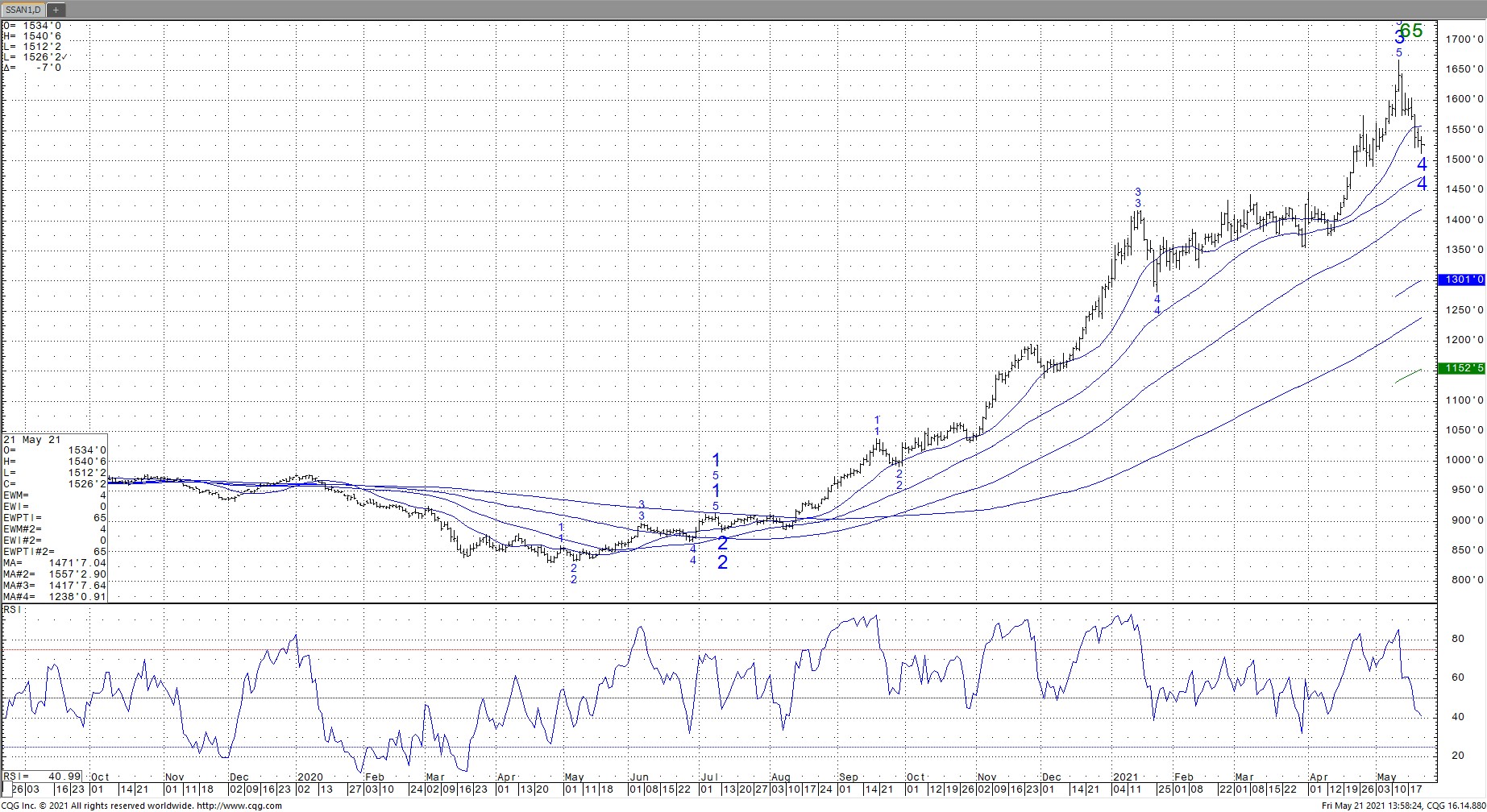

SOYBEANS

Soybeans traded lower. For the week, nearby soybean futures ranged from 15.12 to 16.04. Favorable US weather and slowdown in US exports weighed on prices. US season to date soybean exports are near 2,058 mil bu vs 1,276 last year. Total commit is near 2,258 mil bu vs 1,517 last year. USDA goal is 2,280 vs 1,682 last year. US Midwest 2 week forecast calls for normal to above temps and normal rains. Most estimate US soybean plantings near 80 pct vs 54 average. SMN weekly range was 392-426. Lower China prices offered resistance. There is talk that China hog producers may have dropped pct meal in ration to 10 pct from 18 last year. BON rallied to near 70.49 only to drop to 64.28. Rally linked to talk of higher US biofuel demand. Drop due to lower Asia demand/prices.

