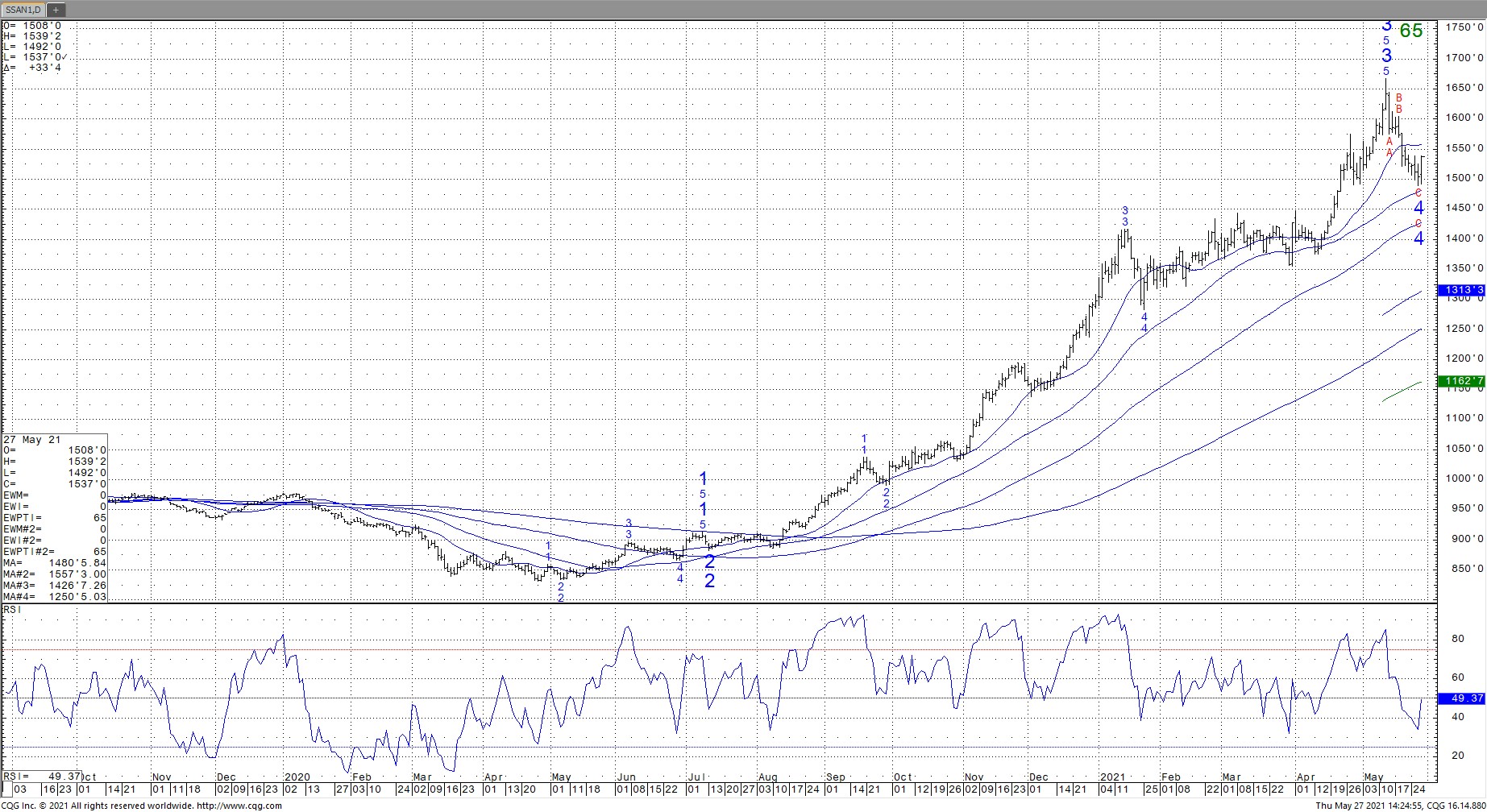

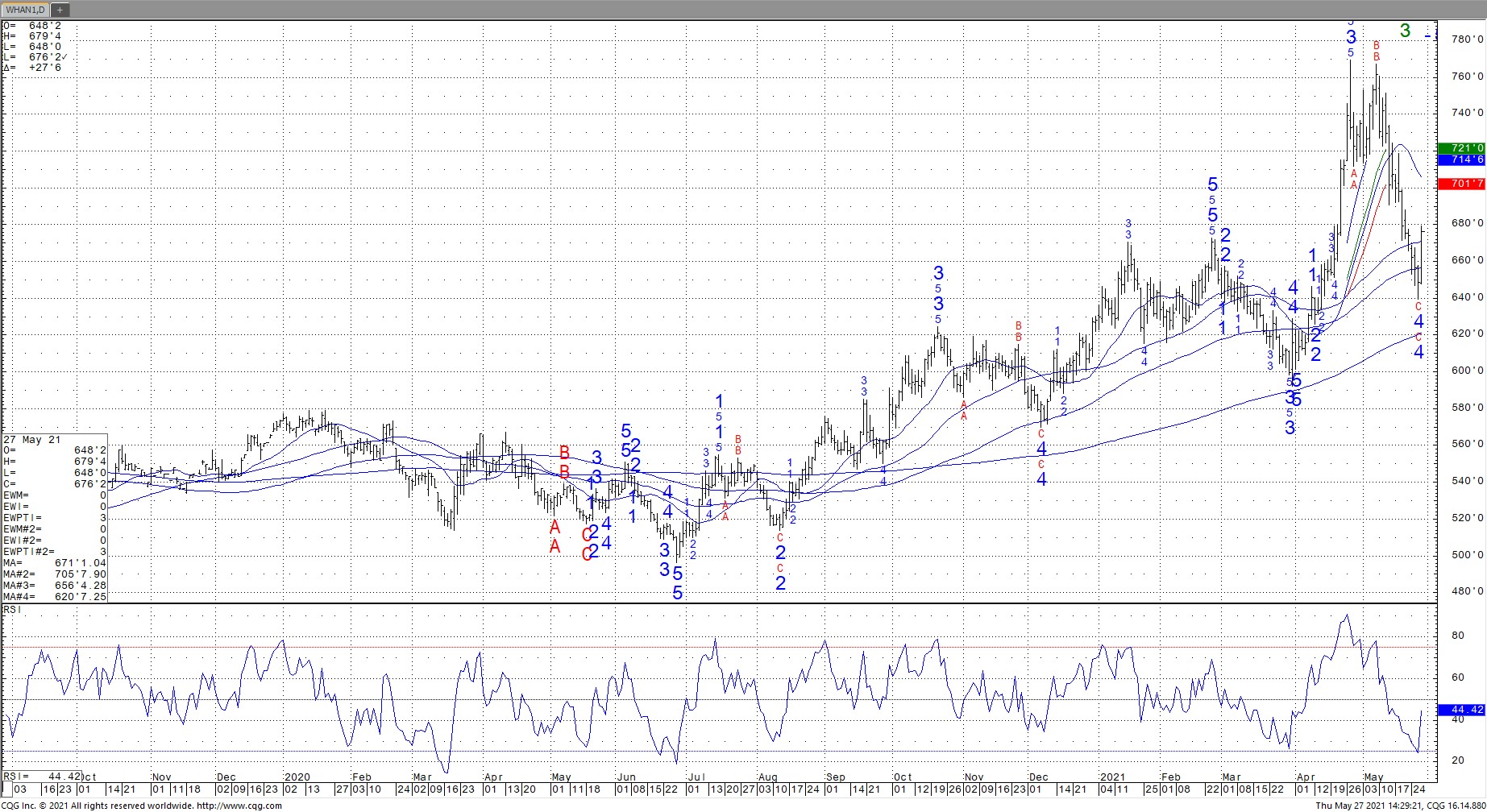

SOYBEANS

Soybeans traded sharply higher. Overnight prices were lower on concern over slow US soybean exports pace and declining US crush margins. Dalian soybean, soymeal, soyoil and palmoil prices were all lower. There was talk that China will soon start buying new crop US soybeans. This and fact the market may have reached downside technical objective and was becoming oversold may have triggered new consumer buying. There was also a large CN buy order just before soybeans started to rally. Key to price actions remains China interest in new crop US soybeans and summer weather. US old crop soybean export commit is near 2,260 mil bu vs 1,541 last year. USDA goal is 2,280 vs 1,682 last year. China old crop shipments are near 1,284 mil bu with total commit near 1,310. US new crop commit is near 267 mil bu. China is 113. Some feel China could take 1,500 mil nu of US new crop soybeans. China soybean crush margins remain negative but Brazil May soybean exports were a record 100 mil bu. Seasonally, World trade slowly shifts from Brazil to US. USDA est total US 2021/22 soybean demand near 4,420 mil bu vs 4,575 this year. 87.6 million planted acres and a yield near 50.8 will be needed to satisfy demand.

CORN

Corn futures rallied sharply with CN up the daily 40 cent limit. Overnight prices were higher on talk the market had become oversold and that end users may have been net buyers on Wednesday break especially CZ. US farmer has also been a reluctant seller on the break in futures. US domestic cash corn basis remain firm on increase ethanol and feed demand. Old crop corn export commit is near 2,700 mil bu vs 1,568 last year. USDA goal is 2,775 vs 1,778 last year. China shipments are near 535 mil bu with total commit near 905. Most feel China will