SOYBEANS

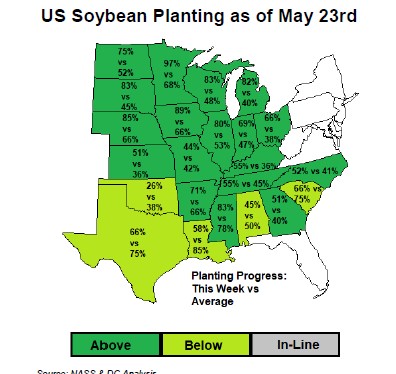

Soybeans traded lower on talk of favorable US weather and a slowdown in China buying World soybeans. China crush margins continue to be negative. There was talk that last week, China bought 7-17 soybean cargoes from Brazil vs 40 needed to buy every week to reach the 100 mmt import estimate. Slow China buying continues to weigh on Brazil soybean export prices. Concern increased on Argentina export logistics, ongoing dock strikes and talk of a nationwide lockdown due to Covid. Asian vegoil prices tuned higher on talk of higher demand versus lower EU and Canada canola prices. Asian soymeal prices continue to trend lower. China continues to talk about lower pct of soymeal in hog rations. USDA est US soybean plantings at 75 pct vs 54 average. Some are concerned about US summer weather in the Dakotas where 12.7 million US soybean acres are planted.

CORN

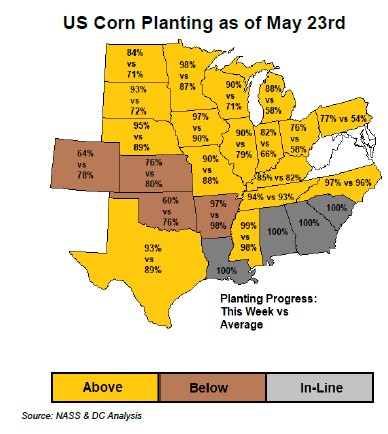

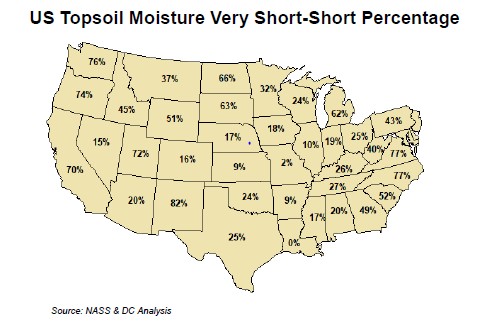

Corn futures traded sharply lower. Overnight trade was lower on favorable US Midwest weather and lack of new US new crop sales announced for China. US cash markets remain firm due to increase ethanol demand, feed demand and corn needed to fill open and unshipped corn sales. There were unfounded rumors that China was rolling forward US old crop unshipped open sales. Most still feel China will take the open sales if we have the corn to ship. Most feel that to date China has bought 15 mmt new crop corn from US and Ukraine. China has also been granted 7 mmt of new corn import licenses. This could bring their buying total to near 22-23 mmt. Some feel they will take atleast 30-35 mmt 2021/22 imports all origins. Some could see total as high as 50 mmt. USDA estimated that 90 pct of the US corn was planted. US farmer selling has slowed due to lower prices. Interesting that rally in corn and recent selloff is almost equal to action in Bitcoin. Some est that Bitcoin is 90 pct retail and large traders are trying to force the retail out of the market. Overnight, Some weather watchers reported that Pacific Ocean temps were cooling which could raise the odds of summer US plains ridging. . Some are concerned about US summer weather in the Dakotas where 8.9 million US corn acres and 1,200 mil bu are planted.

WHEAT

Wheat futures traded lower. Improving weather in US HRW crop area esp KS and higher than average US SRW crop ratings offered resistance. Steep selloff in corn and lower EU wheat prices also offered resistance. Forecast of drier US north plains weather and lower than expected USDA rating of the US HRS crop offered support to MWN. US HRW states KS 55 G/E and OK 51. WA was rated 43 G/E vs 56 last week. OH is 74 pct G/E. USDA rated the US spring wheat crop 45 pct G/E versus 57 expected and 80 last year. There was also 1.0 mmt of wheat offered this week at Egypt tender. Egypt bought from Romania at prices $20-25 below US HRW. There remains confusion over Russia export supplies, new crop size and new crop export prices. Still, Russia new crop prices with export tax are lower than US HRW. Managed funds continue to add to new short positions in Chicago wheat futures.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.