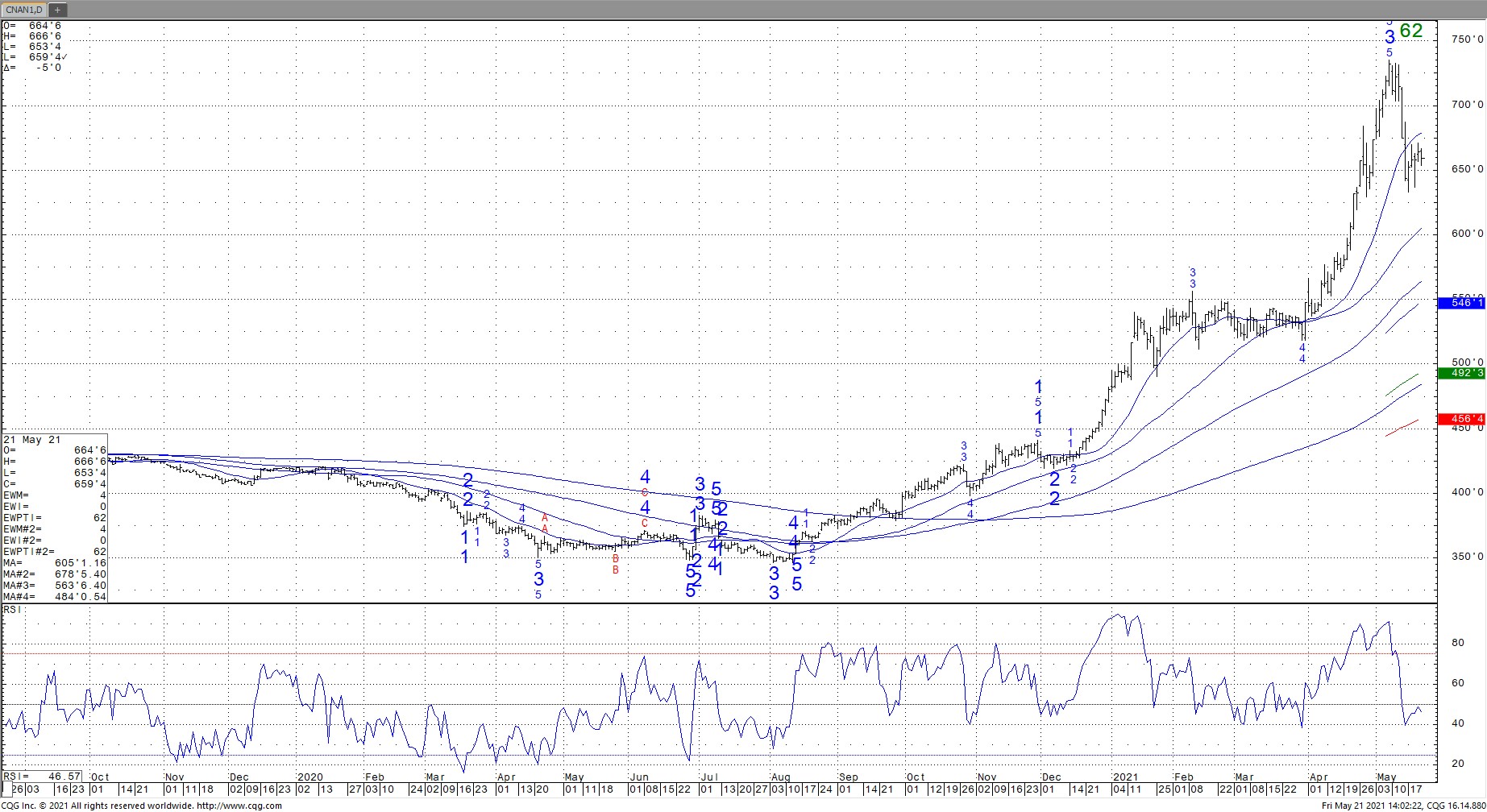

CORN

Corn futures traded lower. Favorable US Midwest weather offset firm US domestic and export basis, record new crop China buying US corn and talk of lower Brazil supplies. China buying is estimated near 10-11 mmt. There were no new China sales announced today. There remains uncertainty over Argentina exports with dock strikers calling for more vaccinations and talk Argentina could increase export taxes. This week, Argentina ban the exports of beef. This helped US cattle futures. Weekly range has been 6.33-6.71. US season to date corn exports are near 1,852 mil bu vs 1,038 last year. Total commit is near 2,678 mil bu vs 1,551 last year. USDA goal is 2,775 vs 1,778 last year. Some feel final US 2020/21 corn demand could be 100-200 mil bu higher than US May guess. Weekly US ethanol production was up 5 pct. Margins have improved and summer driving is expected to increase demand. US Midwest 2 week forecast calls for normal to above temps and normal rains. Most estimate US corn planting near 92 pct vs 80 average. US 2021 corn acres suggest a carryout near 1,200 vs USDA 1,502. 96 million acres suggest a carryout near 1,900. Uncertainty to US 2021 crop adds to price range and volatility.