talk the old crop open unshipped sales. Weekly new crop corn sales were 224 mil bu. Total commit is near a record 575 mil bu. China commit is near 421 mil bu. Some feel China could take 1,250 mil bu of US new crop corn. USDA est total US 2021/22 corn demand near 14,765 mil bu vs 14,870 this year. Some feel USDA could be 300-400 mil bu to low in their demand est. 93.0 million planted acres and a yield near 179.5 will be needed to satisfy demand. This suggest US summer weather will be key to prices. USDA will issue its first estimate of the US 2021 corn crop rating next week. Some feel the rating could be over 70 pct G/E. 11 of 15 years, that the first rating of the crop was over 70 pct the final yield was at or above USDA May est. Extreme summer weather dropped the other years below the USDA May yield.

WHEAT

Wheat futures rallied sharply higher. Some feel that technically, wheat futures had become oversold. Managed funds have turned net short Chicago wheat futures. Wheat followed corn sharply higher trade. There remains concern that US north plains, PNW and Canada prairie weather will turn dry. This could lower NA HRS supply and White wheat supply. This could support higher wheat prices. EU old crop wheat prices are firm on tight supply. New crop prices have trended lower on improved weather. US old crop wheat export commit is near 943 mil bu vs 984 last year. USDA goal is 965 including flour vs 965 last year. East Europe and new crop Black Sea export prices are a discount to US HRW. USDA est US 2021 all wheat crop near 1,872. Most are near 1913. USDA est 2021/22 carryout near 774. Some are near 731. Some est the HRW crop near 731 vs 659 ly. Carryout 232 vs 342. SRW crop at 332 vs 266 ly. Carryout 170 vs 115. HRS crop at 510 vs 530 ly. Carryout 250 vs 270.

charts by CQG

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.