports offered support. New money Is pouring into the market on concern about US summer weather. So far, the start of the US 2021 corn crop is favorable. USDA May supply and demand report is approaching. Trade looks for US 2020/21 corn carryout to be near 1,275 mil bu vs USDA 1, 352. Trade also est Argentina corn crop near 47 mmt vs USDA 47 and Brazil 103 vs USDA 109. One private group est the crop closer to 95 mmt. There were reports today that the crop could drop to only 85 mmt if May is dry. Trade estimates US 2021 corn crop near 15,029 mil bu vs 14,182 last year. China came back from Holiday and grains were sharply higher. Dalian corn was up 10 cents and near 10.85. There were reports from China that corn stocks may be lower than trade is trading. Black Sea corn is trading near $293 fob and up $30 in 2 weeks. Weekly US old crop corn sales were near 137 mt vs 521 last week. Total commit is near 67.8 mmt vs 37.4 last year. USDA goal is 67.9 mmt vs 45.1 ly. China shipments are near 11.3 mmt with total commit at 23.2 mmt. There is 2.3 mmt in unknown. This week, trade heard that China will export open sales.

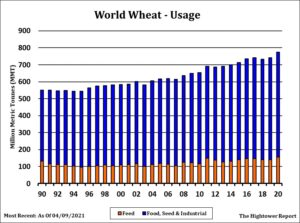

WHEAT

Wheat futures rallied and closed near session highs. Overnight trade was lower on what some termed profit taking. Weekly US export sales were negative and US export prices are still a premium to EU and Russia. Sharp gains in corn helped wheat rally into the close. Wheat cannot afford to be cheaper that corn or World feed demand will increase over supply. USDA May supply and demand report is approaching. Trade looks for US 2020/21 wheat carryout to be near 850 mil bu vs USDA 852. Trade estimates US 2021 wheat crop near 1,877 mil bu vs 1,826 last year. Winter crop 1m259 vs 1,171, HRW 711 vs 659, SRW 309 vs 266 and white winter 238 vs 246 ly. Spring forecast still suggest dry PNW and NA HRS areas. Drier west HRW and normal rains for SRW. EU weather is improving with new rains. Russia and parts of east EU are too wet. Weekly US old crop wheat sales were a negative 95 mt vs 223 last week. Total commit is near 25.5 mmt vs 26.1 last year. Baltic wheat is $7-10 below Russia, $35 below corn and $50 below US HRW.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.