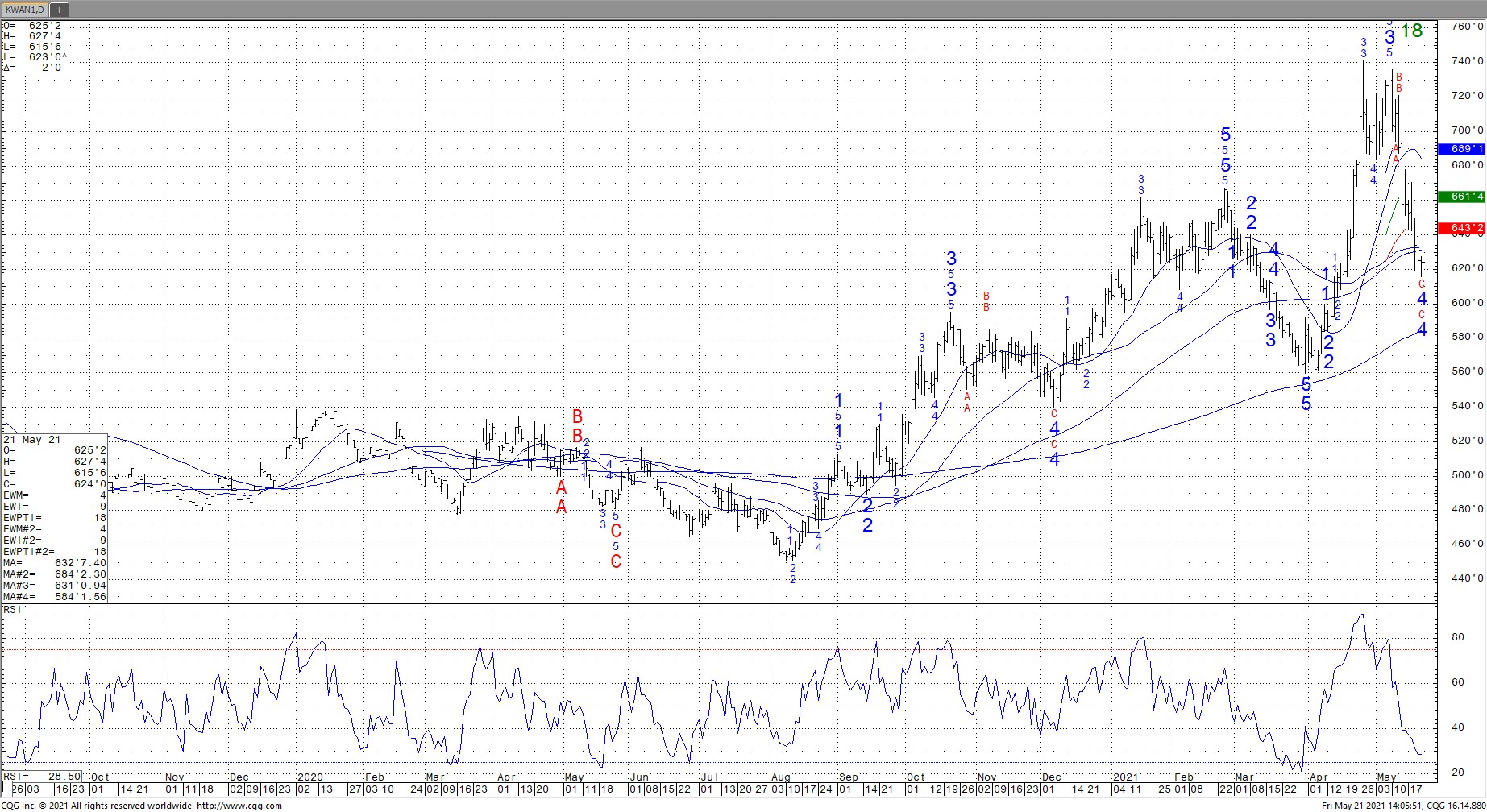

WHEAT

Wheat futures ended mixed. For the most part, Wheat futures followed corn. Weekly Chicago futures gapped lower on good weather. Futures traded lower on talk of record Kansas yield. Weekly range was 6.65 to 7.18. Key remains summer north hemisphere weather and global trade/demand. In March, WN was near 5.98, rallied in April to 7.69 only to fall back to today’s low near 6.65. June 2020 low was 4.96. KWN started in Aug,20 near 4.50. Rallied to 6.67 in Feb, dropped to 5.59 in March, jumped to 7.40 in early May then dropped to today low near 6.15. Most of the drop this month due to KS crop tour est KS 2021 wheat yield at a record 58. MWN started near 5.59 in Dec, 20, rallied to 6.65 in Jan, dropped to 6.06 in April, rallied to near 8.07 in early May due to dry US weather and dropped to today’s low near 6.87 on forecast of rain.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.