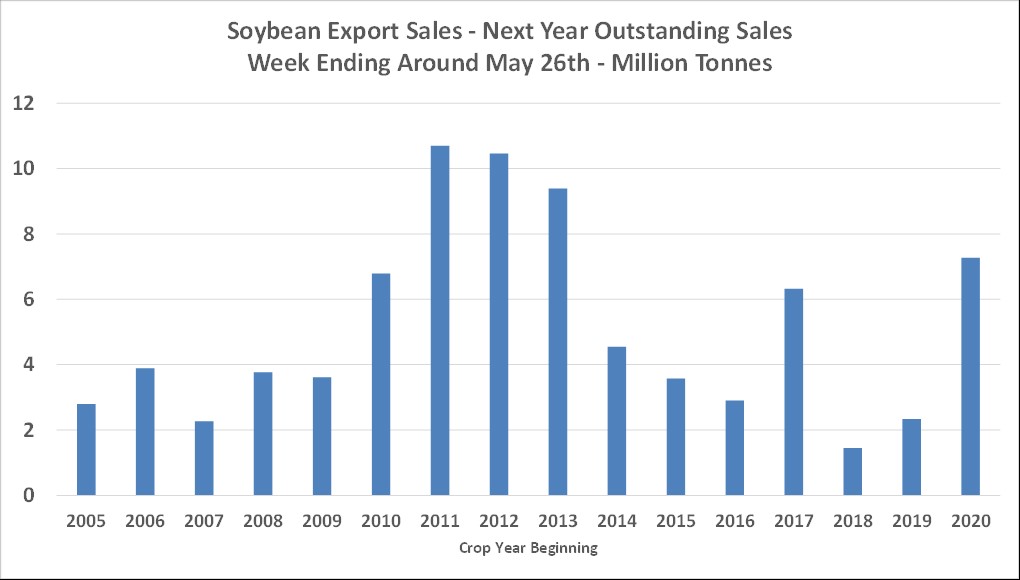

SOYBEANS

Soybeans ended lower. Trade gave back some of Thursdays gains. Soymeal gained on soyoil. Trade will soon be gearing up for US summer weather trade. Over the last 2 days, midday long range US Midwest weather maps showed a strong ridge over the US plains and Midwest. Overnight maps though do not show the ridge. Next Monday, NOAA will update the Pacific sea surface temps. They have been cooling which could suggest US plains ridging this summer. Colder trend could increase chances for the ridge eventually this summer. Next 2 weeks PDO reading could be key to US summer weather and price actions. North plains ridge could stress crops there. 15 pct of US soybean acres are in the Dakotas. Trade will also be watching for new China buying US.

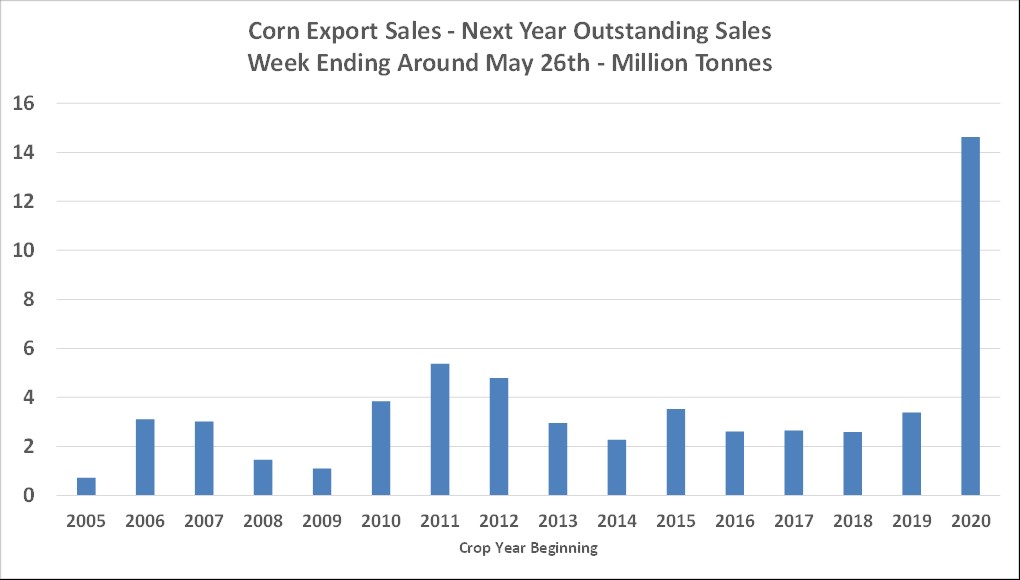

CORN

Corn futures traded lower. Trade gave back some of Thursdays gains. Trade will soon be gearing up for US summer weather trade. Long term key to prices will be weather and China buying US Ag goods. Of late, China has been trying to talk down commodity prices. They have slowed buying US new crop corn. This week US and China had first trade talks. China requested rollback if Trump tariffs and lifting US sanctions on China companies. Still most feel they could buy 30-32 mmt US corn vs 23 this year. Since May 12, CN has dropped from 7.35 to 6.02. Much of the drop was due to better US weather and slowdown in China buying US Ag goods. Grains reached key technical support but open interest has dropped. Increase in volatility and price ranges has limited new trading. Over the last 14 trading days, CN trading range has averaged 24 cents and some feel a weather market and that daily range could increase. Over the last 2 days, midday long range US Midwest weather maps showed a strong ridge over the US plains and Midwest. Overnight maps though do not show the ridge. Next 2 weeks PDO reading could be key to US summer weather and price actions. North plains ridge could stress crops there. 10 pct of US corn acres are in the Dakotas.

WHEAT

Wheat trade was mixed. Chicago and KC wheat again followed lower trade in corn. Dry US NA HRS weather forecast offered support to MWN over 7.00. Since early May, WN dropped from 7.67 to 6.39. KWN dropped from 7.41 to 5.88 on improved US HRW weather and larger than expected est of 2021 KS wheat crop. MWN dropped from 8.07 to 6.68 on talk of better NA HRS weather. Since the low, MWN has bounced back to a close today near 7.27 on a drier forecast. Drop in US HRW futures has made US export prices more competitive to EU prices. Russia export prices are lower but new export taxes June 2 adds to their export price confusion. New crop EU wheat prices are lower than US. Large Global wheat supplies offers resistance to wheat futures. Uncertain US, Canada and Russia spring wheat weather/ crop outlook offers support. Wheat futures is also expected to follow corn price direction.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.